Why choose NVDA over DELL: Both Nvidia and Dell have demonstrated strong performance and growth in the booming artificial intelligence (AI) sector. However, analysts are fiercely bullish on Nvidia, citing its exceptional performance and dominance in the semiconductor industry. Nvidia is the stand-out player, setting the pace with its innovations and market leadership.

NVDA vs DELL: Which is the Best Stock to Buy in 2024?

Over the past year, Nvidia (NASDAQ: NVDA), a leading chipmaker and semiconductor giant, has gained significant attention and enthusiasm due to its remarkable growth and key role in the booming artificial intelligence (AI) sector.

However, Nvidia is not the only tech company showing exceptional returns. Dell Technologies (NYSE: DELL) has also made impressive gains, outperforming Nvidia in the last 12 months. Notably, these two companies have recently partnered to build an AI factory, linking their fortunes in the tech industry.

Table of Contents

Given these developments, investors are now asking: DELL VS Nvidia the better investment?

Analysts Perspectives on NVDA

Experts remain highly optimistic about Nvidia. According to TradingView, out of 60 analysts, 45 rate NVDA as a ‘strong buy’ and 9 as a ‘buy.’ There are 6 ‘neutral’ ratings and no ‘sell’ recommendations.

The overall price target for NVDA is somewhat conservative, predicting a 2.96% increase to $1,182.28 in the next 12 months. However, the most optimistic forecast sees NVDA soaring 21.92% to $1,400 by May 2025.

Analysts Perspectives on Dell

Analysts have a positive outlook on Dell. Among 21 experts analyzed by TradingView, 13 rate DELL as a ‘strong buy,’ and 4 as a ‘buy.’ There are 3 ‘neutral’ ratings and 1 ‘sell’ recommendation.

The overall price target for DELL is bearish, predicting a 12.80% drop to $156.40 by May 2025. However, the most optimistic forecast sees DELL climbing 33.92% to $240 in the next 12 months. Conversely, the most pessimistic forecast predicts a 45.41% decline to $98.90.

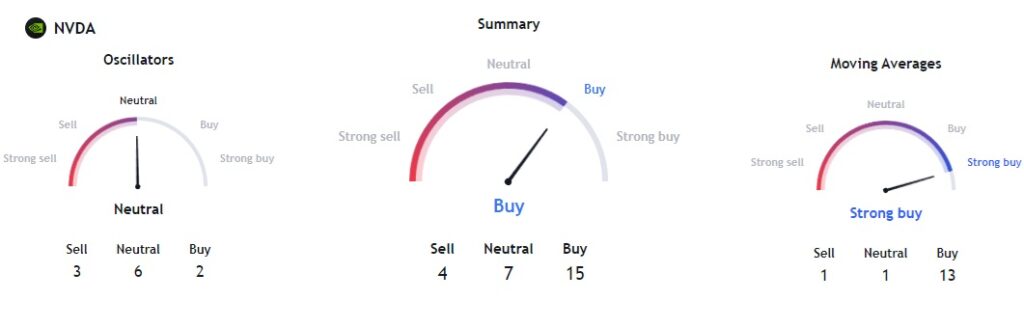

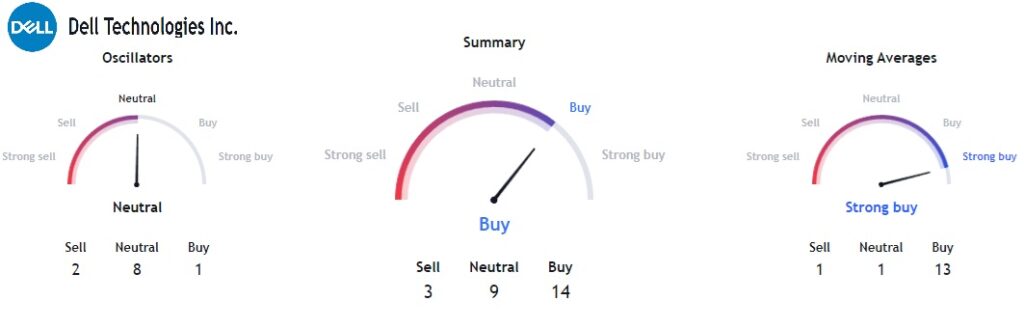

Technical Analysis Comparison NVDA vs DELL

Technical analysis (TA) from the last 30 days, retrieved from TradingView on May 30, shows a strong buy rating for both Nvidia and Dell.

- Nvidia: Rated as a ‘strong buy’ overall, with oscillators indicating ‘buy’ and moving averages showing ‘strong buy.’

- Dell: Similarly rated as a ‘strong buy,’ with moving averages and oscillators also indicating ‘buy.’

- Dell will release its earnings report after the closing bell on May 30.

- Nvidia has announced a 10-for-1 stock split scheduled for later in June, which may influence market dynamics.

Dell’s Potential Returns and Risks Compared to Nvidia

- Optimistic Forecasts:

- If Dell meets the most optimistic forecasts, it could generate significantly better returns than Nvidia.

- Dell’s stock could climb 33.92% to reach $240 within the next 12 months.

- Potential Downside:

- The biggest estimated downside for Dell is a decline of 45.37%, which would bring the stock down to $98.

- This downside risk is similar to the bearish forecasts for Nvidia.

In summary, while Dell has the potential for substantial returns if optimistic forecasts are met, it also carries a significant risk of decline, comparable to the risks faced by Nvidia.

Why should you choose Nvidia (NVDA) over Dell Technologies (DELL)

Strong Analyst Confidence

Nvidia enjoys overwhelming support from analysts, with most rating it as a ‘strong buy.’ This bullish sentiment indicates high confidence in Nvidia’s growth potential, particularly due to its key role in the booming AI sector.

Consistent Growth Forecasts

Nvidia’s price target forecasts are consistently positive. Even the conservative estimates predict a 2.96% gain, while the most optimistic foresee a substantial 21.92% increase. This reliable growth outlook provides a more secure investment trajectory compared to Dell, which faces mixed and more volatile predictions.

Technical Strength

Technical analysis shows that both Nvidia and Dell have strong buy ratings. However, Nvidia’s technical indicators, supported by robust market sentiment and performance metrics, give it a slight edge.

Strategic Moves and Market Position

Nvidia’s upcoming 10-for-1 stock split is a strategic decision likely to boost its market dynamics. Analysts prediction forecast NVIDIA’s annual revenue to reach more or less $111.5B in 2025

This move could make Nvidia’s shares more accessible to a broader range of investors, potentially increasing demand and enhancing stock performance.

Furthermore, Nvidia’s market capitalization has surpassed that of tech giants like Alphabet and Meta. Analysts predict Nvidia could hit a $10 trillion market cap by 2030, a surge of 258% from current levels. This highlights the company’s significant growth potential and market dominance.

Why Dell Might Still Be Attractive

Dell does offer the potential for higher returns if it meets optimistic forecasts, with a possible 33.92% increase. However, its mixed analyst ratings and bearish overall price target introduce more uncertainty and risk.

Dell’s Strengths in AI and Market Performance

Dell’s drivers are designed for basic users who prioritize a highly stable PC experience and do not play games.

- AI Credibility and Market Growth:

- Dell has solidified its credibility in the AI sector, gaining more believers among analysts and investors.

- Dell’s stock has surged, reflecting strong market confidence. On Friday, the stock saw a significant increase.

- Impressive Market Value:

- Over the past 12 months, Dell’s market value has more than tripled, showcasing robust growth and investor interest.

- Collaboration with NVIDIA:

- Dell and NVIDIA together provide enterprises with a strong foundation of expertise and advisory services to accelerate the adoption of Generative AI (GenAI).

Dell remains a solid choice for users seeking stability and reliability in their computing needs, while also making significant strides in the AI industry.

Conclusion: DELL VS Nvidia (NVDA)

Considering the stronger analyst confidence, consistent growth forecasts, strategic market positioning, and ambitious market cap projections, Nvidia (NVDA) emerges as the better investment choice for 2024. For investors seeking a more stable and promising tech stock with long-term growth potential, Nvidia is our top recommendation.

Will Dell Technologies rise/fall in 2025?

On average Dell stock price projections by Wall Street analysts forecast that Dell Technologies’s share price could fall to $142.00 by May 28, 2025, from DELL’s current value.

Where will be Nvidia in 2030?

Nvidia’s market capitalization has surpassed that of tech giants like Alphabet and Meta, with analysts predicting Nvidia could hit a $10 trillion market cap by 2030 a surge of 258% from current levels.

Where will be Dell Stock in 2040?

Our analysts foresee a positive outlook for Dell Technologies, Dell Stock Prediction 2040 is expected to hit $461.28 in 2040 which is a +163.12% rise from its current value.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.