The 5 Best Dividend Stocks in Singapore to buy in 2024 are DBS Group Holdings (SGX:D05), United Overseas Bank Ltd (SGX:U11), OCBC (SGX:O39), ST Engineering (SGX:S63), HongkongLand USD (H78).

A good quarterly dividend yield among Top Singapore Dividend Stocks is usually between 2% and 5%. This is the average for companies in the S&P 500 index that pay dividends. But what’s considered good can change depending on how the Stock market is doing and your investment plans. Also, if you’re looking at stocks with dividend yields higher than 8%.

Here’s a brief description of companies in Singapore that gives most profitable dividend stocks:

- DBS Group Holdings (SGX:D05): DBS has a market capitalization of S$93.152 billion and a share price of S$36.63. They pay a dividend of S$2.16 per share, yielding at 5.90%.

- United Overseas Bank Ltd (SGX:U11): With a market capitalization of S$49.085 billion, UOB’s share price is S$29.68. Their dividend per share is S$1.70, resulting in a dividend yield of 5.73%.

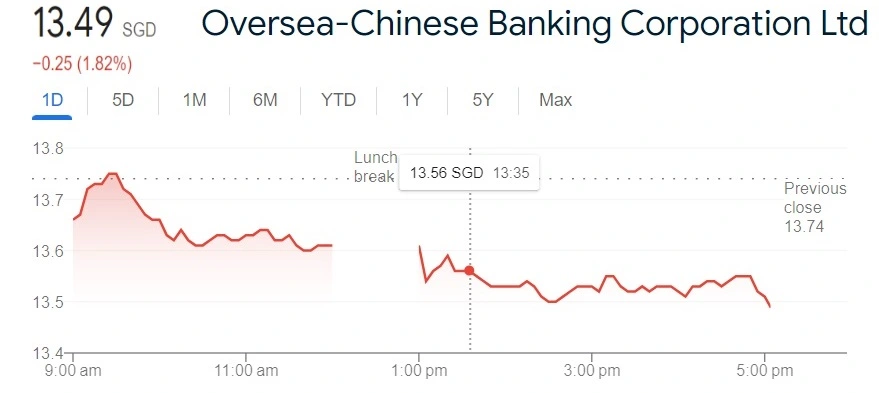

- Oversea-Chinese Banking Corporation (SGX:O39): OCBC has a market capitalization of S$60.644 billion, with a share price of S$13.74. They pay a dividend of S$0.84 per share, yielding at 6.11%.

- Hongkong Land (H78.SI): Hongkong Land’s market capitalization is S$6.774 billion, and their share price is S$3.07. They pay a dividend of S$0.16 per share, yielding at 7.17%.

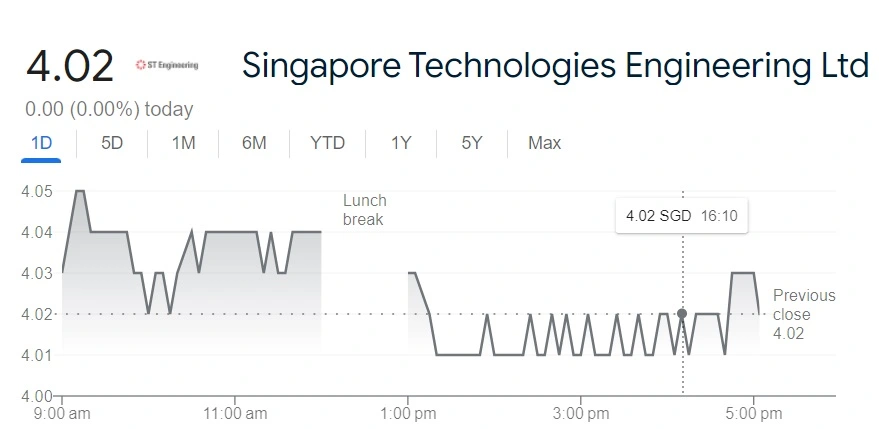

- ST Engineering (S63.SI) : With a market capitalization of S$12.542 billion, ST Engineering’s share price is S$4.02. They pay a dividend of S$0.16 per share, resulting in a dividend yield of 3.98%.

Key Factors in Identifying Top Dividend Stocks to Buy

Dividend Yield

This percentage measures how much dividend is earned per dollar invested. While a higher yield is appealing, we prioritize companies with a long-term profitable track record and consistent dividend growth. This stability helps weather economic challenges.

Payout Ratio

This ratio reveals the portion of a company’s profits distributed as dividends. A low payout ratio indicates potential for future dividend increases. We also consider the stock’s debt-to-equity ratio for deeper insights into financial health. Payout ratio shows dividend share of profit.

Share Price Performance

This metric reflects a stock’s overall health and growth potential. We evaluate a company’s profitability and debt levels for long-term viability. Assessing share price performance alongside these factors helps identify promising dividend stocks in Singapore.

- Key Factors in Identifying Top Dividend Stocks to Buy

- 5 Best Dividend Stocks in Singapore to buy in 2024

- DBS Group Holdings ( SGX:D05 )

- United Overseas Bank Ltd (SGX:U11)

- Oversea-Chinese Banking Corporation (SGX:O39)

- Singapore Technologies Engineering Ltd (SGX:S63)

- Hongkong Land Holdings Limited (SGX: H78)

- How to Check which dividend stocks to buy or Hold? Which Singapore stock pays highest dividend?

5 Best Dividend Stocks in Singapore to buy in 2024

When people pick stocks, they often want ones that perform better than the overall market. One way to do this is by finding companies that the market might be undervaluing. By buying these companies, investors hope to make more money than if they just invested in the entire market. This strategy of finding undervalued businesses is a way to make better-than-average returns in the stock market.

Below is the List of Best 5 Dividend Stocks to buy in Singapore in 2024:

DBS Group Holdings ( SGX:D05 )

Establishing its presence in the financial realm of ASEAN, DBS Group Holdings Ltd embarked on a momentous journey fifty years ago. On November 29, 1968, DBS shares commenced trading on the Stock Exchange of Malaysia and Singapore, marking a significant milestone in the region’s economic landscape. As the parent company of DBS Bank Ltd, DBS Group Holdings Ltd oversees vital financial operations, including the management of senior and capital finances in adherence to Basel III standards.

| Open | SGD 36.40 |

| Market Cap | $ 9.32T |

| High | SGD 36.57 |

| Low | SGD 35.98 |

| P/E ratio | 9.31 |

| Div yield | 5.33% |

| 52-wk high | SGD 36.63 |

| 52-wk low | SGD 30.30 |

United Overseas Bank Ltd (SGX:U11)

United Overseas Bank Limited (UOB) is one of the 5 Best Dividend Stocks in Singapore to buy in 2024 , a bank based in Singapore. It operates in three main parts: Group Retail (GR), Group Wholesale Banking (GWB), and Global Markets (GM).

- Group Retail (GR): This part of the bank serves individual customers. It offers a variety of products and services such as deposits, insurance, cards, wealth management, investments, and loans. These services are available across UOB’s branch network worldwide.

- Group Wholesale Banking (GWB): This segment focuses on corporate and institutional clients. It provides services tailored to the needs of businesses and large organizations.

UOB aims to meet the financial needs of both individual customers and businesses, providing a wide range of banking services and products across different segments.

United Overseas Bank Ltd (SGX:U11) Financials

| Open | 29.53 |

| High | 29.73 |

| Low | 29.31 |

| Mkt cap | 49.085B |

| P/E ratio | 8.80 |

| Div yield | 5.80% |

| 52-wk high | 30.27 |

| 52-wk low | 26.82 |

Oversea-Chinese Banking Corporation (SGX:O39)

Oversea-Chinese Banking Corporation (SGX:O39) OCBC is a big bank that helps lots of people and businesses with their money. If you’re an individual, they offer things like checking accounts, savings, loans, and credit cards. They also help manage your wealth if you have a lot of money.

For businesses, they provide different financial services such as loans, investments, and advice. OCBC Bank (039.SI) also deals with things like trading money, providing insurance, and managing funds for investments. They’ve been around for a long time, since 1912, and they’re well-known for being trustworthy and offering good services to their customers all over the world.

Oversea-Chinese Banking Corporation (SGX:O39) Financials

| Open | 13.66 |

| High | 13.75 |

| Low | 13.49 |

| Mkt cap | 60.644B |

| P/E ratio | 8.70 |

| Div yield | 6.08% |

| 52-wk high | 13.75 |

| 52-wk low | 12.00 |

OCBC’s stock opened at $13.66, reached a high of $13.75, and dropped to a low of $13.49. The market capitalization, which shows how much the company is worth, is $6.09 trillion. The P/E ratio, which indicates how much investors are willing to pay for each dollar of the company’s earnings, is 8.70.

The dividend yield, which shows how much a company pays out in dividends each year relative to its stock price, is 6.08%. The 52-week high and low represent the highest and lowest prices at which the stock has traded over the past year, which are $13.75 and $12.00, respectively.

Singapore Technologies Engineering Ltd (SGX:S63)

Singapore Technologies Engineering Ltd, known as ST Engineering, is a big company based in Singapore that works in technology and engineering. They do a lot of work in different areas like aerospace, making things for smart cities, and working in defense and public security. ST Engineering is a multinational company, meaning they operate in many countries around the world. They focus on developing advanced technology and solutions to help improve various sectors and make the world a better place.

According to moneymystica, the average price target for ST Engineering (S63) over the next 12 months is S$4.10, with a high forecast of S$5.05 and a low forecast of S$4.00. This represents a 13.44% change from the last price of S$3.94.

Singapore Technologies Engineering Ltd (SGX:S63)Financials

| Open | 4.03 |

| High | 4.05 |

| Low | 4.01 |

| Mkt cap | 12.542B |

| P/E ratio | 21.51 |

| Div yield | 3.98% |

| 52-wk high | 4.05 |

| 52-wk low | 3.54 |

Hongkong Land Holdings Limited (SGX: H78)

Hongkong Land Holdings Limited (SGX: H78) is a company that deals with investing, managing, and developing properties. HongkongLand USD (H78) have both commercial and residential properties across Asia. Specifically, they own and oversee around 850,000 square meters of office and retail space in Asia. Most of their properties are located in Hong Kong and Singapore. They focus on providing spaces for offices and retail businesses in these areas.

Hongkong Land Holdings Limited (SGX: H78) Financials

| Open | 3.08 |

| High | 3.10 |

| Low | 3.05 |

| Mkt cap | 6.774B |

| P/E ratio | – |

| Div yield | – |

| 52-wk high | 4.54 |

| 52-wk low | 3.05 |

According to financial analysts the average 12-month price target for Hongkong Land Holdings (H78) is $3.63, which is a 23.96% increase from the last price of $3.09. The high forecast is $4.65 and the low forecast is $3.08.

How to Check which dividend stocks to buy or Hold? Which Singapore stock pays highest dividend?

Choosing which dividend stocks to buy or Hold involves thinking about many things to make a smart choice. Here’s 5 Best Dividend Stocks in Singapore to buy in 2024 you can pick the right ones:

| Company | Market Cap (S$) | Share Price (S$) | Dividends Per Share (S$) | Highest Dividend Yield (%) | Analyst Consensus |

|---|---|---|---|---|---|

| DBS (SGX:D05) | S$93.152B | S$36.63 | S$2.16 | 5.90 % | Moderate Buy |

| UOB (SGX:U11) | S$49.085B | S$29.68 | S$1.70 | 5.73 % | Moderate Buy |

| OCBC (SGX:O39) | S$60.644B | S$13.74 | S$0.84 | 6.11 % | Hold |

| Hongkong Land (H78.SI) | S$6.774B | S$3.07 | S$0.16 | 7.17 % | Moderate Buy |

| ST Engineering (SGX:S63) | S$12.542B | S$4.02 | S$0.16 | 3.98 % | Strong Buy |

Is ST Engineering a good investment now?

According analysts prognosis ST Engineering (SGX:S63) analyst rating consensus is a Strong Buy

Does does SGX pay its dividends?

Since 2008, Singapore Exchange Ltd has consistently paid dividends every quarter without interruption.

What are 5 Best Dividend Stocks in Singapore to buy in 2024?

Ranked on top the 5 Best Dividend Stocks in Singapore to buy in 2024 are DBS Group Holdings (SGX:D05), United Overseas Bank Ltd (SGX:U11), OCBC (SGX:O39), ST Engineering (SGX:S63), HongkongLand USD (H78).

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.