In this article, we will discover the latest updates and performance of Rivian Automotive Inc. stock. Price Today $10.52 Invest in (NASDAQ: RIVN) innovative electric vehicle (EV) technology and track share prices, market trends, and Rivian stock finance news and view Rivian Automotive Inc’s long-term stock price, forecast, and latest RIVN news and analysis today with moneymystica.

Great News for Rivian Stock Investors!

finance.yahoo.com

Rivian Automotive, Inc. is an innovative company specializing in electric vehicles (EVs) and accessories. Their advanced electronic Vehicles, including the R1T and R1S models, feature cutting-edge technology systems. Rivian also provides charging solutions through the Rivian Adventure Network, and its centralized fleet management platform, FleetOS, offers comprehensive services. With a focus on innovation and sustainability, Rivian is reshaping the future of transportation.

This morning’s jobs report has stirred market reactions. Wedbush analysts have raised Rivian’s price target of $30 – $25, indicating positive prospects for the company. However, Wolfe Research has downgraded Paramount’s rating, suggesting a less favorable outlook for the company. In another development, DigitalOcean announced its intention to acquire Paperspace. Meanwhile, (Find the latest Rivian Automotive, Inc. (RIVN) stock quote, historic price & data and news/quote/RIVN/) on Yahoo Finance Live, anchor Rachelle Akuffo has been analyzing various trending stocks during the morning trading session.

DigitalOcean has acquired Paperspace for $111 million, enabling it to enhance AI/ML applications and tap into GPU technology typically utilized by larger enterprises.

Rivian Automotive, Inc. – Revolutionizing Electric Vehicle Industry

Rivian Automotive, Inc. was founded by Robert J. Scaringe in June 2009, with its headquarters located in Irvine, CA. It has a current manpower of 14.122K working employees. Rivian understands the importance of charging solutions for electric vehicles. To cater to this need, they offer two options.

The Rivian Adventure Network consists of Direct Current fast charging sites strategically placed for convenient and rapid charging. Additionally, Rivian Waypoints chargers contribute to expanding the charging infrastructure further.

To streamline and optimize fleet management, Rivian provides FleetOS, their exclusive end-to-end centralized fleet management subscription platform. FleetOS covers a wide range of services, including vehicle distribution, service, and maintenance, telematics, software services, charging infrastructure, connectivity management, Driver+ integration, and lifecycle management.

Moreover, FleetOS supports various additional services such as leasing, financing, insurance, smart charging and routing, remote diagnostics, and vehicle resale.

Rivian’s comprehensive approach ensures that customers have access to cutting-edge electric vehicles, efficient charging solutions, and robust fleet management capabilities. They strive to deliver an exceptional experience throughout the entire journey of owning and operating their vehicles.

Overview of Rivian Automotive Inc.’s stock

Rivian Automotive, Inc. (RIVN.MX) Stock Major Holders has been nothing short of remarkable. Since going public in November 2021, Rivian’s stock price skyrocketed, making it one of the best-performing stocks in the automotive industry. The current real-time price of Rivian Automotive, Inc (RIVN) is $14.70 as of JUN 21, 2023 2:56 PM

| Previous close | 14.37 |

| Open | 13.86 |

| Bid Price | 13.39 x 3200 |

| Ask Price | 13.40 x1200 |

| Day’s Range | 13.16 – 13.91 |

| 52 Weeks High | $68.15 |

| 52 Weeks Low | $15.28 |

| Avg. Volume | 31,006,721 |

| Market Cap | 14.074B |

| 5Y Monthly | N/A |

| PE Ratio | (TTM) N/A |

| EPS (TTM) | 6.98 |

| Earnings Date | 09/05/2023 |

| Dividend & Yield | N/A |

| Dividend Date | N/A |

| Target Est. | 27.60 |

Rivian Automotive Inc. (RIVN) Quarterly Reports YOY Change

the revenue, net profits, and net profit margins for Rivian Automotive Inc. Q1, 2023 as follows

Revenue

Rivian Automotive Inc. shares gained 595.79% revenue growth, reaching $661 million in Q1 2023. RIVN experiences a strong stock performance at Yahoo Finance this significant growth suggests strong sales performance or an expansion of the company’s product offerings.

Net Profits

Rivian Automotive Inc.’s net profit also showed a notable increase of 15.32% compared to the same period in the previous year, amounting to -$1,349 million in Q1 2023. It’s important to note that a negative value indicates a net loss rather than a profit.

Net Profit Margins

Rivian Automotive Inc.’s net profit margin improved significantly by 87.83% compared to the same period in the previous year, resulting in a net profit margin of -204.08% in Q1 2023. Again, a negative value indicates a loss rather than a profit.

Additionally, it is mentioned that on a quarterly growth basis, Rivian Automotive Inc. experienced a 0.3% fall in revenue and a 21.71% increase in net profits over the last three months. The net profit margins also saw a 21.47% jump during the same period.

Do Amazon and Ford own Rivian Automotive Inc.?

Rivian made headlines in 2020 when it secured major funding from investors like Amazon and Ford. This influx of capital has bolstered the company’s ability to advance its production plans and bring its electric vehicles to market. Rivian’s highly anticipated models, such as the R1T electric pickup truck and the R1S electric SUV, have generated significant anticipation among consumers and investors alike.

These Rivian Automotive Inc. predictions are achievable as demand for EV cars is increasing day by day and Rivian is getting success in establishing contracts for supplying to various companies.

Last year, Rivian secured a deal with Amazon for providing 100,000 electric delivery vans, which pushed up demand for their electric vans. parts of electric vehicle ev maker rivian automotive nasdaq rivn are accelerating higher

Must Read: How to do Price Prediction using Machine Learning

Should I buy Rivian Automotive, Inc (RIVN) Shares

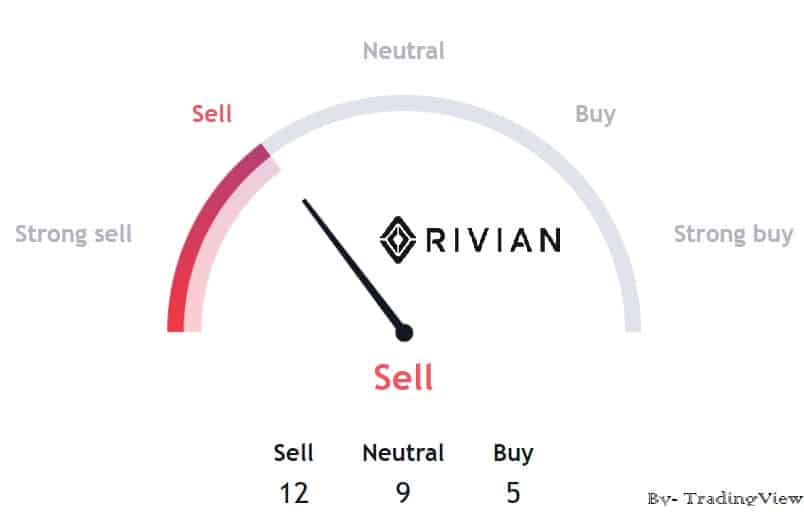

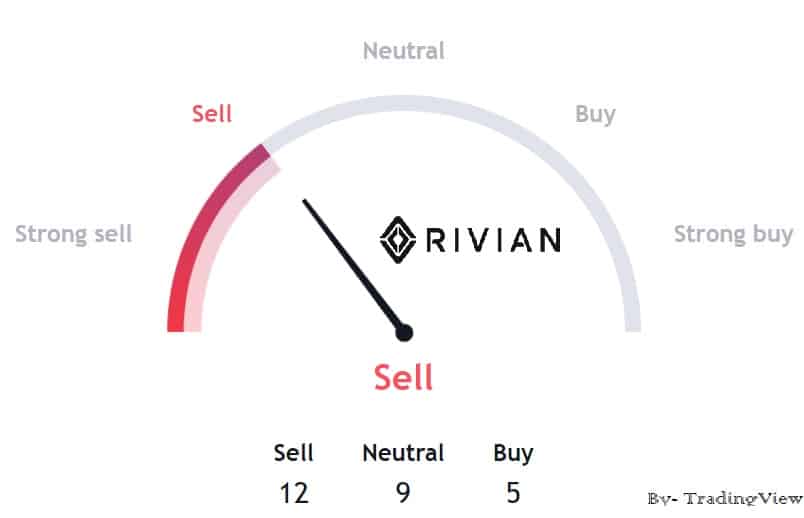

RIVN technical analysis

it is not advisable to consider Rivian stock as a buy at this time due to many reasons while Rivian’s Q1 earnings beat expectations and the recent announcement about Tesla Superchargers garnered attention, it’s crucial to approach investing in Rivian stock with caution. Currently, the shares are trading well below their IPO price of $78.

Rivian Automotive Inc. Prediction 2022

As per our technical analysis and current market situation, the stock price forecast for 2022 is $45 as the first target and $70 as the second target.

Rivian Stock Forecast 2030

Rivian stock price estimate for 2030 is $745.34 as the first target and $845.45 as the second target. Overall, in 2030, the Rivian stock forecast 2030 could range from $745.34 to $845.45.

After Tesla’s cyber truck, Rivian is the most popular brand in Pickup trucks (dual motor r1t electric) and their designs are unique and beautiful. generally speaking on Friday investors and Rivian Automotive Nasdaq rivn are accelerating higher to start the week.

As they are more focused on Utility trucks, they could become one of the best EV manufacturing companies in the SUV class of vehicles. Their vehicles are designed for Off-road as well, which makes them more unique on their own.

Once, the demand for EVs kicked in, then the need for EV cars will increase and people will buy Rivian vehicles as well which will increase their profit. Ultimately, the share price of Rivian will go up in 2023 and gradually increase till 2030 and could hit our targets.

Rivian stock price Forecast 2040

$RIVN stock price for 2040 is around $1500. In 2040, Rivian will become 30 years old company and if products of Rivian perform well in the market then for sure these price targets are very much reachable.

According to the technical analysis, the price target is 80% accurate for the stock price of Rivian in the years 2030, and 2040. If the company exists for years, then the trust and the brand value will increase along with the sales and the profit of the company.

Just like Rivian, there is one more EV maker called NIO. We have researched and written a post on What Will Be the Price of NIO’s Stock current price and forecast for a week. Read it to know more.

Must Read: FORECAST FOR THE PRICE OF APPLE (AAPL) IN 2022,2023, 2030, 2040

Overall, the Rivian stock price forecast says it will range between $45 to $70 in 2022. Rivian has performed very well and is expected to perform better in 2022.

Rivian Automotive Inc Prediction 2023

The stock price will range between $123 and $157 in 2023 as per our price prediction. The company is pushing its capabilities very hard to improve the production rate. So, they can sell more cars and make more profit.

Rivian Automotive Inc. Prediction 2050

The stock price prediction for 2050 is around $2349. These price forecasts are based on technical analysis made by different software and tools.

The main component of an electric vehicle is its battery. Batteries are like the backbone of every electric vehicle. Mainly, these batteries are made up of Lithium. If the sales of EV will increase, then the sales of Lithium batteries will also increase. So it is very important to know about those companies and their stocks.

Will Rivian Automotive Inc. Stocks Grow In The Future?

Yes, in the stock market, you can’t say it will grow or not as well it all depends on the fundamentals of the company as well. 290,000 vehicle delivery is expected by the end of 2024 with $25.8 billion in revenue. 701,918 vehicle delivery is expected by 2030 with $78.7 billion in revenue. So, from these figures, you can expect what could happen.

Why Is Rivian Automotive Inc. Stock So Low?

Currently, the company is facing problems with mass production and delivery due to supply-chain shortages. Fewer deliveries of cars mean fewer sales and fewer sales mean less profit. If a company is not making a profit, it is certain that its share price will go down or that there are any issues going on inside the company’s management.

These days, the news is getting viral about the upcoming recession. So, people are scared these days and do not put their money into shares instead they are dumping shares which cause the stock prices to go down.

Are Rivian Stocks Overpriced?

stock is overpriced based on its production, which is currently affected due to supply-chain shortages around the globe.

Will Rivian Stock Recover?

The stock will recover in the future as the company is getting stronger day by day and acquiring more and more clients for their trucks.

What Will Rivian Stock Be Worth In 5 Years?

As per analysis, the stock price in the next 5 years will hit 3 digits back and will trade over $500

Is Rivian a Publicly traded Company?

The stock is publicly traded and it is registered on NYSE with ticker code RIVN.

Expert forecasts on the future of Rivian Automotive (RIVN)

The 16 analysts offering 12-month price forecasts for Rivian Automotive Inc have a median target of 50.50, with a high estimate of 83.00 and a low estimate of 27.00. The median estimate represents a +48.79% increase from the last price of 33.94.

Is Rivian Stock a Good Buy? Analyzing Future Potential and Risks

If you’re wondering whether Rivian stock is a good investment, let’s examine the specifics. While we remain optimistic about Rivian’s long-term prospects as a key player in the electric vehicle (EV) market.

RIVN technical analysis

Being a first mover in EVs Rivian has become the first producer for delivering EV trucks to their clients. They have already attached a huge amount of people to their trucks and have 1000s of pre-orders in their hands.

Recently in 2022, it secured a deal with Amazon.INC for providing them EV vans for the purpose of delivery and pickup.

The Bear Case For Rivian

Since the start of May 2022, it has only produced around 5,000 E-vehicles and they are expecting to finish 2022 by producing nearly 25,000 vehicles.

The production rate is quite less in comparison to other competitors such as Ford which sold over a million vehicles in 2021 and Tesla which produced around 300,000 cars in the first quarter of 2022.

Conclusion – RIVN Yahoo Finance

So in this post, we discussed Rivian Automotive Inc (NASDAQ: RIVN) market cap, share price, PE ratio, a 52-week low, and high.

Also in this post, the main focus was on discussing stock price predictions for 2030, 2040, and 2050 based on technical analysis by experts, historical prices, and current market news.

FAQ

What is the Dividend History of RIVN?

there is currently no available dividend history for Rivian Automotive Inc. It is possible that the company has never provided a dividend to its shareholders, or it could indicate that a dividend is pending or not yet declared.

What is Rivian Automotive Inc, RIVN logo?

RIVIAN is the logo

Why and When Was Rivian App Down?

As of 7:35 pm PT, Monday, April 3, the problem affecting the Rivian app, customer account pages, and website functionality has been successfully resolved by the service center experts. Users can now access these platforms without any issues.

Is rivian stock on Robinhood?

Yes, Rivian stock (ticker symbol RIVN) is available for trading on the Robinhood platform. You can sign up for a Robinhood brokerage account to buy or sell RIVN stock and options commission-free.

What was Rivian’s highest stock price?

The stock price history for Rivian (RIVN) indicates that the highest end-of-day price recorded was $174.01 USD on November 16, 2021. On the other hand, the lowest end-of-day price was $12.50 USD, which occurred on April 25, 2023.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.