Oversea-Chinese Banking Corporation Ltd (SGX: O39) is currently trading at 15.64 SGD, up 0.17 SGD (1.10%) today.

OCBC Bank Share Price (SGX: O39) Oversea-Chinese Banking Corporation Limited (O39.SI) is primarily involved in foreign exchange activities, money market operations, and fixed income and derivatives trading owned by individual investors, who hold a 55% ownership stake, while private companies own 23% of the O39 company. On May 21st, OCBC (SGX: O39) will raise its dividend to SGD0.42 from last year’s comparable payment. With this, the dividend yield rises to 6.1%, which will satisfy shareholders of (SGX: O39)

OCBC Bank Share Price Singapore (SGX: O39.SI) The target price of OCBC today on the Singapore Exchange (SGX:039) is SGD 13.69-0.02(-0.15%). The intrinsic value of OCBC (SGX: O39) saw a low of 13.57 and the highest price of OCBC share of 13.75, within a 52-week range of 12.00 to 13.89.

Table of Contents

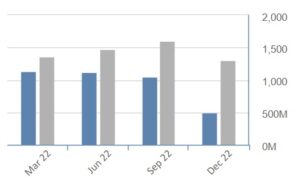

- The trading volume for the day was 4,985,400 shares, Stock price fluctuations slightly below the average daily volume of 5,566,872 shares. The market capitalization of O39 stock code stands at approximately $61.607 billion.

- The stock’s Beta over the past five years is 0.64, indicating a lower volatility compared to the overall market. The price-to-earnings ratio (PE Ratio) for the trailing twelve months (TTM) is 8.83, based on an earnings per share (EPS) of 1.55.

- OCBC is scheduled to report earnings on May 10, 2024, with Stock market trends a forward dividend yield of 6.14% and an ex-dividend date of May 8, 2024. Analysts’ one-year target estimate for OCBC’s stock price is 14.47.

Singapore Investment opportunities boasts three major banks: OCBC, DBS, and United Overseas Bank. OCBC, as one of the private banks, holds a renowned status and ranks as the second-largest bank in the Asia Pacific region. The bank’s strong performance extends not only in Singapore but also beyond its borders, attracting investors globally.

Oversea-Chinese Banking Corporation Ltd (OCBC), a prominent Singaporean bank, disclosed its intention to explore the redevelopment of its property located on Chulia Street, within Singapore’s central business district. This announcement, made through a stock exchange filing, confirms an earlier report by The Business Times.

OCBC stated, “OCBC Bank wishes to announce that we are exploring the redevelopment of 63, 65 Chulia Street and 18 Church Street to rejuvenate a strategic area in the central business district.” Additionally, OCBC emphasized its commitment to preserving the heritage of its headquarters, OCBC Centre, a notable landmark in Singapore and Southeast Asia.

Investors often ponder the reasons behind the fluctuation of OCBC’s share prices. To make well-informed investment decisions, it is essential to comprehend the factors that influence bank share prices, including market conditions, financial performance, and global events.

OCBC offers a diverse array of credit card promotions and deals, covering various aspects like shopping, dining, and travel. Experience the perks and rewards by applying for an OCBC credit or debit card today.

Before we delve into one of the biggest banks in Southeast Asia Pacific, let’s grasp a basic understanding of the Singapore stock market. The Singapore Exchange (SGX) serves as the primary platform for trading stocks, boasting a listing of over 700 companies. Renowned for its robust regulation and fairness, the SGX attracts investors from across the globe. Transactions in this market must be settled within two days, ensuring prompt and efficient trade execution. Moreover, the SGX offers a wide range of investment options, including company shares, loans, stock bundles, and even real estate, catering to various investor preferences.

Oversea-Chinese Banking Corporation Limited (O39.SI)

Over the past few years, the OCBC stock price in Singapore has demonstrated remarkable resilience, showcasing its ability to withstand market fluctuations. From 2016 to 2020, shares of Oversea Chinese Banking Corporation experienced a steady climb, rising from S$8.00 to S$11.00. However, the onset of the COVID-19 pandemic led to a slight dip in the share price, reaching SGD $9.00.

Despite the challenges posed by the pandemic, Singaporean economy showed signs of recovery, reaching SGD $10.00 as of June 2021. This recovery reflects the bank’s strong fundamentals and adaptive strategies in response to the dynamic market conditions during the pandemic.

The fluctuations in the OCBC share price are influenced by various factors such as market conditions, global events, and the bank’s financial performance. As investors track these movements, they can assess the bank’s performance and make informed decisions based on historical trends and the latest financial data.

SGX:O39 – CDP – Singapore Exchange Share Price History

OCBC’s current dividend yield of around 3% makes it an attractive choice for income-focused investors seeking stable returns.

The share price of O39.SI on SGX reflects strong financial performance in recent years. In 2020, OCBC reported a net profit of SGD 3.8 billion, a notable 10% increase from the previous year. This success is further highlighted by a solid Return on Equity (ROE) of 8.9% and a Net Interest Margin (NIM) of 1.63%. OCBC’s ability to diversify revenue streams has been instrumental in its growth, with 43% of revenue generated in Singapore, 25% from Greater China, and 32% from the rest of the world in 2020.

The bank’s financial performance significantly impacts OCBC’s share price in Singapore. In the first quarter of 2021, OCBC recorded a net profit after tax of SGD $1.5 billion, representing an impressive 24% increase from the same period in 2020.

OCBC has prioritized digitalization and the expansion of its wealth management services. The bank’s recent acquisitions in Indonesia and Malaysia have further strengthened its presence in the region, demonstrating its commitment to strategic growth.

OCBC Target Prices (O39.SI) – Singapore Analyst Ratings

| Bank Name | Oversea-Chinese Banking Corporation Limited |

| Sector / Industry | Banking / Financial Services |

| Founder | Tan Ean Kiam |

| Address | No. 10-00 OCBC Centre East 63 Chulia Street, Singapore 049514 Singapore |

| Founded | 31 October 1932 |

Oversea-Chinese Banking Corporation Limited (OCBC) is a leading financial services provider with a strong presence in Singapore, Malaysia, Indonesia, Greater China, and beyond. Offering a comprehensive range of products and services, OCBC caters to individual customers and businesses alike.

For individual customers, OCBC’s Global Consumer/Private Banking segment provides a variety of offerings, including checking accounts, savings and fixed deposits, housing and personal loans, credit cards, and wealth management products such as unit trusts and structured deposits. The bank also offers brokerage services and personalized wealth management solutions for high-net-worth individuals.

Serving corporates, public sectors, and small to medium enterprises, OCBC’s Global Wholesale Banking segment delivers an array of financial solutions. These include long-term project financing, short-term credit, trade financing, customized equity-linked financing products, capital market solutions, and corporate finance and advisory services.

OCBC’s Global Treasury and Markets segment engages in foreign exchange activities, money market operations, fixed income, and derivatives trading, and provides structured treasury products and financial solutions tailored to diverse market needs.

In addition to its banking services, OCBC offers life and general insurance products through its Insurance segment, along with fund management services to address clients’ investment requirements.

With a history dating back to 1912, OCBC has established itself as a reputable institution, serving clients globally. Its commitment to providing reliable and comprehensive financial services has contributed to its prominence in the industry.

Factors affecting Lion Bank Limited Share Price Singapore include strong financial performance, industry trends, and economic indicators. Q1 2021 saw a 24% YoY increase in net profit after tax to SGD $1.5 billion. The Bank’s focus on digitalization and expanding wealth management services keeps it ahead. Economic indicators like interest rates, inflation, and GDP growth also impact share prices. Investors should monitor these factors for informed decisions.

Market Trends | OCBC Bank Share Price

Like all companies listed on the stock market, oversea Chinese banking corp. the share price is influenced by market trends. In general, when the market is bullish, share prices tend to rise, and when the market is bearish, share prices tend to fall.

However, it’s worth noting that individual stocks can move differently from the market as a whole. For example, if it announces positive news, such as strong earnings or a new product launch, its share price may rise even in a bearish market.

Financial Performance | OCBC Bank Share Price

Another critical factor that affects OCBC’s share price is its financial performance. As a bank, generates revenue from several sources, including interest income, fees and commissions, and trading income.

Investors pay close attention to OCBC’s financial metrics, such as net profit, return on equity (ROE), and net interest margin (NIM). These metrics give investors insight into the bank’s profitability, efficiency, and risk management.

Global Events | OCBC Bank Share Price

Finally, global bank events can also impact OCBC’s share price. For example, if there is a significant economic downturn in a country where OCBC bank limited has a significant presence, such as China, this could negatively affect the bank’s earnings and share price.

Similarly, if there is a geopolitical event that impacts the financial markets, such as a trade war or a terrorist attack, this could also affect its share price.

oversea Chinese Banking Corp. Forecast & Growth Analysis

So, what does the future hold for a South Asia oversea Chinese banking corp limited SGX? According to market experts, OCBC Bank is well-positioned for growth in the coming years. Its strong financial performance, expanding regional presence, and focus on digitalization and wealth management are all positives. In addition, the gradual recovery of the global economy and increasing demand for financial services in Asia bode well for the bank’s future growth.

Risks associated with investing in OCBC Bank

As with any investment, there are risks associated with investing in OCBC Bank Limited. One such risk is the impact of external factors such as changes in regulations, market trends, and economic indicators. In addition, the banking industry is highly competitive, which can impact O39.SI Bank’s profitability. Finally, there is always the risk of unexpected events such as natural disasters, cyber-attacks, or pandemics, which can have an adverse impact on the bank’s financial performance.

Now that we understand the factors that affect share price let’s take a closer look at the bank’s financial performance and share price history.

Financial Performance | OCBC Bank Share Price

The has a strong track record of financial performance. In 2020, the bank reported a net profit of SGD 3.8 billion, up 10% from the previous year. The bank’s ROE was 8.9%, and its NIM was 1.63%.

OCBC has also been successful in diversifying its revenue streams. In 2020, the bank generated 43% of its revenue from Singapore, 25% from Greater China, and 32% from the rest of the world.

Today the share price has been relatively stable over the past few years, with some ups and downs along the way. In January 2017, the share price was SGD S$9.37. By January 2021, the share price had risen to S$10.98.

However, it’s worth noting that the O39 share price, like all stocks, is subject to volatility. In March 2020, at the height of the COVID-19 pandemic, OCBC’s share price fell to SGD 7.70. By November 2020, the share price had recovered to SGD 9.20.

OCBC Singapore bank posts record quarterly profit, indicates rates peaking- Reuters

South Asia country Singapore Limited bank OCBC posts record; reported a record quarterly profit on Wednesday which it credited to higher net interest margins. The bank’s Group Chief Executive Officer Helen Wong suggested that interest rates had reached a peak and would be stable for the remainder of the year. Its January-March net profit rose 39% to S$1.88 billion ($1.4 billion), outstripping the Refinitiv mean estimate of S$1.74 billion from five analysts polled.

The total net interest margin in the first quarter was 2.30%, up from 1.55% in the same period a year earlier, although it had decreased from 2.31% in the fourth quarter. For 2021, OCBC predicts its full-year net interest margin will inch up to 2.2%, more optimistic than its initial expectation of 2.1%.

These are recently Viewed tickers on Google: Black Rifle Coffee Company Stock (BRCC); Solar Integrated Roofing Stock (SIRC Stock)

The o39 dividend for the year (ocbc dividend payout date 2022 – 2023) is in detail with the help of the Chart below.

| Year | Yield | Total | Amount | Ex-Date | Pay Date |

|---|---|---|---|---|---|

| 2023 | 3.26% | SGD 0.4 | SGD 0.4 | 8/5/2023 | 19/5/2023 |

| 2022 | 4.58% | SGD 0.56 | SGD 0.28 | 12/8/2022 | 25/8/2022 |

Oversea-Chinese Banking Corporation Limited Overview

Oversea-Chinese Banking Corporation Limited (Hong Kong) share and stock rates for future investment may gain from S$1.20 to S$1.29(O39.SI). Oversea-Chinese Banking Corporation Limited O39.SI Stock Price SGX; Shares in Singapore Exchange Stock Market Rates are coming out next week in Singapore (SG)

O39.SI Key Statistics | SGX: OCBC Financials

OCBC Bank’s financial performance has been strong in recent years. Its net profit after tax for the first quarter of 2021 was SGD $1.5 billion, a 24% increase from the same period in 2020. Its return on equity (ROE) was 10.5%, which is above the industry average. In addition, its capital adequacy ratio (CAR) was 15.5%, which indicates that the bank has a strong capital position. sgx o39 share price statistics are mentioned below.

| Gross Margin | N/A |

| Operating Margin | 54.68% |

| Net Profit Margin | 51.83% |

| ROI | 5.97 |

OCBC Bank Share Price Quotes

| Bank Name | Real-Time Price | Change | Change% |

|---|---|---|---|

| OCBC Bank | 12.05 | -0.05 | -0.41% |

Tips for investing in OCBC Bank share price

If you are considering investing in OCBC Bank, here are some tips to keep in mind:

– Do your research: Understand the bank’s financial performance, industry trends, and economic indicators to make an informed investment decision.

– Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different sectors and geographies.

– Monitor your investments: Keep an eye on the bank’s financial performance and share price trends to ensure your investment continues to meet your expectations.

What do analysts think about OCBC bank share price? Let’s take a look at some of the latest recommendations and forecasts. According to our 5 analysts the earning estimate for the March qtr. 2023 the stock price of ocbc is 0.39; the low estimate is 0.30; the High Est. is 0.41 and concerning the next qtr. earning (June 2023) the avg. est. of 0.4; low est. 0.39; High est. 0.42 and year-ago EPS be 0.33

OCBC Bank Rating Recommendations

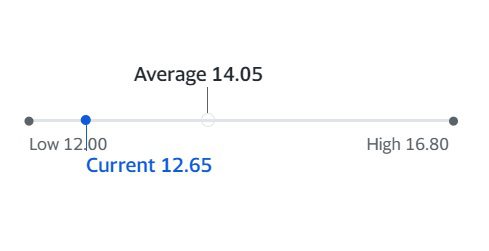

Analyst’s Price Target for OCBC share Price shows a low price of 12.00; a current price of S$12.65 highest share price of 16.80 represents a growth estimate of O39.SI of 18.90% in the year 2023 & in the next 5 years of 6.02%

What are Trading Conditions for OCBC Bank Share Price (O39.SG)

| Spread | 0.11 |

| Long Spot Trading Fee | -0.0199% |

| Short Spot Trading Fee | -0.001954% |

| Minimum Trade Qty. | 1 |

| currency | SGD |

| Gross Margin | 20% |

| Stock Exchange | Singapore (SGX) |

OCBC Central Bank Stock price gives you an ownership interest in one or more companies. On the other hand, OCBC’s share price represents ownership of one specific company only. For instance, if X has invested in stocks, it may mean that X has a portfolio of shares that spans different companies. However, if X has invested in shares, you may ask X, which company’s shares have been invested in, or how many shares they have invested in.

Knowing the O39.SI Oversea-Chinese Banking Corporation Limited (SGX: 039) makes a strong presence in financial services in Singapore, Malaysia, Indonesia, Greater China Increasing Its Dividend To SGD0.42.

When you own stock in a company, you own Oversea-Chinese Banking Corporation Limited shares. The word stock has no value and can relate to one or more companies. In contrast, each OCBC share has a specific value and relates to a specific company.

Comparison with Other Singaporean Banks

How does OCBC compare with other Singaporean banks? Let’s take a look at some key metrics.

Market Capitalization | OCBC Bank Share Price

OCBC has a market capitalization of SGD 43.8 billion as of March 2021, making it the second-largest bank in Singapore after DBS.

Financial Metrics

OCBC’s financial metrics compare favorably with other Singaporean banks. For example, OCBC’s ROE of 8.9% is higher than DBS’s ROE of 7.4%.

Dividends | OCBC Bank Share Price

OCBC has a strong track record of paying dividends to shareholders. In 2020, the bank paid a total dividend of SGD 0.36 per share.

What does the future hold for OCBC’s share price? While OCBC (Oversea-Chinese Banking Corporation Limited) is indeed the second-largest financial services group in Singapore based on total assets., several factors could impact the bank’s share price.

1. Economic Recovery

As the global economy recovers from the COVID-19 pandemic, this could drive demand for loans and other financial services, which could boost OCBC’s earnings and share price.

2. Interest Rates

As a lender, OCBC is sensitive to changes in interest rates. If interest rates rise, this could increase the bank’s net interest margin and boost its earnings and share price.

2. Competition

The banking industry is highly competitive, and OCBC faces stiff competition from other banks and fintech companies. The bank must continue to innovate and adapt to stay ahead of the competition.

Is OCBC a Good Investment?

So, is (oversea-Chinese banking corp) a good investment? Like all investments, there are risks and challenges associated with investing in OCBC shares. However, the bank has a strong track record of financial performance, a diversified revenue stream, and a solid reputation in the Singaporean banking industry.

Investors who have a long-term investment horizon, a diversified portfolio, and a willingness to do their research may find that OCBC shares are a good fit for their investment strategy. As always, it’s important to consult with a financial advisor before making any investment decisions.

When was the last OCBC stock split?

The last stock split for OCBC (Oversea-Chinese Banking Corporation Limited) occurred on August 3rd, 2005.

What are the career opportunities at OCBC Bank?

There are various job openings in OCBC Bank Hong Kong, Singapore CLICK HERE just enter your Job title (Field), preferred Location & Organization.

What are the main services provided by OCBC Bank Singapore?

The main services provided by overseas Chinese Banking Corporation Ltd. Singapore are as follows:

Corporate banking, investment banking, retail banking, private banking, treasury management, investment management, asset management & wealth management.Who is OCBC owned by?

OCBC (Oversea-Chinese Banking Corporation Limited) is a publicly traded company with ownership distributed among various shareholders, including institutional investors and individuals.

Is OCBC Stock a Smart Investment Choice?

According to the TipRanks’ analyst consensus, O39 stock currently holds a favorable Moderate Buy rating. With an average target price of S$14.12, market analysts predict a promising growth potential of 11.6% from its current level.

What is the target price for OCBC Share Price Singapore?

Based on our Fundamental Analysis & Analysts’ Ratings OCBC (039: SGX) 12-month Price Target is S$14.19 recommended as a STRONG BUY.

Is OCBC Bank Share a good investment?

Yes, OCBC Bank is a solid investment option for the long term. Its strong financials, expanding regional presence, and attractive dividend yield make it an attractive option for income investors. In addition, its focus on digitalization and wealth management services positions it well for future growth.

What are the 12-month price targets for OCBC Bank?

According to an analysis by 7 Wall Street analysts in the last 3 months, OCBC’s average price target is S$14.84, with a high forecast of S$18.36 and a low forecast of S$13.10.

Should I invest in OCBC Bank?

YES, OCBC Bank boasts the highest dividend yield among the three local banks, standing at an impressive 6.15%. This dividend increase is attributed to OCBC’s strengthened earnings over the year.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.