Investing in Wilmar International F34 stock, an agribusiness company in Singapore (SGX: F34.SI) at a price of SGX $3.75 in the Singapore Exchange closed on a loss of 14% Intrinsic Valuation could be a good opportunity in agriculture. Wilmar does different farming activities worldwide, which helps them manage price changes.

They handle everything from sourcing to selling, making their operations efficient. Wilmar is also focused on sustainable farming. With its stock price lower now, it might be a good time to invest for potential growth. They have a history of sharing profits with investors through dividends.

According to recent analysis by 5 Wall Street experts, the average price target for Wilmar International over the next 12 months is S$3.74. The high forecast is S$4.30, while the low forecast is S$3.35. This average price target suggests a 7.22% increase from the current price of S$3.49.

Wilmar International Limited ticker symbol (SGX F34.SI) has announced a cash dividend of 0.11 per share. The ex-date for this dividend is April 29, 2024. This means that shareholders who own the stock on or before April 29, 2024, will be eligible to receive the dividend payment.

There are exciting Wilmar International F34 Stock Announcements! They’re sharing updates about important shareholders and employees who are buying or selling company stock. This shows how confident they are in the company. Wilmar International also made more money in the first half of 2022, with earnings per share (EPS) going up to US$0.18 from US$0.12 in 2021. Changes to the board will happen on July 1, 2022, as announced on June 28.Additionally, Tong Shao Ming has been appointed as the alternate director at Wilmar International Limited.

Table of Contents

Financial Analysis of Wilmar International Ltd

Wilmar International Ltd is careful with debt, keeping a low ratio of debt to equity at 0.42, which shows they manage money wisely. They earn enough to cover their interest payments. However, their Altman Z-Score of 1.74 means they’re not as financially strong as other companies in the industry. This shows they could work on becoming more stable and trustworthy with money. On the positive side, Wilmar International Ltd owns more long-term assets than they owe in long-term debts, which is good for their overall financial health.

| Previous Close | 3.5100 |

| Open | 3.5100 |

| Day’s Range | 3.4900 – 3.5500 |

| 52 Week Range | 3.0700 – 4.1500 |

| Volume | 4,015,700 |

| Avg. Volume | 5,201,590 |

| Market Cap | 22.037B |

| Beta (5Y Monthly) | 0.52 |

| PE Ratio (TTM) | 9.05 |

| EPS (TTM) | 0.3900 |

| Earnings Date | Feb 21, 2024 |

| Forward Dividend & Yield | 0.17 (4.93%) |

| Ex-Dividend Date | Apr 29, 2024 |

| 1y Target Est | 3.91 |

Wilmar Intl Dividend Yield (SGX F34) – Singapore

Wilmar International Limited (SGX: F34) paid dividends twice in 2020. In August, shareholders received SGD 0.04 per share, paid on August 27 after being announced on August 18 and 19. In June, another dividend of SGD 0.095 per share was paid on June 24 after being announced on June 15 and 16.

Currently, Wilmar International Limited (F34) is trading at SGD 3.4, showing a 0.59% increase with a rise of 0.02 SGD. The dividend yield for Wilmar International (SGX: F34) is 5.04%, meaning shareholders received a return of 5.04% on their investment through dividends. Over the past decade, the company has consistently increased its dividend payments, which is good news for investors.

Wilmar International Limited F34 stock Overview

Wilmar International Limited (F34.SI) is a major player in the global agribusiness industry, operating across regions like Southeast Asia, China, and Europe. The company focuses on four key segments: Food Products, Feed and Industrial Products, Plantation and Sugar Milling, and Others.

In Food Products, Wilmar processes and distributes various items like vegetable oils, sugar, flour, noodles, and snacks. The Feed and Industrial Products segment produces animal feeds, palm products, and biodiesel.

Wilmar emphasizes sustainability in its Plantation and Sugar Milling segment, specializing in palm oil and sugarcane cultivation while prioritizing environmental responsibility.

Founded in 1991 and headquartered in Singapore, Wilmar International owns a large oil palm plantation covering 231,697 hectares as of December 31, 2022.

wilmar International Limited share price (SGX: F34) target Today

Wilmar International Stock (F34) Share Forecast & Price Target suggests the average price target is S$3.70 with a high forecast of S$4.23 and a low forecast of S$3.30. The average price target represents a 8.22% change from the last price of S$3.350.

Wilmar International F34 stock presents a Strong Investment Potential opportunity due to its impressive performance and growth potential. With a market cap of S$23.7 billion and a current stock price of SGD S$3.80 (-0.050 or 1.30% change), the company demonstrates financial strength and stability.

Earnings Growth and Revenue Projections

Wilmar International has exhibited a commendable average annual earnings growth rate of 16.3%, indicating steady progress in profitability. Though the projected earnings growth stands at -3.8%, the company’s annual revenue is expected to grow at a modest rate of 2% per year, presenting an opportunity for stable growth in the agricultural products industry.

Dividend Yield and Stability

As a dividend-paying company, Wilmar International F34 stock currently offers an attractive dividend yield of 4.41%. This provides investors with a potential income stream while holding the stock. The company’s well-balanced payout ratio of 30.98% further enhances the stability of its dividends.

The Kuok Group holds the largest share in Wilmar International F34 stock with 27% of outstanding shares. Archer-Daniels-Midland Company is the second-largest shareholder, holding 24% of common stock. Notably, Khoon Hong Kuok also holds approximately 6.4% of Wilmar company stock, further reaffirming his commitment to the company’s success.

Competitors and Industry Analysis

Wilmar International faces competition from top players in the agricultural products industry, including Tyson Foods, Archer Daniels Midland, Sinar Mas, Everspring Farms, Golden Agri Resources, First Resources, Bumitama Agri, and Thai Beverages.

Read More Black Rifle Coffee Stock Company(BRCC)| How to invest in Stocks (with max. Profit)

Wilmar Share Price History

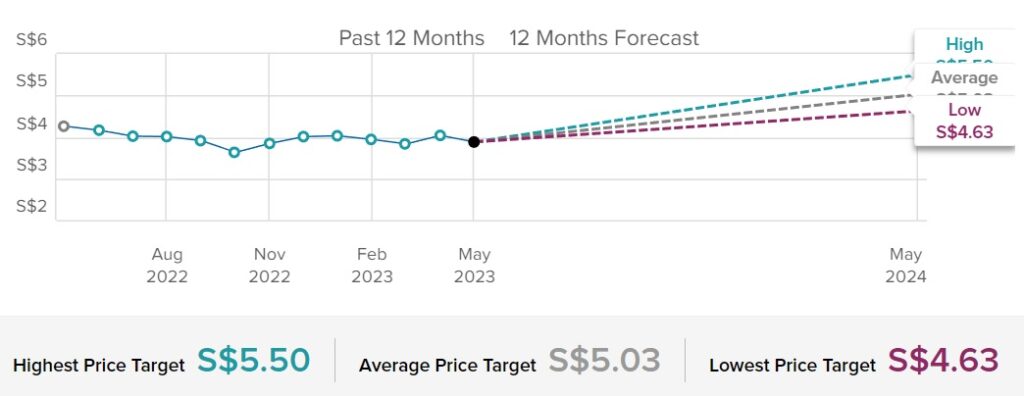

WLMIY F34 stock price forecast for 12 months has received 3 price targets from Wall Street analysts over the last 3 months. The average price target is S$4.95 with a high forecast of S$5.50 and a low forecast of S$4.63. The average price target represents a 26.97% change from the last price of S$3.90.

Wilmar International (F34) Stock: Share Price Prediction and Market Insights

Wilmar International (F34) Stock: Examining Historical Data and Forecasting Future Performance

Wilmar International Limited is a company that operates in various regions across the world and deals with agricultural products. The company has four different segments, which are Food Products, Feed and Industrial Products, Plantation and Sugar Milling, and Others.

The Food Products segment is responsible for processing and distributing a range of edible food products, including vegetable oil, sugar, flour, rice, noodles, specialty fats, snacks, bakery, and dairy products.

The Feed and Industrial Products segment deals with animal feeds, agricultural commodities, oleochemicals, and other related products. The Plantation and Sugar Milling segment is responsible for cultivating and milling palm oil and sugarcane.

The Others segment provides logistics services and is involved in investment activities. Wilmar International Limited is headquartered in Singapore and was established in 1991. As of December 31, 2022, the company owned an oil palm plantation that covered an area of 231,697 hectares.

Wilmar international investor relations

As a global agribusiness firm, Wilmar International Limited operates in Singapore, South East Asia, the People’s Republic of China, India, Europe, Australia/New Zealand, and Africa.

Is Wilmar a good Stock?

YES, In the past year, Wilmar’s 90% subsidiary Yihai’s share price has jumped >400%; and it is now trading cheaper than its subsidiary. Hence, it is noticeable that there are many worthwhile (stable dividends and satisfactorily good growth prospects) for Wilmar International share (WLMIF)right now if it can continue to make headway with its subsidiary.

Wilmar international competitors (Top 4)

Wilmar share price target By Experts

Based on the ratings of 5 Wall Street analysts, Wilmar International (F34) is rated as a Strong Buy.

Technical Analysis Wilmar Share Price History

The Moving Averages Convergence Divergence (MACD) is a 3.90 indicator but the current share of Wilmar International Limited (F34) Stock makes $3.94 suggests it is a- BUY

The 20 Days Exponential Moving Averages Convergence Divergence (MACD) is a 3.90 indicator but the current share Wilmar International (F34) makes $3.94 suggests – BUY

The 50 Days Exponential Moving Averages Convergence Divergence (MACD) is a 3.98 indicator but the current share of Wilmar International (F34) makes $3.94 suggests – BUY

Wilmar International f34 stock (Financial Statistics)

| Fiscal year Ends | 31 Dec 2022 |

| Last Quarter | 31 Dec 2022 |

| Profit Margin | 3.27% |

| Operating Margin | 4.35% |

Wilmar international annual report

wilmar international news

To deliberate the market capitalization of the group’s subsidiaries, CGS-CIMB raised its target price on Wilmar International to S$4.82 from S$4.68. (READ MORE)

On the Singapore Exchange (SGX), Wilmar International was among the top five value-traded and upwardly mobile shares last week.

FAQ- Wilmar International f34 stock

What is the current price of Wilmar Stock Price?

The Current price of Wilmar Stock Price is $3.75 −0.060 (1.57%) as on July 2023

What is Bloomberg Wilmar International Share Price History

The Bloomberg Wilmar International Ltd. (F34:SP) is $3.96

Who is the largest/biggest shareholder in Wilmar International Ltd.?

The Kuok Group is the largest shareholder in Wilmar International Ltd. with 27% of shares outstanding.

Is Wilmar Intl Ltd. (SGX F34) a undervalued Stock?

Yes, based on the analysis provided, Wilmar International appears to be undervalued. The current share price of S$3.40 represents a 32% discount compared to the average price target of S$3.74 from Wall Street analysts.

What is today’s Value of Wilmar International Ltd (F34.SI)

As of 2024-04-22, the Fair Value of Wilmar International Ltd (F34.SI) is 3.75 SGD ▲(10.11% Upside)

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.