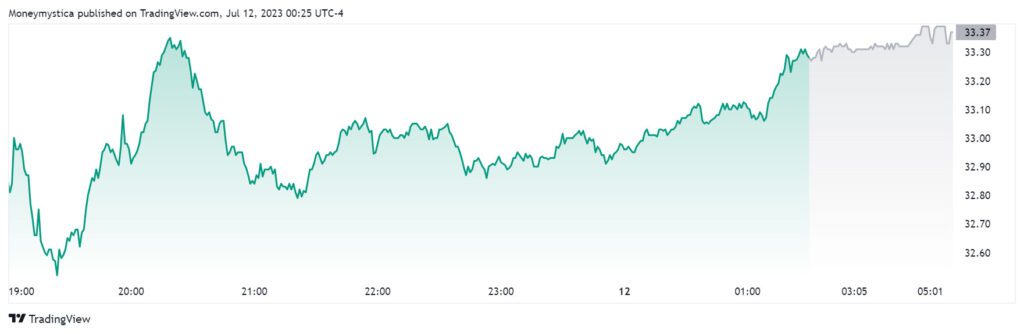

Explore the future trajectory of Intel stock price forecast & insights into whether is Intel a good stock to buy. The stock price today is $33.34 +0.56 (+1.71%)

Day’s Range$32.5 – $33.36 | 52-Week Range$23.87 – $39.15 | Previous Close$32.74 |Volume28.15M | Average Volume (3M)44.00M | Market Cap $136.56B | Enterprise Value$161.64B | Total Cash (Recent Filing)$27.53B | Total Debt (Recent Filing)$50.27B | Price to Earnings (P/E)-47.6 | Next EarningsJul 27, 2023 | EPS Estimate-$0.04 | Dividend Yield1.22 (3.66%)| Last Dividend Ex-DateMay 04, 2023

In 2023, the Intel stock price (INTC)started at $26.40 and has since risen to $33.70, a 28.5% increase. The forecasted price for the end of 2023 is $40.36, representing a year-to-year change of +49%. By the end of 2024, the price is expected to reach $44.19, indicating a +29% increase from the current price. On average, analysts forecast that INTC’s EPS will be -$0.15 for 2023

INTRODUCTION TO COMPANY INTEL CORPORATION

Intel is a prominent American company that specializes in manufacturing computer chips used across various industries. While it once held significant market share, increasing competition from rivals like AMD and Nvidia, as well as internal chip development by companies like Apple and Microsoft, have led to a decline in Intel’s dominance. Nevertheless, Intel remains a major player in enterprise computing industries, particularly in data centers.

In this article, we will closely examine Intel’s recent performance, market position, dividend, financials, and expert opinions to provide a comprehensive outlook on intel Stock price prediction for 2023, 2024, 2025, 2026, 2027, 2028, 2030, and where will be the share price of Intel be in 5 – 10 years.

Why do I check these stocks Daily: Lucid Stock Price Prediction for Savvy Investors 2023-2030 | Rivian Stock Price Prediction 2025-2030 Blissful RIVN Forecast | Roku stock forecast and price target 2025 are worth buying | OCBC Bank Share Price SGX: O39.SI Singapore

Intel Corporation(INTC) Overview

Intel Corporation, an American multinational technology company, is renowned for its manufacturing of microprocessors used in personal computers (PCs). The company supplies microprocessors to leading computer systems manufacturers such as Acer, Dell, HP, and Lenovo, and its x86 series of microprocessors are widely used in the PC industry.

In addition to microprocessors, Intel produces a diverse range of computing and communication-related products. These include motherboard chipsets, integrated circuits, network interface controllers, embedded processors, graphics chips, processing units, systems-on-chip (SoCs), Wi-Fi and Bluetooth chipsets, modems, mobile phones, CPUs, flash memory, and vehicle automation technologies.

Established on July 18, 1968, by Gordon Moore and Robert Noyce, who are recognized as semiconductor pioneers, Intel played a significant role in the development of Silicon Valley. The company achieved a major milestone in 1971 by creating the world’s first commercial microprocessor chip, solidifying its position as an industry leader.

Intel’s reputation is built on the quality of its products and its continuous innovation. With strong leadership, the company remains relevant in the dynamic tech space. Intel has gained recognition for its aggressive marketing tactics and its efforts to defend its market position. As a result, it is well-positioned for future technological advancements and innovations.

Latest News from Intel Newsroom

Intel’s 4th Gen Xeon Scalable processor and Habana Gaudi2 deep learning accelerator achieved impressive results in the MLPerf Training 3.0 benchmark. The results validate Intel’s value in AI, with Xeon processors ideal for volume workloads and Gaudi excelling in large language models and generative AI. Intel’s scalable systems and optimized software make AI deployment easier across the data center, from cloud to edge.

Intel Corporation (INTC) Stock Price Swap History

Analyzing Intel Corporation’s stock price movements over the years provides valuable insights into its historical performance. It is important to note that historical data alone cannot guarantee future stock price movements, as market conditions and various factors can significantly impact stock prices.

Intel’s initial public offering (IPO) occurred on October 13, 1971, at a price of $23.70 per share. Adjusted for subsequent stock splits, the IPO price is $0.04 per share. Yahoo Finance began tracking the stock in 1985, and the analysis below utilizes their data.

Here is a summary of Intel’s stock prices on various dates:

- January 1, 1985: Opened at $0.60 and closed at $0.64.

- November 1, 1987: Opened at $0.84 and closed at $0.69.

- March 1, 1988: Opened at $0.90, reached a high of $1.02, and closed at $0.94.

- December 1, 1989: Opened at $1.10 and closed at $1.42.

- June 1, 1990: Opened at $1.51 and closed at $1.49.

- December 1, 1991: Opened at $1.27 and closed at $1.53.

- June 1, 1993: Opened at $3.47 and closed at $3.44.

- January 1, 1994: Opened at $3.89 and closed at $4.08.

- June 1, 1995: Opened at $7.03 and closed at $8.13.

- December 1, 1996: Opened at $15.75 and closed at $16.37.

- December 1, 1997: Opened at $19.63, reached a high of $20.44, and closed at $17.56.

- January 1, 1999: Opened at $29.98 and closed at $35.24.

- June 1, 2000: Opened at $63.09 and closed at $66.84.

- December 1, 2001: Opened at $32.29 and closed at $31.45.

- January 1, 2003: Opened at $16.02 and closed at $15.66.

- June 1, 2004: Opened at $28.37 and closed at $27.60.

- December 1, 2005: Opened at $26.94 and closed at $24.96.

- January 1, 2007: Opened at $20.45 and closed at $20.96.

- June 1, 2008: Opened at $23.05 and closed at $21.48.

- December 1, 2009: Opened at $19.46 and closed at $14.14.

- January 1, 2011: Opened at $21.01 and closed at $21.46.

- June 1, 2012: Opened at $25.40 and closed at $26.65.

- December 1, 2013: Opened at $24.00 and closed at $25.96.

- January 1, 2015: Opened at $36.67 and closed at $33.04.

- June 1, 2016: Opened at $31.62 and closed at $31.59.

- December 1, 2017: Opened at $44.74 and closed at $46.16.

- December 1, 2018: Opened at $50.00 and closed at $46.93.

- June 1, 2019: Opened at $44.25 and closed at $47.87.

- January 1, 2020: Opened at $60.24, reached a high of $69.29, and closed at $63.93.

- June 1, 2020: Opened at $62.49 and closed at $59.83.

- December 1, 2020: Opened at $48.75 and closed at $49.82.

- January 1, 2021: Opened at $49.89, reached a high of $63.95, and closed at $55.51.

- June 1, 2021: Opened at $57.61 and closed at $56.14.

- December 1, 2021: Opened at $49.84, reached a high of $55.00, and closed at $51.51.

- January 1, 2022: Opened at $52.65, reached a high of $56.28, and closed the year at a low price of $25.82.

- It is important to consider that these historical stock prices are provided as a reference and do not guarantee future performance. Multiple factors, such as market conditions, company developments, industry trends, and global events, can influence stock prices.

the updated information on the market share and performance of Intel CPU and AMD. It seems that as of 2022, Intel maintained its market leadership position with a 71% share, although it has experienced a decline from its previous dominance. The drop in revenue from the segment can be attributed to delays in next-generation products and weakness in enterprise spending due to macroeconomic conditions.

AMD, on the other hand, secured the second position with a 20% market share. Its success can be attributed to the increased adoption of its EPYC processor Milan, particularly in the x86-based CPU for data centers. AMD has seen significant growth in its data center portfolio with a 62% year-on-year growth in 2022. The adoption of AMD processors by cloud providers and server companies has contributed to its rising market share.

In addition, you mentioned AWS (Amazon Web Services) and its in-house ARM-based chip called Graviton. AWS has been an early adopter of ARM architecture in data centers, and its Graviton chip has reached its third generation. AWS has expanded Graviton’s penetration in its offerings, supporting machine learning-based instances with in-house accelerators. This represents a shift from general-purpose computing to catering to specific workloads.

Intel Stock Price Forecast 2023, 2025, 2030

It’s important to note that these predictions are based on factors such as historical price data, volume fluctuation, market trends, and comparable stocks. However, it’s crucial to understand that stock price predictions are not guaranteed outcomes and should be approached as expert suggestions rather than definitive future prices.

The price predictions provided by the analysis suggest that Intel stock (INTC) could potentially experience positive growth as a long-term investment. The forecast indicates a potential increase in value, with the stock reaching $39.927 by the end of 2023, $64.80 in 2024, and a mean price of $82 by 2025.

Intel Stock Price Forecast 2023

The Intel Corporation’s standing as a tech giant portends well for its stock in the upcoming months of 2023. Our research indicates that the peak price of the stock in June is expected to be $31.66, while December should see it reaching its maximum at $39.927. If you are looking to invest in Intel stock for the long term, understanding how the price will move over time can help you make an informed decision on when to buy or sell, and potentially increase your chances of earning a robust return on investment.

Intel Stock Price Forecast 2024

Intel’s aggressive marketing tactics are likely to remain effective, resulting in higher revenues and increased market dominance. According to our research, the stock is expected to open at $55.97 and close at $52.85 when 2023 ends. There is a potential for the price per share to reach a minimum of $41.37 and a maximum of $64.50 by 2024.

Intel Stock Price Forecast 2025

The 33 analysts offering 12-month intel stock price prediction 2025 for Intel stock forecast (INTC) have a median target of 82.00, with a high estimate of 95.00 and a low estimate of 71.00. The median estimate represents a 2.29% increase from the last price of 64.50.

Intel Stock Price Forecast 2030

This Intel stock price forecast covers the next 1 0 years, up until 2030. We believe that Intel will make great strides in this time and their stock price will likely increase significantly. The predicted opening and closing prices for 2030 are $128.50 and $138.96 respectively, with a minimum of $112.74 and a maximum of $140.85 per share.

Is Intel a good stock to Buy: Expert Analysis & Ratings

- Moving Averages Convergence Divergence (MACD) indicator: The MACD indicator for Intel (INTC) is 0.26, which is generally interpreted as a Buy signal.

- 20-Day Exponential Moving Average (EMA): The 20-day EMA for Intel (INTC) is 32.77, while the share price is $33.30. This indicates a potential Sell signal.

- 50-Day Exponential Moving Average (EMA): The 50-day EMA for Intel (INTC) is 31.86, while the share price is $33.30. This suggests a potential Buy signal.

FAQ – INTEL STOCK PRICE FORECAST

What is Intel’s (INTC)stock symbol?

Intel Corporation is traded under the ticker symbol INTC on the NASDAQ exchange, commonly referred to as NASDAQ: INTC or INTC-Q.

Is Intel a buy Hold or a sell? Is Intel a Good Investment?

According to the opinions of 27 stock analysts in the past year, 10 analysts recommended strong buying of INTC-Q (Intel Corporation), while 14 analysts recommended selling the stock. These factors recommend it is a long-run good investment.

Why is Intel stock dropping?

Intel reported a substantial decline (INTC 1.74%)in revenue during its latest quarterly update, following a period of pandemic-driven sales growth. Tough competition from AMD and global supply chain issues have impacted Intel’s stock price. However, Intel remains focused on business growth, aiming to increase profits and potentially improve stock performance in the future.

What is the Intel dividend per share?

Intel offers a forward dividend yield of 0.50 (1.53%) 4.89%, higher than the S&P 500 average, with a dividend payout ratio of 50%, indicating its ability to sustain dividend payments.

What is Intel’s Stock Forecast for 5 years?

According to analysts, the INTC forecast for Intel’s stock price in 5 years is estimated to range between $68 to $85. This suggests an optimistic outlook for Intel’s long-term performance.

What is Intel’s Stock Price from the past 6 months?

the median Intel stock forecast (INTC) stock price over the past 6 months is $29.4. This indicates a 1.55% increase on average from the Intel price target of each prediction. It suggests that the forecasted stock price has experienced a slight upward trend over the given time period.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.