Lucid Stock Price Prediction explained with FintechZoom Lucid Stock Analysis detailed (LCID) will surely be priced at nearly $11.89 in 2025, Lucid Group, Inc. stock will be 24.30 by 2030, $200 in 2040, and $410 in 2050.

In the fast-changing world of stock markets, predicting a company’s future stock price involves looking at financial data, industry trends, and the company’s potential. Lucid Motors, a new electric vehicle (EV) market player, has caught a lot of attention lately.

As of July 17, 2024, Lucid Group Inc.’s stock is priced at an opening value of $3.97, which means that the LCID stock price increased by $0.36 showing a 9.97% potential gain compared to the previous trading day’s closing price.

Key Takeaways:

Analysts are bullish for Lucid’s stock’s bright future if we foresee 2024. Moreover, with ongoing developments in EV technology and increasing consumer interest, LCID stock price is predicted to grow.

Looking over Lucid’s stock’s average growth over the past 10 years we assume that LCID stock will be priced at $ 7.50 in 2025 with estimates ranging from as low as $4.09 to as high as $11.19.

lucid stock price prediction 2030 is expected to reach a record-high price range of $14.50 to $24.30 by 2030.

Read: Rivian Automotive Inc. stock: RIVN stock forecast & prediction and 2030

About Lucid Group Inc (LCID) Company Overview

Lucid Group, Inc. (NASDAQ: LCID)is an American company (formally known as Atieva, Inc.) that makes luxury electric vehicles. It is based in Newark, California. Lucid designs its cars in California and builds them at its factory in Arizona. The company was founded in 2007. Lucid aims to create sustainable cars that are intuitive, liberating, and designed for all types of travel, without compromising on quality.

Company Profile

| Company Name | Lucid Group, Inc. |

|---|---|

| Symbol (Trade) | LCID (NASDAQ) Russell 1000 component |

| Industry | Automotive |

| Founded | 2007 |

| Founders | Bernard Tse, Sam Weng, and Sheaupyng Lin |

| Headquarters | Newark, California, U.S. |

| Key people | Peter Rawlinson (CEO, CTO), Andrew Liveris (Chairman), Sam Weng (COO) |

| Revenue | Decrease US$595 million (2023) |

Lucid Stock Price Prediction Analysis

Lucid Group Inc. stock market is expected to open at $2.52 by 17th June 2024. On average, the LCID price target could be $3.10 a high forecast of $4.25, and a low forecast of $2.50. The average price target represents a 24.50% change from the current price of $2.52.

Read: Is it the Right Time to Buy NIO Stock in 2024

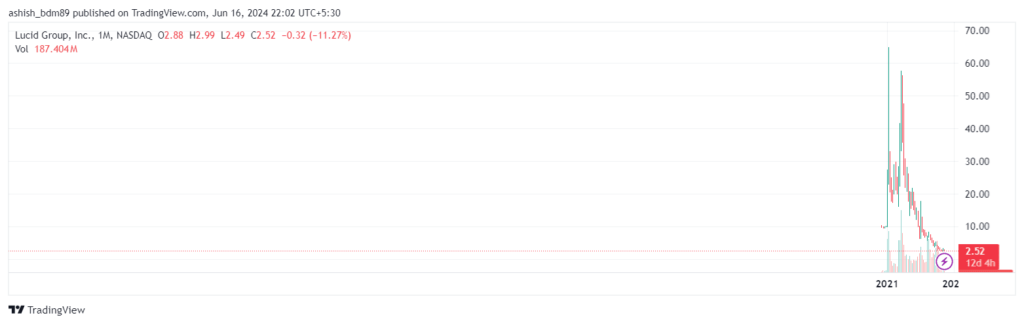

Lucid Stock Price History, Growth and Chart

LongTerm Lucid Stock Price Prediction and Forecast 2024, 2025, 2030, 2040, 2050, 2060

Our Expert Analysis for Lucid stock forecast represents that LCID stock price will reach $4.04 in 2024, $7.40 in 2025, $24.36 by 2030, $41.35 by 2040, $50.45 by 2050, and $100 by 2060

Lucid Stock Price Prediction 2024

Lucid Motors share price prediction examines that LCID Forecast will reach approx. an average price target range from $2.52 to $4.04 by the end of 2024. It’s truly disappointing for investors that Lucid Group Inc. stock is not expected to grow in production in 2024.

Lucid Stock Price Prediction 2025

Lucid Motors 2025 Forecasts somewhere 5 billion earnings as liquid money. LCID stock in 2025 could be priced as high as $11.89 and deflate as low as $3.90 from its current price.

Lucid Stock Price Prediction 2030

Based on the past 10 years of growth we can say Lucid Group, Inc. stock price will skyrocket in 2030, and LCID stock will be priced at $24.36 per share by 2030. The average growth is a whopping gain of 866.67% from its current Price.

Moreover, Looking further, despite facing challenges like slowing growth and losses in the electric vehicle (EV) industry, Lucid Motors could see big gains in increased production and revenue. Yahoo Finance shows an optimistic outlook for the company.

Related: CPB Stock Forecast 2025,2030,2035,2040,2050,2060 Price Target

Lucid Stock Price Prediction 2040

By 2040, Lucid Stock Predictions forecasts a potential price growth of 30% and a range of $200 to $350 by 2040, which means LUCID will be producing a great deal of profit or making a huge amount of money.

Lucid Stock Price Prediction 2050

Lucid Stock Price Prediction 2050 forecasts a price range of $410 to $550 If Lucid stock’s price follows the S&P 500 index’s multi-year growth rate.

Lucid Stock Price Prediction 2060

It is impossible to forecast for sure what is Lucid’s Stock price prediction for 2060, but we asked chatgpt and forecast that LCID stock will range between $100 to $160.

What is the LCID Prediction for 2040?

If Lucid stock’s price follows the S&P 500 index’s multi-year growth rate, LCID could reach as high as $44.61 in 2040.

What will LCID stock cost in 2030?

Based on the latest indications the lucid could be priced at $4.00 by the end of 2024 and in the next 5 years LCID stock will range between $11.40 to $ 25.23 per share in 2030.

What is LCID Stock worth in 2025?

According to our Lucid Group Inc. stock prediction for 2025, LUCID stock will be priced at $ 12.06 in 2025.

What is LCID stock prediction for 2028?

According to our latest long-term LCID forecast, the Lucid price will range between $18.16 to $22.50 within the year 2028.

What will Lucid stock be priced in 5 years?

Lucid Group Inc. stock next five years is expected to grow 10 times potentially upside in 2029 and reach $20.20 compared to today’s rates.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.