Rivian stock price prediction 2030 is $18.78 per share and Rivian stock price Target for 2030 could slide down by 6% from today. However, RIVN stock will be priced at $ 11.54 in 2025. Rivan has attracted considerable attention, however, RIVN stock will be priced at $ 18.78 in 2030 since its initial public offering (IPO). Rivian Stock Price Prediction 2025 Analyst Estimates are forecasted between $180.11 and $240.95 per share whereas Rivian’s stock will be priced at $340.00 per share by 2030. Rivian stock price prediction for 2040 ranges from $156 to $410.

Table of Contents

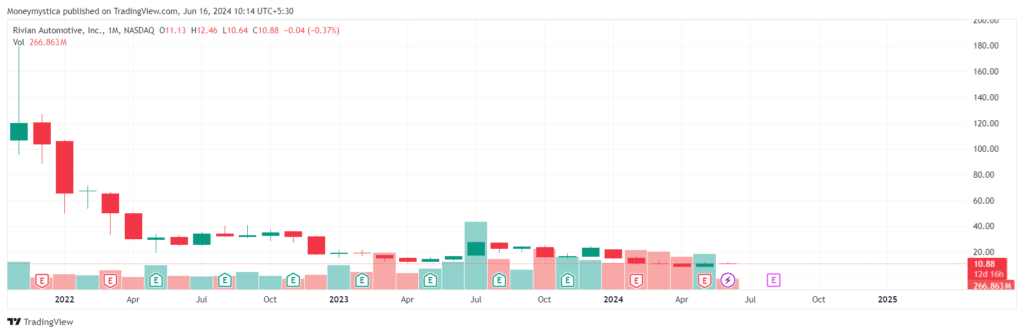

Rivian Stock has again gained curiosity among investors who invested their money in Electric Vehicles (EV) Stocks since its debut on the stock market in November 2021. Its stock value increased dramatically to $180 in its first week. But the COVID-19 lockdown was crucial for the decline of Rivians stock prices.

Technology stocks are outperforming the rest of the market and even Wall Street analysts forecast Rivian’s stock price over the next year in 2025 to be $17.54 a 6.31% upside over the current price. Of the 28 analysts who published the stock, the consensus recommendation is a 2.1 “Outperform” Score.

Rivian stock is currently priced at $16.66, with a potential gain of 1.80%, indicating an upside of 75% from its current market price by 2024.

If things go well, we are confident that Rivian stock will reach $22 by the end of 2025, with the average RIVN price target estimated at $17 by the end of 2025.

Out of curiosity, we wish a bright future for Rivian Automotive Inc.’s stock and expect Rivian’s stock to reach up to $145 per share by 2030. RIVN’s price target by the end of 2030 is expected to range between $101 to $135.00. Despite the highs and lows suffered by Rivian Automotive Inc., the management is very hopeful that the company can successfully produce a million vehicles a year by 2030.

According to moneymystica, Rivian Stock Price Prediction 2040 could be between $98 and $190 by the year 2040, starting from its last price of $11.14.

What is Fintechzoom Rivian stock?

Rivian Automotive, Inc. is an American electric vehicle manufacturer and automotive technology and outdoor recreation company founded in 2009. Rivian produces an electric sport utility vehicle (SUV) and a pickup truck based on a versatile “skateboard” platform, which can support future vehicle models or be adopted by other companies.

Rivian Automotive, Inc. Class A Common Stock is one of the rapidly growing electric vehicle (EV) companies. On June 10, Chief Executive RJ Scaringe sold 71,429 Rivian (RIVN) shares for a market value of $820,883.50, according to regulatory filings. Meanwhile, Rivian Automotive, Inc. (NASDAQ: RIVN) announced its first quarter 2024 financial results, surpassing expectations with impressive vehicle production and deliveries.

Company Profile

| Company Name | Rivian Automotive Inc |

|---|---|

| Symbol (Trade) | RIVN (NASDAQ) |

| CEO | RJ Scaringe (June 2009–) |

| Founded | June 2009 |

| Founder | RJ Scaringe |

| Headquarters | Irvine, CA |

| Number of Employees | 16,790 (2023) |

| Revenue | 4.43 billion USD (2023) |

Rivian Inc (RIVN) Stock Fundamental Analysis

| Previous Close | $11.11 |

| Open | $10.92 |

| Day’s Range | $10.81 – $11.23 |

| 52 Week Range | $8.26 – $28.06 |

| Volume | 21,147,442 |

| Avg. Volume | 37,067,373 |

| 1y Target Est | $15.92 |

| Market Cap (intraday) | $10.829B |

| Beta (5Y Monthly) | 2.01 |

| PE Ratio (TTM) | — |

| EPS (TTM) | -5.77 |

| Earnings Date | Aug 6, 2024 – Aug 12, 2024 |

| Forward Dividend & Yield | — |

| Ex-Dividend Date | — |

Rivian Automotive, Inc. Class A Common Stock (RIVN) Historical Growth, Quotes

Rivian (RIVN) Stock Analyst Price Target by 247wallst.com

Now let us check out 24/7 Wall Street predictions about Rivian’s future, growth expectations and stock price estimates through 2030, as outlined in the table below.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2024 | $17.51 | gain of 6.31% |

| 2025 | $22.00 | Gain of 33.57% |

| 2026 | $34.00 | Gain of 106.45% |

| 2027 | $64.00 | Gain of 288.58% |

| 2028 | $95.00 | Gain of 476.90% |

| 2029 | $127.00 | Gain of 671.12% |

| 2030 | $140.00 | Gain of 750.01% |

TipRanks Forecast of Rivian

Based on 19 Wall Street analysts offering 12-month price targets for Rivian Automotive in the last 3 months. The average price target is $13.47 with a high forecast of $21.00 and a low forecast of $8.00. The average price target represents a 23.81% change from the last price of $10.88.

Zacks RIVN Price Target For Rivian Automotive

Based on short-term price targets presented by 22 analysts, the average price target for Rivian Automotive derived to $16.14. The forecasts range from a low of $10.00 to a high of $30.00. The average price target represents an increase of 45.27% from the last closing price of $11.11.

Long-term Rivian Stock Price Prediction and Forecast 2025, 2030, 2040, 2050, 2060

Our long-term Rivian stock forecast represents that Rivian stock price prediction in 2024 is $11.94, $22 by 2025, $45 by 2030, $184.20 in 2040, $291 in 2050, and ultimately $878 in 2060.

Rivian Stock Price Prediction 2024

Rivian stock has dropped more than 50% in 2024, after surging to the end of 2023, and is now 84% below its IPO price of $78. However, We anticipate Rivian’s price to reach $15 by the end of 2024.

Rivian Stock Price Prediction 2025

We are optimistic about Rivian stock price prediction for 2025, anticipating Rivian stock to reach $22 per share and range from $17.5 to $22 by 2025. We think analysts are happy about Rivian’s ability to find a way to overcome the current EV industry slump better than many electric vehicle (EV) companies like Nio, Tesla, etc. in 2025.

Rivian Stock Price Prediction 2029

Despite a slower-than-expected growth of RIVN, we expect substantial expansion over the next five years by 2029. Rivian is set for big growth with their new electric vehicles like the R1T, R1S, and R2, even though the U.S. electric car market is growing slower than expected.

Rivian Stock Price Prediction 2030

Rivian stock price prediction forecasts an exponential growth of 332.69% potentially reaching an average price of $45 per share by 2030. If Rivian captures a 10% share of the EV market by 2030, it could reach $45 highest price from its current level.

Rivian Stock Price Prediction 2040

By 2040, Rivian stock is projected to reach $184 with a 5% annual growth rate, $795 with an 11.13% annual growth rate (based on the S&P 500 historical ROI over the last 50 years), and $947 with a 15.2% annual growth rate (based on the QTEC historical ROI over the last 18 years).

| Year | Growth Rate | Rivian Stock Price |

|---|---|---|

| 2040 | 5% annual growth | $184 |

| 2040 | S&P 500 historical 11.13% ROI (last 50 years) | $795 |

| 2040 | QTEC historical 15.2% ROI (last 18 years) | $947 |

Rivian Stock Price Prediction 2050

The long-term Rivian price outlook is bullish. Analysts project that RIVN company could be a leader in electric vehicles (EV) by 2050, with the stock trading at $291 if it follows the S&P 500 index it can grow at a 6.5% annual rate until then.

Rivian Stock Price Prediction 2060

Rivian stock price price prediction 2060 will grow at steady rates and reach $878 per share by 2060. However, actual values may differ significantly depending on how financial dynamics change.

Rivian Inc (RIVN) Stock Technical Analysis for Rivian’s downfall.

Now let’s discuss why Rivian, once celebrated as the fastest-growing electric vehicle (EV) company with an all-time high (ATH) share price of $172 on November 16, 2021, has seen RIVN stock decline by approximately 93.94% from 2021 to 2024 for several reasons like

Financial Performance: a larger-than-expected loss of $1.36 per share in Q4 2023, contributed to a sharp drop in its stock price.

Production and Sales: Despite Rivian’s ambitious mean targets their production outlook for 2024 remained unchanged at 57,000 vehicles, similar to 2022, suggesting slower-than-anticipated growth. This has raised concerns about their ability to meet demand and generate sufficient revenue.

Competitive Pressures: Rivian faced intense competition in the electric vehicle (EV) market, particularly from established automakers like Ford, which has aggressively priced its F-150 Lightning models.

Market Sentiment and Investor Expectations: Most of the people were optimistic with high expectations surrounding Rivian’s IPO in 2021 fueled initial excitement and a surge in stock price.

Macroeconomic Factors: Higher inflationary pressures can squeeze consumer budgets, impacting demand for Rivian’s vehicles.

Conclusion: What will RIVN stock be worth in 5 years?

In five years, predicting RIVN’s stock value is uncertain. Rivian’s low valuation, strong growth potential, and path to profitability suggest it could be a fair investment over the next five years. Some believe it’s a long-term investment with potential cash flow positivity by 2029.

However, volatility due to EV industry dynamics and reliance on external capital could affect investor confidence. Optimistically, lower interest rates might boost EV demand, but overall, RIVN’s future stock value depends on navigating these challenges effectively.

What is Rivian share price target for 2030?

CNN forecasts that Rivian Automotive Inc could reach a median target of $25.50 per share within the next 12 months, with a potential increase of as high as $45.

What is stock worth in 2025?

Based on Rivian’s share price target for 2025 analysts forecast a slow-motion rise in Rivian’s stock value, with projections reaching up to $22 by 2025.

What will RIVN stock be worth in 5 years?

In five years, RIVN’s stock value is uncertain due to potential cash flow challenges until at least 2029, industry volatility, and reliance on external funding.

What is the RIVN Stock Price Forecast for 2025?

Based on the latest Rivian price prediction our analysts project that RIVN stock will hit $18 by the middle of 2025 and then $20 by the end of 2025.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.