Roku stock forecast and price target 2025: If you’re considering investing in Roku stock (NASDAQ: ROKU) & confused about whether it is Roku a buy in 2025, Roku stock buy or sell, Roku stock a buy, Roku stock a good buy, should you buy Roku stock.

Roku’s stock is expected to start at $84.70 in November, with potential fluctuations, reaching around $83.90 by the end of the month, and in December 2023, it may begin at $85.90, fluctuating between $81.04 and $91.28, averaging $82.11, and close at $79.22, showing a slight decrease of -3.5%. Roku, Inc. Stock (ROKU) is expected to reach an average price of $140.60 in 2025, with a high prediction of $215.60 and a low estimate of $70.29.

Will the Roku stock price hit $500 by 2025?

Roku Stock Price is currently valued at $84.75 +6.70(8.58) and The stock price jumped 52% in the last week on improving prospects, the company’s total market cap is $11.99 billion, with over 45 million shares available. Even with a recent upside potential in price, the overall outlook for Roku, Inc. remains noteworthy, the stock remains positive BUT Roku will not reach $500 by 2025 Yet the company showing promise for potential investors.

In this article, we will explore the key factors to consider when evaluating a company’s potential for long-term growth and how to spot stocks that are likely to yield significant returns over time Roku’s leadership team is led by CEO Anthony Wood, and other key management team members include CFO Steve Louden and President of Media Charlie Collier.

$Roku, Inc. is a leading technology company known for its streaming platforms and devices. They offer user-friendly and affordable products that connect TVs to the internet, providing access to a wide range of streaming services. Roku’s popularity stems from its simplicity, extensive content library, and compatibility with various providers. It continues to innovate and expand its offerings in the ever-growing streaming market.

Roku Inc (ROKU) Stock Forecast & Price Target

Get the Latest updates on real-time Roku Inc (ROKU) stock forecast today, 1 month, 3M, 6M, 12 months, and 5 years price prediction. Discover the earnings per share (EPS) forecast and price target for Roku stock in 2025

Roku, Inc. (ROKU) Stock Performace Overview

| Market Cap | 10.45B |

| Ticker Symbol | ROKU |

| Price Change(24h) | 642.37K |

| 1Day Range | $72.15 – 75.45 |

| Earning Date | 31-01-2023 |

| Prev Close | 73.59 |

| Open Price | 73.47 |

| 52 Week Range | 38.26 – 101.42 |

| Avg. Volume | 7,745028 |

| Dividend & Yield | N/A (N/A) |

Roku is the leading streaming platform in theU.S. by hours watched with under 59 billion hours of content streamed in 2020. In the industry, the leading players are Roku, Hulu, TiVo, Comcast, Amazon Fire TV, and Google Chromecast. Among these, Roku has shown remarkable growth compared to its competitors in recent times. Roku generates profit from advertising, distribution freights, tackle deals, zilch licensing, and subscription deals.

Roku stock cast About Roku inc 1155 COLEMAN AVENUE, SAN JOSE, California, 95110, United States1408556-9040 www.roku.com

Roku, Inc. (ROKU) Stock Options

Discover the Roku stock option price and option chains for Roku Inc (ROKU)[58.20 +0.47 (+0.81%)] on NASDAQ. The option chain provides details such as the price, volume, and open interest for each option strike price and expiration month. It includes information on both call and put options. To view the basic ROKU option chain and compare options, visit the website or platform provided by MoneyMystica.

considering investing in Roku stock, it is crucial to analyze the earnings per share (EPS) and Roku stock dividends forecast and price target for 2025. For the final quarter ending December 2022, the agreement EPS forecast has slightly decreased from -1.69 to -1.7 (a decrease of 0.59) within the past week.

Additionally, it has declined from -1.65 to -1.7 (a decrease of 3.03) over the past month. It’s noteworthy that out of the two judges making daily predictions, one has raised their forecast, while the other has lowered theirs.

ROKU Earning Forecast: For the next quarter, the estimated earnings per share (EPS) for ROKU is -$1.27, with a range of -$1.55 to -$1.12. This information may be helpful for investors to anticipate ROKU’s financial performance in the upcoming quarter.

It is worth noting that in the previous quarter, ROKU’s EPS was -$1.38. In the past 12 months, ROKU has beaten its EPS estimate 75% of the time, indicating a potentially strong track record of financial performance. In comparison, the overall industry has beaten the EPS estimate 60.78% of the time in the same period.

Sneak Peek At Top Trending Stock Forecast & Price Predictions

- Rivian Automotives inc

- Nio Stock Forecast

- Black rifle coffee company stock

- Dow Jones Industrial Average (DJIA etf)

- Apple stock price prediction 2025

- Facebook and Metaverse Stock Price Analysis & Prediction

- Lucid price analysis

- Netflix stocks

Roku Stock Forecast 2025| Roku Stock Price Prediction 2025

Based on 25 analysts’ ratings & reviews have provided monthly Roku price forecasts for 2025, Roku Inc. Stock (ROKU). The average forecast for $ROKU in 2025 is approximately $169.70, with a high of $175.76 and a low of $55.40. Please note that these forecasts are subject to market conditions and are not guaranteed. However, the average Roku stock price prediction of $168.96 represents a significant increase of around +129.14% from the last recorded price of $75.12.

| Month | Forecast | MIN Rate | MAX Rate | Change % |

|---|---|---|---|---|

| Jan | 46.87 | 44.39 | 51.03 | 13.01 % |

| Feb | 46.64 | 42.67 | 50.95 | 16.26 % |

| Mar | 48.88 | 44.25 | 51.76 | 14.51 % |

| Apr | 45.54 | 41.55 | 49.80 | 16.57 % |

| May | 43.63 | 41.58 | 46.19 | 9.97 % |

| Jun | 41.85 | 39.89 | 43.05 | 7.35 % |

| Jul | 39.69 | 37.78 | 43.31 | 12.76 % |

| Aug | 40.54 | 39.57 | 41.91 | 5.57 % |

| Sep | 40.88 | 37.06 | 42.16 | 12.10 % |

| Oct | 45.25 | 43.57 | 46.61 | 6.52 % |

| Nov | 46.39 | 43.16 | 48.79 | 11.53 % |

| Dec | 47.84 | 43.36 | 50.65 | 14.39 % |

Roku Stock Forecast 2030

Based on the company’s historical growth in the past few years, Roku stock will give good profitable returns in the long term. With a share price of more than $495, the company can hit its new all-time high in 2030. Based on our comprehensive fundamental analysis to predict Roku stock price prediction in 2030. In accordance with our fundamental analysis, the topmost target for Roku stock is $370, while the succeeding target for Roku stock is $495.

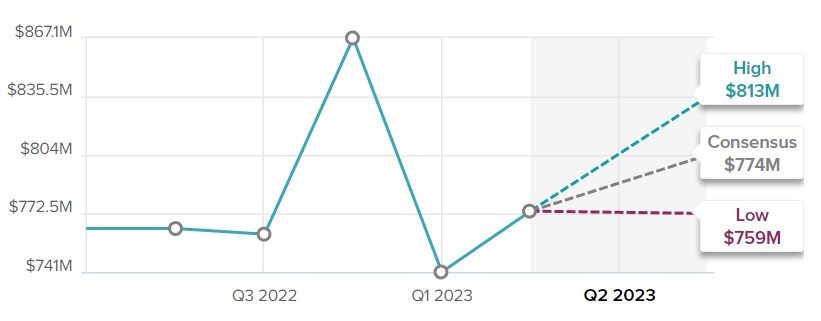

- ROKU’s next quarter sales forecast is $773.79M, with a range of $758.92M to $813.00M.

- In the previous quarter, ROKU’s sales results were $740.99M.

- ROKU has beaten its sales estimates 75.00% of the time in the past 12 months.

- ROKU’s overall industry has beaten sales estimates 64.29% of the time in the same period.

Where will Roku stock be in 5 years?

From 2023 to 2028 next five years could be extremely better, as Roku’s user base grows 5x. Roku stock forecast for 2028 (5 years), 19 predictions are provided for each month of 2028 with an average Roku stock price of $137.72, a high of $142.58, and a low of $133.09. From the last price of $70.69, the average Roku stock forecast for 2028 represents a 90.59% increase.

Disclaimer Notice: Roku stock forecast and price target 2025

Roku Stock Buy or Sell

Roku Stock Buy or Sell – According to the consensus of 19 Wall Street analysts covering (NASDAQ: ROKU) stock, the recommendation is to STRONG Buy ROKU stock.

- Long-term ROKU investors should look past its bearish FQ4 ’22 guidance and concentrate on the especially perfecting stoner criteria therefore far.

- It’s no secret that the company will remain empty through 2025, thus, investors should also disregard its growing SBC charges and share dilution in the meantime.

- We believe that most of the skepticism is already overly ignited, but this might change depending on the Market’s decision in December.

- Given the strategic balancing position of ROKU, shareholders with the latest threat tolerance may afford to sniff at the existing situation and disregard the hype.

FAQ – Roku stock forecast and price target 2025

why is Roku stock down

In response to a shift in the factors that made Roku successful in 2020 and 2021, the company’s stock crashed in 2022. Consequently, it is seeing a decline in revenue growth, particularly in its crucial platform/advertising division.

Is Roku stock a good buy in 2023?

Based on the opinions of 19 Wall Street analysts covering (NASDAQ: ROKU) stock, there is a consensus to Buy ROKU stock. Among the analysts, 6 (31.58%) are recommending ROKU as a Strong Buy, 4 (21.05%) are recommending ROKU as a Buy, 6 (31.58%) are recommending ROKU as a Hold, 1 (5.26%) are recommending ROKU as a Sell, and 2 (10.53%) are recommending ROKU as a Strong Sell. It’s important to note that analyst recommendations are subjective and based on individual opinions, and investors should conduct their own research and analysis before making any investment decisions.

What is Roku’s Price Target?

As of May 6, 2023, the average price target for ROKU is $69.89 with a high target of $89.00 and a low target of $30.00. This suggests a potential upside of 27.14% from the current share price of $54.97.

Is Roku growing?

At this time, there seem to be 65.4 million daily active accounts. Streaming hours increased by 21% over the previous year, exceeding expectations by 2.2% and representing a significant increase. The Roku Channel, which is owned by Roku, had a staggering 90% increase in streaming hours from Q3 2021 to Q3 2022.

Will the Roku stock price hit $500 by 2025

Good news for Roku, Inc. stock overall, but it’s not expected to hit $500 by 2025. Still, there’s a promise for potential investors.

What is Roku’s 12-month forecast?

The average price target for Roku based on 22 Wall Street analysts offering 12-month price targets in the last 3 months is $69.74, with a high forecast of $89.00 and a low forecast of $41.00. This represents a potential upside of 26.87% from the current price of $54.97.

is it worth buying Roku stock right now?

In the past 12 months, 24 Wall Street analysts have given Roku “buy,” “hold,” and “sell” ratings. The consensus among Wall Street research analysts is that ROKU shares should be “held”. At present, there are currently 4 sell ratings, 10 hold ratings, and 10 buy ratings. In a hold rating, analysts believe that investors should maintain their ROKU positions without purchasing additional shares or selling existing ones.

How can I buy shares of Roku?

ROKU stock can be bought through any online brokerage account, including WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

What is ROKU’s future stock price?

According to 18 analysts, Roku Inc. has an average 12-month price target of $74.00, with a high estimate of $91.04 and a low estimate of $42.30. The median estimate suggests a potential increase of +23.49% from the current price of $65.13.

What is the Long-Term Roku Stock Price Prediction for 2025?

According to analysts prediction for Roku stock cost 2025 can reach the highest price target of $248.15 in 2025.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.