Based on the latest analysis Stek Stock Price Prediction is expected to reach an average price of $ 12.10 in 2024, $18.17 in 2025, $25.10 in 2030, $39.50 in 2035, and $50.80 in 2040

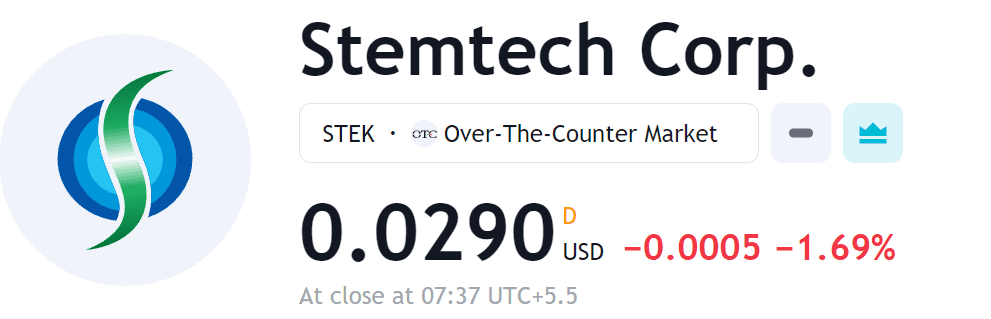

As of the latest update, Stemtech Corp (STEK: OTCQB) real-time stock quotes indicate a current price of 0.030 USD, reflecting a slight decrease of 0.00050 USD (1.67%) from the opening value today. The market day they opened at 0.032 USD, with the highest point reaching 0.032 USD and the lowest at 0.028 USD.

Related Stocks: 10 Best Penny Stocks to Buy that will explode

About Stemtech Corp (STEK) Stock Company Outlook

Stemtech Corporation stands as a global network marketing company at the forefront of health and wellness. With a commitment to scientific innovation, the company specializes in developing products that bolster overall well-being by promoting healthy stem cell physiology, often referred to as stem cell enhancers. Embracing the moniker of a “Stem Cell Nutrition Company,” Stemtech is dedicated to advancing the understanding and application of stem cell science in the pursuit of optimal health.

Stemtech Corp. operates in the Health Technology sector, with Charles S. Arnold serving as its CEO. The company is headquartered in Miramar and was founded in 2005. Stemtech Corp.’s focus lies in health-related technologies, contributing to advancements in the field. To learn more about their work and initiatives, official website at stemtech.com. The company is identified by the ISIN code US85859W1027.

Related Big Investments to watch: Top 3 Best Blue Chip Stocks to Buy For 2024

Stemtech Corp (STEK) Stock Performance & Earnings

Now let us explore the most recent updates on Stemtech Corporation (STEK) with the latest stock quote, historical data, and breaking news to inform your stock trading and investment decisions.

| Open | $0.0315 |

| Day High | $0.0315 |

| Day Low | $0.028 |

| Prev Close | $0.03 |

| 52 Week High | $0.28 |

| 52 Week Low | $0.02 |

| Market Cap | $3.082M |

| Shares Out | 104.48M |

| 10 Day Avg Volume | 162,740.33 |

| Dividend (Yield) | N/A- N/A |

| Beta | 2.12 |

| YTD % Change | -9.23% |

The current share price of Stemtech [STEK] is $0.03, with a Stock Score of 16. This score is 68% below its historical median of 50, indicating a higher-than-normal risk. Stemtech is currently trading in the 10-20% percentile range compared to its historical Stock Score levels.

| Quarterly Financials (USD) | Sept 2023 | Y/Y |

|---|---|---|

| Revenue | 12.98L | 24% |

| Net Income | -10.42L | 105.98% |

| Diluted EPS | -0.01 | 102.63% |

| Net Profit Margin | -80.24% | 104.82% |

Long-Term Stek Stock Price Prediction 2025, 2030, 20305, 2040

The Stemtech Corp (STEK) stock price forecast for the next 12 months appears to be optimistic, as indicated by an average analyst price target of $12.00. This reflects a substantial potential increase of +38989.45% from the current price of $0.0295. The highest analyst price target stands at $23.00 and the lowest Stek target price is $1.0478.

Related Stocks: HD STOCK FORECAST 2024 – 2025 – 2030 Growth

| Year | Average | Low | High |

|---|---|---|---|

| 2024 | $19.60 | $1.15248 | $24.21 |

| 2025 | $20.32 | $2.02763 | $37.95 |

| 2026 | $16.31 | $2.90268 | $51.69 |

| 2027 | $7.72 | $3.77773 | $65.41 |

| 2028 | $81.61 | $4.65289 | $86.02 |

| 2029 | $75.66 | $5.96541 | $99.76 |

| 2030 | $67.65 | $6.84046 | $113.49 |

| 2035 | $132.38 | $11.65 | $188.05 |

| 2040 | $214.48 | $16.47 | $264.57 |

| 2045 | $326.63 | $20.85 | $340.11 |

| 2050 | $43.58 | $25.65 | $408.78 |

Stek Stock Price Prediction 2024

Stemtech Corp Stock (STEK) is anticipated to have an average price target of $11.53 in 2024, ranging from a high forecast of $22.01 to a low of $1.0478. This forecast suggests a remarkable +60299.85% increase from the current price of $0.0295 from today.

Stek Stock Price Prediction 2025

Stemtech Corp Stock (STEK) is expected to reach an average price of $20.32 in 2025, with a high prediction of $37.50 and a low estimate of $2.027. This indicates an +63587.04% increase from the current price of $0.0295 from today.

Stek Stock Price Prediction 2030

Stemtech Corp Stock (STEK) is expected to reach an average price of $67.65 in 2030, with a high prediction of $113.49 and a low price of $6.840. This indicates an +63587.04% increase from the last price of $0.0295 from today.

Stek Stock Price Prediction 2035

Stemtech Corp Stock (STEK) is expected to reach an average price of $132.38 in 2035, with a high prediction of $188.05 and a low estimate of $11.65. This indicates an +63587.04% increase from the rise from the last recorded price of $0.029.

Stek Stock Price Prediction 2040

Stemtech Corp Stock (STEK) is expected to reach an average price of $214.48 in 2040, with a high prediction of $264.57 and a low estimate of $16.47. This indicates an +63587.04% increase from the rise from the current price of $0.029.

Stek Stock Price Prediction 2045

Stemtech Corp Stock (STEK) is expected to reach an average price of $326.63 in 2045, with a high prediction of $340.11 and a low estimate of $20.85. This indicates an +63587.04% increase from the rise from the last recorded price of $0.029.

Stek Stock Price Prediction 2050

Stemtech Corp Stock (STEK) is expected to reach an average price of $332.38 in 2050, with a high prediction of $388.05 and a low estimate of $41.65. This indicates an +63587.04% increase from the rise from the last recorded price of $0.029.

Also Read: Can AMD Stock Reach $200 per Share

What is the Stemtech Corp Stock (STEK) 1-Year Price Target?

STEMTECH (OTCQB: STEK) is making waves by setting new records with a surge in recruits, creating exciting opportunities in the thriving global stem cell market. As of the latest update, the current Stemtech [STEK] share price stands at $0.03. The STEK score is currently at 27, signaling a 46% deviation below its historic median score of 50.

Looking ahead, the stock price forecast for Stem Inc., guided by 14 analysts, projects a median target of 5.25, with a high estimate of 15.00 and a low estimate of 3.00. This median estimate reflects a noteworthy +90.56% increase from the last recorded price of 2.76. Stay informed about STEMTECH (STEK) and Stem Inc. for strategic investment decisions in this dynamic market.

- Mullen Automotive Stock Price Forecast 2025, 2030 Growth

- Curaleaf Holdings Stock Forecast 2023 – 2025 – 2030

- GTBIF Stock Forecast 2025, 2030, 2040 Growth

- ARM Stock Price Prediction 2024,2025,2030 Growth Analysis

- ChargePoint Stock Price Prediction 2025, 2030 CHPT Growth

Stemtech Corp Stock (OTCMKTS: STEK) Dropping?

Stemtech Corp (OTCMKTS: STEK) is currently experiencing a series of substantial declines in recent trading, signaling challenges for this prominent promotion. Stemtech transitioned into a publicly traded company (OTCQB: STEK) in August 2021, opening up new avenues for Independent Business Partners to earn income by promoting Stemtech products.

Amidst these developments, it’s crucial to note that in October, U.S. job openings witnessed a significant decline, reaching their lowest point since March 2021. This decline suggests a potential easing in the previously tight labor market conditions.

What is the Stem Stock Price Target?

The 17 analysts analyzing 12-month price forecasts for Stem Inc. have a median target of 5.85, with a high estimate of 14.00 and a low estimate of 3.49. The median estimate represents a +81.50% increase from the last price of 0.30.

What is Stemtech Corp Stock Forecast 2025?

Based on the latest analysis Stem Stock Stock will have an average price target of $20.30 with a high price target of $ $37.50 and a low side of $11.65 from the current price.

What will Stem Stock cost in 2030?

Based on the latest analysis Stem Stock Stock will have an average price target of $67.65 with a high price target of $ $113.49 and a low side of $6.840 from the current price of $0.30.

Is it worth buying Stem Stock?

In the current month, STEM has received 6 Buy Ratings, 5 Hold Ratings, and 3 Sell Ratings. STEM average Analyst price target in the past 3 months is $5.56.

What is the Stemtech Corp (STEK) stock price forecast in 2024?

Showing a positive outlook for Stem’s future as Wall Street analysts project an average share price of $6.39 by December 8, 2024. This forecast indicates a promising potential upside of 131.38% from the current STEM share price of $2.76.

Is Stem Corp a profitable investment?

As of now, Stem Inc. has generated $449.5 million in revenue over the past 12 months. However, its profit margin stands at -30.7%. The year-over-year quarterly sales growth is recorded at 34.4%. Analysts anticipate adjusted earnings to be -$0.824 per share for the current fiscal year.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.