Hi Friends! Welcome to our blog where we’ll talk about Direxion Daily Semiconductor Bull 3X Shares (NYSE: SOXL) Stock.

We’ll also look at SOXL Stock Price Prediction 2025, 2030, 2040, and 2050, and analyze if SOXL stock is a good idea for the long term. today’s price, its history, charts, what stocks it owns, and when it will report earnings next.

The SOXL ETF price increased by 2.68% on Friday, 10th May 2024, going up from $39.96 to $41.03. During the previous trading day, the ETF’s price varied by 4.26%, hitting a minimum of $40.32 and a maximum of $42.04. In the last 10 days, the price has gone up 6 times, leading to a 3.31% growth over the past fortnight.

The upside in trading volume on the final day aligned with the price increase, seen as a favorable indicator from a technical perspective. A total of 47 million shares were traded, valued at around $1.91 billion, which is 9 million more shares than the day before.

Table of Contents

About Direxion Daily Semicondct Bull 3X ETF Company

Under typical conditions, the fund primarily invests 80% of its net assets in financial instruments like swap agreements, index securities, and ETFs that follow the index, as well as other financial instruments offering leveraged exposure to the index or ETFs tracking the index. The index evaluates how well local companies involved in designing, distributing, and manufacturing perform.

SOXL Stock Price Today Per Share

The price of the SOXL ETF increased by 2.68% on the previous trading day (Friday, May 10, 2024), climbing from $39.96 to $41.03. On the previous trading day, the ETF had a 4.26% fluctuation, moving from a low of $40.52 to a high of $42.24. The cost increased on 6 out of the last 10 days and has gone up by 3.22% in the last 2 weeks. There was an increase in volume and price on the last day, indicating a positive technical signal, with a total of 9 million more shares traded compared to the previous day. A total of 47 million shares were traded for around $1.91 billion.

Soxl stock price prediction 2024 walletinvestor

Walletinvestor.com predicts that the stock price of Direxion Daily Semiconductor Bull 3X Shares (SOXL) may decrease significantly from $38.970 to $0.0279, representing a 99.929% change.

SOXL Stock Price Prediction 2025, 2026, 2029, 2030, 2034, 2035, 2040, 2050

LongTerm Direxion Daily Semiconductor Bull 3X Shares Stock (SOXL) is expected to reach an average price target of $30.730 in 2024, SOXL share price is $34.91 in 2025, $44.10 in 2026, $50.25 in 2029, $55.10 in 2030, $60 in 2034, $68.80 in 2035, $75 in 2040, and $88 in 2050.

| Year | Average Price | High Price | Low Price |

|---|---|---|---|

| 2024 | $30.730 | $37.233 | $33.510 |

| 2025 | $34.910 | $42.304 | $38.073 |

| 2026 | $44.100 | $53.361 | $48.025 |

| 2029 | $50.250 | $60.803 | $54.723 |

| 2030 | $55.100 | $66.751 | $60.076 |

| 2034 | $60.000 | $72.600 | $55.340 |

| 2035 | $68.800 | $83.248 | $64.923 |

| 2040 | $75.000 | $90.750 | $61.675 |

| 2050 | $88.000 | $106.48 | $75.832 |

Direxion Daily Semiconductor Bull 3X ETF (SOXL) Historical Performance

By analyzing the past performance of the Direxion Daily Semiconductor Bull 3X ETF (SOXL), which has demonstrated an average growth of 66.3% over a year, we can predict potential upcoming values for SOXL given its current price of $34.91.

Based on its moving averages, TipRanks.com reports that Direxion Daily Semiconductor Bull 3x Shares (SOXL) is currently displaying conflicting signals. The EMA over 10 days is currently at 44.23, indicating a suggestion to “Sell”. This indicates that the stock’s price trend is likely bearish or weakening in the near future. Conversely, the 100-day exponential moving average stands at 36.96, signaling a suggestion to “Buy”.

Resistance Levels (Wallet Investor)

| Resistance Level | Price ($) |

|---|---|

| R3 | 44.733 |

| R2 | 43.947 |

| R1 | 42.728 |

Support Levels (Wallet Investor)

| Support Level | Price ($) |

|---|---|

| S1 | 40.723 |

| S2 | 39.937 |

| S3 | 38.718 |

Exponential Moving Averages (TipRanks)

| Moving Average | Price ($) | Signal |

|---|---|---|

| 10-day EMA | 44.23 | Sell |

| 100-day EMA | 36.96 | Buy |

| – | – | – |

Related News on Stocks:

- Wilmar International (SGX: F34) Has confirmed Its Dividend Of $0.11

- Closing call: Cardiol Therapeutics Inc. down on Thursday (CRDL)

- Why NVDA stock fall 10%

Direxion Daily Semiconductor Bull 3X Shares Stock (SOXL) Price Forecast for 2024

SOXL has done exceptionally well in the past year, beating the market with a price return of +196.7%, while the SPY ETF managed only +28.5%.

Based on the current short-term trend analysis, Direxion Daily Semiconductor Bull 3X Shares is expected to rise 18.13% during the next 3 months and, with a 91% probability hold a price between $35.15 and $64.16 at the end of this 3-month period.

SOXL Stock Price Prediction 2025

Stockinvest.us says that the Direxion Daily Semiconductor Bull 3X ETF (SOXL) is showing a sell signal from its long-term average and a buy signal from its short-term average. This indicates a pessimistic outlook for the stock, and it will withstand the $40.99 long-term average if it keeps increasing. Nevertheless, the stock drop may find some backing from the $38.80 short-term average.

If the economy remains stable in a hit or flop scenario, with no increase or decrease, the stocks will stabilize at $53.00. Every investor should monitor both stocks and real estate investments closely in 2025. This can be the finest moment for you.

SOXL Stock Forecast 2030

If you are planning to buy or sell SOXL stock in 2030, it would be a very wise decision to consider. Nevertheless, as market risk is inherent in all trading and investment activities, we suggest being cautious with your spending.

As of May 11, 2024, after analysing historical chart we can say that ETF could be risky investment that offers high potential returns because its long-term average exceeds its short-term average. Yet, according to Seeking Alpha, the future of SOXL still appears optimistic because of its robust earnings growth rates and favorable technical depiction.

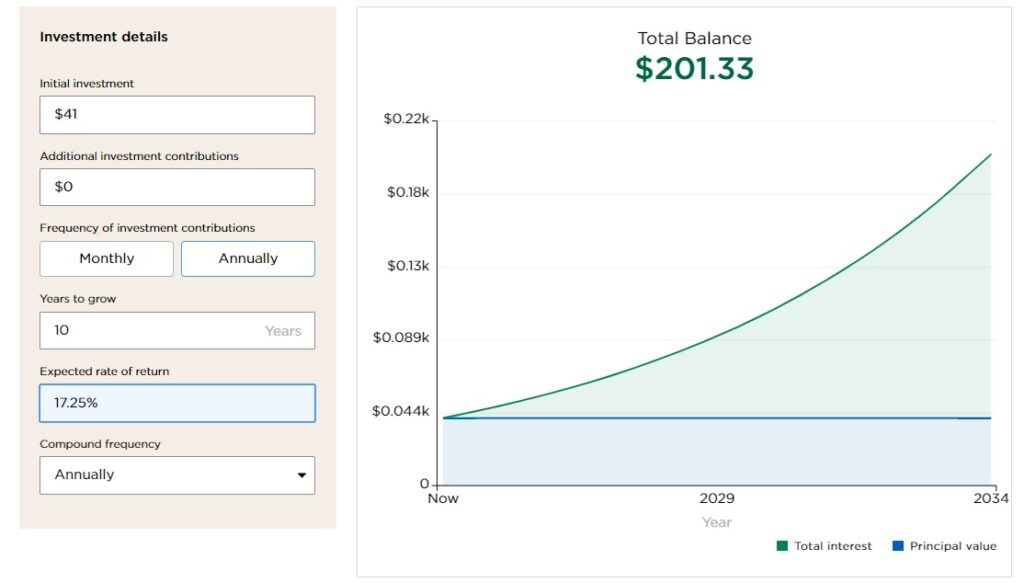

If SOXL ETF continues to rise at its current speed of growth during the last ten years, it will be worth $171.71 per share in the year 2030. If my forecast for Amazon stock in 2030 comes true, the value of SOXL stock will increase by 17.25% relative to where it is now trading.

SOXL Stock Price Prediction 2034

If Direxion Daily Semiconductor Bull 3X Shares were to follow the S&P’s historical yearly growth rate of 19.25% until 2034, the SOXL stock would be priced at $238.43, or about 7x higher than its current price.

For example, if you’d invest $ 41.00 today and contribute an additional $ 0.00 every year, your investment would be worth $ 238.43 in 10 years if we take into consideration an average SOXL’s yearly profit of 19.25%.

SOXL Stock Price Prediction 2035

SOXL | Direxion Shares ETF Trust – Direxion Daily Semiconductor Bull 3X Shares SOXL price prediction 2035 is expected to reach an average price of $68.80 reaching a high price target of $83.248 with a low estimate of $64.848 from the current price of $30.79 per share.

SOXL Stock Price Prediction 2040

In 2040, we would advise when the price of SOXL reaches an average price target of $334.10, indicating a good time to buy SOXL’s shares as their value could gain 14.01%. Direxion Daily Semiconductor Bull 3X Shares (SOXL) stock should grow at 14.01% from its current levels.

SOXL Stock Price Prediction 2050

Direxion Daily Semiconductor Bull 3X Shares Stock (SOXL) is expected to reach SOXL high price prediction of $106.345 in year 2050 and averagr price of $88.00 with low price of $75.832 signifying -6.12% decrease from SOXL price of $30.79 from today.

Is SOXL stock a good buy in 2024?

SOXL is a high-risk, high-reward investment option in 2024 whic means high chances for big rewards, but also comes with a lot of risks.

Is SOXL a hold for long term investment?

No, SOXL is specifically designed for short-term trading rather than long-term buy and hold strategies, so SOXL is not a long term investment

What is SOXL stock 50-day moving average?

The 50-day moving average (MA) for Direxion Daily Semiconductor Bull 3X Shares (SOXL) is currently at $43.02. SOXL’s current trading price is below this 50-day MA, which indicates a bearish short-term signal.

Is SOXL overpriced?

On Thursday, 10th May 2024, the price of the SOXL ETF dropped by -1.06% from $40.39 to $39.96. Throughout the last day of trading, the ETF experienced a 3.32% fluctuation. SOXL is in an overbought condition and requires a pullback or consolidation.

Will SOXL pay dividends in 2024?

Based on the latest information, SOXL paid its most recent ex-dividend yield of 0.42% on Mar 19, 2024.

Why is soxl (soxl) a good stock to buy now?

SOXL’s current score of 58 is 20% lower than its typical median score of 50, indicating an increased level of risk.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.