Looking for a quick way to get some cash? Rest assured, our Google Pay Loan review blog might have the solution you’re looking for. In this review, we’ll delve into all the details you need to know about Google Pay Loan.

Table of Contents

Today we will discover how to easily apply for a loan through Google Pay with our comprehensive guide. Learn about the application process, eligibility criteria, and how Google Pay loans work. Get answers to common queries such as how to pay loan EMIs through Google Pay and the interest rates associated with Google Pay loans, is google pay loan is safe or not?

First off, what’s Google Pay Loan?

It’s basically a loan service offered by Google Pay in partnership with certain major banks in INDIA like Axis Bank, DBS Bank India, HDFC Bank, ICICI Bank, Indian Overseas Bank, and State Bank of India.

Google Pay also lets you borrow money without all the effort of going to a bank or dealing with loads of paperwork.

KEY TAKEAWAYS before applying for a Google Pay Loan

Google Pay doesn’t provide any loans or review your loan application rather it just connects you with banks that are in partnership with it.

These banks verify your Google Pay loan details and validate from their end if you can get a loan. If found not eligible they also offer various loan options in the app depending on other criteria.

The interest rate on the loan depends on the bank you’re applying for a loan.

So, what’s good about Google Pay Loan?

Well, it’s pretty convenient. You can apply for and get your loan right in the Google Pay app. Plus, the whole process is super quick, usually taking just a few minutes. You can also choose how much you want to borrow and how long you want to pay it back.

And here’s the best part – you don’t need to put up any valuable asset or property to get the loan from Google Pay. Also, the interest rates are competitive, and there are no hidden fees. You’ll know exactly what you’re getting into before you apply.

What are the Google Pay Loan Eligibility checks you need to pass?

The Google Pay Loan eligibility criteria vary depending on the partner banks. However, there are some general eligibility criteria that most financial institutions consider:

| Eligibility Requirments | General Eligibility Criteria |

|---|---|

| Age | The Candidate must be between the ages of 18 and 60 · |

| Citizenship | The applicant must be a resident of India. |

| Employment type | Full-time employment or regular business income may be required. |

| Minimum credit score | A minimum credit score of 650 or 700 may be required. |

| Google Pay account | Must have a valid Google Pay account. |

How do I check my loan status on GPay?

To check your loan application status for Google Pay loan on GPay follow these steps.:

- Visit the “Loans” hub.

- Choose the pre-approved loan.

- Select your loan amount and duration.

- Tap “Review details.”

- Fill in the required KYC information and bank details, including your repayment plan.

- Read the bank’s terms and conditions.

- Tap “Accept and apply.”

What are the advantages of Google Pay Loan?

With quick approvals and fast disbursal directly to your Google Pay account, you can access funds swiftly. Plus, enjoy the convenience of fixed durations, EMIs, and a low processing fee, making it a hassle-free experience.

Google Pay Loan has multiple advantages, let’s look at the Key features and its benefits:

Overall, Google Pay Loan offers simplicity and ease by eliminating the need for collateral, branch visits, or hidden charges.

- Convenience: We can apply for and receive the google pay loan entirely within the GPay app, avoiding the need to visit a bank or deal with extensive paperwork.

- Speed: Loans are typically processed and approved within minutes, ensuring rapid access to funds.

- Flexibility: Choose the loan amount and repayment tenure that best suits your needs.

- Affordability: Competitive interest rates make Google Pay Loans a cost-effective option.

- No collateral required: These are unsecured loans, meaning you don’t need to provide any collateral to secure the loan.

- Easy EMI payments: Enjoy hassle-free automatic deductions from your bank account for EMI payments.

- Trusted partnerships: Loans are offered by reputable financial institutions in India.

- No hidden charges: There are no hidden fees; you only pay the interest on the loan amount, with complete transparency.

- Transparency: You can view all the terms and conditions of the loan before applying, ensuring transparency.

- Customer support: Google Pay offers outstanding customer support for any loan-related inquiries or issues. You can reach Google Pay customer support by calling the toll-free number, 1800-419-0157, which is available 24×7.

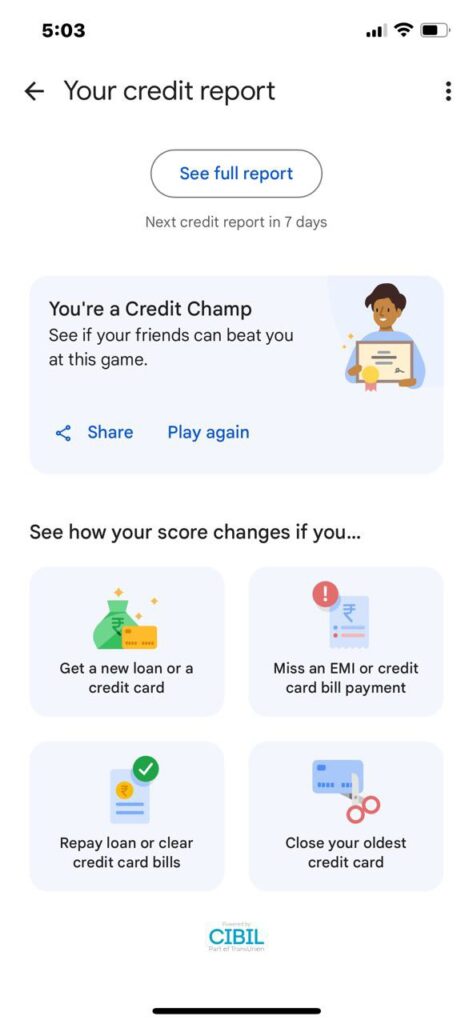

How to check if you’re eligible for a Google Pay Loan

To check if you’re eligible, just open the Google Pay app and look for the “Loan” section. There, you’ll find all the loan offers available to you.

If you’re good to go, applying for a loan is easy. Just follow the steps in the app, pick the loan offer you want, fill in some details, and you’re done.

And if you’re wondering about the status of your loan application, you can check it in the app, too.

So, there you have it – Google Pay Loan in a nutshell. It’s a quick, easy way to get some extra cash when you need it, without all the usual bank hassle.

3 Simple ways to Avail pre-qualified loans Top Banks

Pre-approved loans from Federal Bank

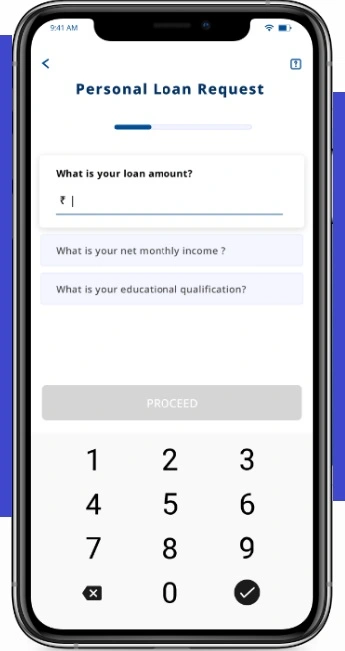

Sure, here are the steps To apply for a personal loan:

- Open the Google Pay app on your smartphone.

- Navigate to the “Money” section within the app.

- Tap on “Loans” to access the loan options available.

- Review the loan offers displayed to see which ones you qualify for.

- Once you’ve found an offer that suits your needs, select it.

- Specify the amount you wish to borrow and the duration for repaying the loan.

- Review all the details of the loan offer carefully.

- If you’re satisfied with the terms, tap on “Continue” to proceed.

- Follow the prompts to provide any necessary information requested by the app.

- After entering all the required details, accept the terms and conditions of the loan.

- Finally, submit your loan application and wait for approval from the lending institution.

Pre-qualified loans with DMI Finance

Here’s the process in a single sentence:

To apply for a loan through Pre-qualified loans with DMI Finance via Google Pay, open the app, navigate to the “Money” section, select “Loans” to view available offers, choose a suitable offer, specify the desired loan amount and repayment duration, review the details, proceed by tapping “Continue,” provide the necessary information, accept the terms, and submit your application for approval.

Avail pre-qualified loans with IDFC

Follow the same process as above, selecting the pre-qualified loan offer within the “Loans” section. Provide necessary personal details, review the terms, and wait for approval.

Remember, each Bank may have slightly different procedures and requirements, so it’s essential to follow the instructions provided within the app.

Conclusion: Google Pay Loan review

Lastly, Google Pay Loan is a convenient, hassle-free, cost-effective, nominal, reasonable, and crystal clear way to get a loan in just minutes. It’s a straightforward solution for your financial needs.

How to take a loan from Google Pay?

Open the Google Pay app, tap on “Loans” in the “Money” section, and find the pre-qualified loan in the “Offers” tab provided by DMI Finance.

How to pay Hdfc personal loan emi through Google Pay?

After your loan gets approved, navigate to ‘My Loan’ on your Google Pay CASHe dashboard, choose your active loan to see your EMI details, and then opt for the ‘Pay EMI’ option to make your monthly installment payment.

Can I apply online for a ₹15,000 Google Pay loan?

Yes, Check eligibility before applying for the credit limit, ensuring you’re 18 or above, an Indian citizen with valid PAN and Aadhaar, employed with a monthly income of ₹15,000 or more.

What is the interest rate of a Google Pay loan?

The interest rate on Google Pay loans varies depending on the lender and your creditworthiness.

How to get a ₹5000 loan instantly?

You can get a ₹5000 loan instantly by applying for a Google Pay Loan. If approved, you’ll receive the loan amount in your Google Pay account within minutes.

What is DMI in Google Pay?

DMI stands for Digital Mandate Initiation. It allows you to authorize a financial institution to debit your bank account for a specific amount on a specific date, used to automate EMI payments for Google Pay Loans.

Are Google Pay instant loans safe or not?

Yes, Google Pay instant loans are 100% safe. Google Pay partners with trusted and reliable banks and all loan transactions are protected by Google’s enhanced security features.

Is Google Pay a reliable company?

Yes, Google Pay is a trusted payment platform used by millions worldwide, offering various features like sending and receiving money, paying bills, and online shopping.

- Zomato Share Price Target 2024, 2025, 2030, 2040, 2050, 2060 Growth

- CRBG stock price prediction 2024, 2025, 2030, 2040, 2050, 2060 Growth

- Nestle India Share Price Target 2024, 2025, 2030, 2040, 2050

- Site Management is changing in Google Adsense Blissful 2023

Disclaimer: The information provided about Google Pay Loan is for general purposes only and should not be considered financial advice. Users are encouraged to verify details directly with Google Pay or financial institutions before making any decisions.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.