The Dow Jones Industrial Average (djia etf), Dow Jones, is a stock market index of 30 prominent companies listed on stock exchanges in the United States

About-Dow Jones (djia)Industrial Average

U.S. shares higher at close of trade; Dow Jones Industrial Average up 1.86%

The DJIA is one of the oldest and most commonly followed equity indices. Many professionals consider it to be an inadequate representation of the overall U.S. stock market compared to a broader market index such as the S&P 500.

The DJIA includes only 30 large companies. It is price-weighted, unlike stock indices which use market capitalization. Furthermore, the DJIA does not use weighted arithmetic mean.

The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor that is currently (as of November 2021) approximately 0.152. The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split.

First calculated on May 26, 1896, the index is the second-oldest among U.S. market indices, after the Dow Jones Transportation Average. It was created by Charles Dow, the editor of The Wall Street Journal and the co-founder of Dow Jones & Company, and named after him and his business associate, statistician Edward Jones.

The word industrial in the name of the index initially emphasized the heavy industry sector, but over time stocks from many other types of companies have been added to the DJIA.

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow. As with all stock prices, the prices of the constituent stocks and consequently the value of the index itself are affected by the performance of the respective companies as well as macroeconomic factors.

Reader Digest – Lucid Automotives stock price & analysis

Current Analysis – Dow Jones Industrial Average(djia etf)

The Dow Jones Industrial Average gained 204 points or about 0.7%. The S&P 500 and Nasdaq Composite gained 0.6% and 0.4%, respectively.

The averages were higher in early trading, with the Dow gaining more than 600 points, but came off their highs as U.S. Treasury yields moved up.

Strong earnings results on Tuesday helped extend a rally that began on Monday. Goldman Sachs rose 3% after strong trading results helped the investment bank beat expectations for earnings and revenue.

That report continued a strong stretch of bank earnings, including beats from Bank of America and Bank of New York Mellon on Monday. Lockheed Martin also rose more than 5% after its earnings per share topped estimates.

Elsewhere, Salesforce rose almost 4% after activist Starboard Value LP revealed a stake in the software giant, boosting the Dow. Shares of Colgate-Palmolive gained nearly 2% after Dan Loeb’s Third Point built a stake in the company, CNBC’s David Faber reported.

Wall Street is coming off a strong start to the week, as the Nasdaq surged 3.43% on Monday for its best day since July 27.

Fears of a recession and overly aggressive central banks have helped push the U.S. markets to their lows of the year in recent weeks, but the solid start to earnings season may signal that the economy is currently in better shape than feared.

“3Q and 4Q earnings should confirm fundamentals remain anchored in resilient labor market and Covid reopening. Equity valuation will likely remain tied to global central bank rhetoric and rates, which is turning incrementally less negative.

As such, we see equities primed for upside into year-end on resilient 2022 earnings, low equity positioning, very negative sentiment and given more reasonable valuation,” Dubravko Lakos-Bujas, JPMorgan’s head of global macro research, said in a note to clients.

Readers Digest – RIVIAN Automotives stock forcast & analysis

The biggest movers

Hasbro — Shares of the toy company dipped 2.3% after the company reported third-quarter earnings that missed expectations. CEO Chris Cocks blamed “increasing price sensitivity” among consumers and inventory glutes.

Carnival Corporation — Shares of the cruise company jumped more than 12% after one of Carnival’s subsidiaries began an offering of $1.25 billion of senior priority notes due 2028. The company plans to use the net proceeds of the offering to make principal payments on debt and for other general corporate expenses, according to a regulatory filing

Goldman Sachs — Goldman Sachs rallied 3% after beating third-quarter analyst expectations for profit and revenue on better-than-expected trading results. The company also announced a corporate reorganization that combines the firm’s four main divisions into three.

LIVE REPORT

Realtime Prices for Dow Jones Stocks; Caterpillar, 231.45. 231.45. 0.51%. 1.18; Chevron, 182.99. 182.99. -0.63%. -1.16.

Dow Jones predictions

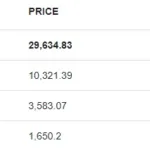

The 22 analysts offering 12-month price forecasts for Dow Inc have a median target of 48.00, with a high estimate of 62.00 and a low estimate of 39.00. The median estimate represents a -4.18% decrease from the last price of 50.10.

Dow Jones predictions for 2022

The forecast for the beginning of October is 28726. Maximum value 31860, while minimum 28254. Averaged Dow Jones value for month 29724. Value at the end of 30057, change for October 4.63%

The forecast for the beginning of November 30057. Maximum value 31725, while minimum 28133. Averaged Dow Jones value for month 29961. Value at the end 29929, change for November -0.43%.

The forecast for the beginning of December 29929. Maximum value 30139, while minimum 26727. Averaged Dow Jones value for month 28807. Value at the end 28433, change for December -5.00%

FAQ – what does djia stand for

What is the prediction for Stock Market in 2022?

The 8% earnings increase, coupled with a rise in margins, would send the S&P 9% higher by the close of 2022, to hit the 5100 targets. But at the end of 2021, S&P profits already looked overripe

What did the Dow Jones do today?

Last Updated 4:15 PM EST Stock indices finished today’s trading session in the red. The Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 decreased by 0.32%, 0.75%, and 1.02%, respectively.

What is the US market doing today?

Trading higher Dow Jones Industrial Average.DJIA

(LAST-(30,608.36) CHANGE(+422.54)

Trading higher Nasdaq Composite Index.IXIC

(LAST)-(10,828.68) — (CHANGE-+152.88)

Trading higher S&P 500 Index.SPX

(LAST) -(3,729.44) (CHANGE)( +51.49)What will the Dow Jones be in 2025?

Algorithm-based forecasting service Wallet Investor was bullish on the Dow Jones index, saying DJIA is “a good long-term (1-year) investment”. It estimated the index to climb to 26,303 points in Mid 2023, rising to 41,167.60 points in Mid 2024 and 45,801.33 points in Mid 2025.

what does djia stand for

The Dow Jones Industrial Average (DJIA) is made up of 30 large stocks. All the stocks are based in the United States. The DJIA is also known as the Dow 30.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.