Black Rifle Coffee Stock Price Today is $5.05 +0.085 (1.71%) (NYSE: BRCC) is a U.S.-based corporation that specializes in the sale of coffee, apparel, accessories, and a range of media content, including digital and print journals, podcasts, and coffee brewing supplies. The company also offers a variety of black coffee roasts, ranging from light to dark, as well as flavored roasts, cocoa, and bundles & features lifestyle gear. Founded in 2014 by the president and chief officer of the Green Berets Youth After in Salt Lake City, Utah, the company has quickly become one of the fastest-growing coffee companies in the country.

| Company Name | Black Rifle Coffee Company |

| Black Rifle Coffee Symbol/Ticker | BRCC |

| (BRCC) stock quote | $4.99 |

| Black Rifle Coffee Headquarters | Salt Lake City, Utah |

| Market Cap | 1.06B |

| 52 week high ▲ | $16.38 |

| 52 Week Low ▼ | $4.78 |

| Open | $5.04 |

| BRCC Website | https://www.blackriflecoffee.com/ |

Key Takeaways:

- Black Rifle Coffee Company is a leading coffee brand known for its specialty coffee, apparel, and media content.

- The company has gained popularity through its military-inspired branding and commitment to supporting veterans.

- Black Rifle Coffee offers a variety of coffee roasts and lifestyle gear to cater to different customer preferences.

- The company has gone public by merging with a Special Purpose Acquisition Company (SPAC), making its stock available for trading.

- Black Rifle Coffee products are sold in various retail outlets and the company has expanded internationally.

- Analysts predict significant growth potential for Black Rifle Coffee stock, with price predictions ranging from $7.40 to $16.40 per share by 2030.

- Factors driving the growth of Black Rifle Coffee stock include its unique branding, expanding distribution channels, and strong financial performance.

- Investors interested in buying Black Rifle Coffee stock can research the company, find a brokerage firm, complete the necessary paperwork, and monitor their investments.

View live BRC Inc on the Trading View chart to follow Black Rifle Coffee stock price Prediction. Live market predictions, BRCC financials, and market news. BRC (NYSE: BRCC) Stock Report. Earnings are forecast to grow 64.15% per year. Now let’s see what Black Rifle Coffee Stock Price Prediction 2023, 2024, 2025, and 2030, say about future investment in coffee shares

The Black Rifle Coffee Company is renowned & remains one of the most popular coffee brands in the world today. The coffee company has carved a cubbyhole for itself with its small-batch coffee roasts and military-inspired boarding.

Black Rifle Coffee Company (BRC Inc.) is also famous for its patriotic branding and mission to support 10 veterans. The company’s logo features a rifle and an American flag, and it frequently collaborates with veteran organizations to give back to the military community.

Whether you are looking for a dark roast or a light roast, your black rifle company has something to suit every taste. The giants are always supported by proprietary systems in this industry. In fact, this company is different from all other companies because it gives you the medicine to get a good job.

To go public, BRCC decided to merge with SPAC, which resulted in the company’s stock becoming available for trading. Customers can find BRC Inc. products in grocery stores, drug stores, mass merchandising outlets, and convenience stores.

Today, Black Rifle Coffee Company’s products are sold online and in more than 5,000 stores across the United States. The company has also expanded internationally, with distribution agreements in place for Canada, Europe, Australia, New Zealand, and Japan.

Read More Learn More

Black Rifle Coffee Company Stock Overview

Black Rifle Coffee Company showed (BRCC’s stock) price some fluctuations, but many experts believe that Black Rifle Coffee (BRC) has significant growth potential due to its unique brand and loyal customer base. Some analysts predict that the stock price of Black Rifle Coffee Company (BRCC) could reach $20 per share within the next year. If you’re interested in investing in BRCC, you can create a BRCC login on the company’s website. From the BRCC stock price and stock price prediction to creating a BRCC login, and getting a prepaid subscription to Black Rifle Coffee Company (BRCC Subscription)our guide covers everything.

Why Black Rifle Coffee Hit an all-time low

What happened to shares of black Rifle coffee it went down 7% down hitting all-time low prices. Today’s change (BRCC 0.37% and $0.02 ), Black Rifle Coffee Company’s price today is $5.39 USD (NYSE: BRCC) also known as BRC -reported financial results for its fourth quarter of 2022 and hit all-time lows. Management reduced guidance for 2023, but the results were within guidance. After being down as much as 10% in earlier trading, BRC stock is down about 7% as of 10:50 a.m. ET.

Why does Black Rifle Coffee Company (BRCC) Need To Extend its client base dramatically?

Over the past year, Black Rifle Coffee Company (NYSE: BRCC)’s stock has lost 38.8%, and tragically, it’s down 82% from its April 2022 high. In February 2022, the company began quoting on the NYSE at $10. And for the next 3 months, it performed exceptionally well.

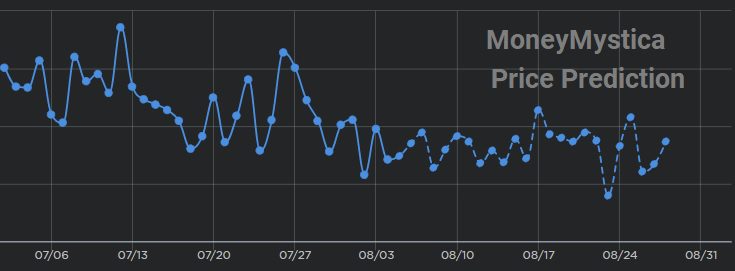

Black Rifle Coffee Stock Forecast 2023 – 2030

Since the ground coffee (BRCC stock) debut, the Black Rifle Coffee stocks have seen ups and downs in BRCC’s Shares. As to the wall street analysts of April 7, 2023, the BRCC Shares trading at $12.50 per share, with a market capitalization of $850 million. While some investors remain cautious, others see it as an exciting investment opportunity.

Black rifle coffee stock Price Prediction 2023

| Year | Black Rifle Coffee Stock Price Prediction |

|---|---|

| 2023 | $5.40 – $8.21 |

As per 19 analysts, Black Rifle Coffee stock is expected to reach a median price of $5.01 USD by the close of 2023, with estimates ranging from a low of $5.43 – $8.21. The projected monthly volatility for the stock is $9.771%.

It is expected that the Black Rifle Coffee Price stock price might begin to recover from here on, as analysts also predicted the recovery phase of BRCC shares in 2023.

Black Rifle Coffee Stock Price Prediction 2024

| Year | Black Rifle Coffee Stock Price Prediction |

|---|---|

| 2024 | $7.04 – $7.50 |

In 2024, analysts predict that Black Rifle Coffee stock could range between $7.04 and $7.50 per share. This forecast suggests a potential upside of 142.98% from the current share price.

Black Rifle Coffee Stock Price Prediction 2025

| Year | Black Rifle Coffee Stock Price Prediction |

|---|---|

| 2025 | $9.00 – $10.74 |

For 2025, the projected stock price range is between $9.00 and $10.74 per share. The stability of the price is expected to be around 5.75% during this period.

| Month | Max. Price($) | Min. Price ($) | Change in Volume (%) | Price Target |

|---|---|---|---|---|

| January | 6.74 | 5.64 | 16.32 | ▼ 6.15 |

| Feburary | 6.17 | 5.61 | 9.09 | ▼ 5.99 |

| March | 5.73 | 4.97 | 12.96 | ▼ 5.40 |

| April | 5.73 | 4.93 | 13.32 | ▲ 5.54 |

| May | 6.45 | 5.42 | 15.91 | ▲ 6.12 |

| June | 6.84 | 6.20 | 9.20 | ▲ 6.62 |

| July | 7.15 | 6.58 | 7.94 | ▲ 6.88 |

| August | 7.63 | 6.68 | 12.30 | ▲ 7.03 |

| September | 6.88 | 5.64 | 18.52 | ▼ 6.27 |

| October | 6.30 | 5.55 | 11.88 | ▼ 5.77 |

| November | 6.08 | 5.47 | 9.98 | ▲ 5.79 |

| December | 6.42 | 5.28 | 18.24 | ▲ 5.94 |

Black Rifle Coffee Stock Price Prediction 2030

| Year | Black Rifle Coffee Stock Price Prediction |

|---|---|

| 2030 | $15.50 – $16.40 |

By 2030, analysts forecast that the Black Rifle Coffee stock price could range between $15.50 and $16.40 per share. This represents a potential increase of 166% for investors who invest in the company now.

Factors Driving brcc stock predictions

One of the key factors driving BRCC’s growth is its unique branding and mission. The company’s patriotic branding and mission to support veterans have gained a loyal following among consumers. The company’s branding has also helped it stand out in the crowded coffee market, where differentiation is essential for success.

Another book value factor driving BRCC’s growth is its expanding distribution channels. The company has been partnering with major retailers such as Target and Walmart, which has helped it reach a wider audience. In addition, lifestyle retailers of the company have been expanding their direct-to-consumer sales through their website and social media channels.

Black Rifle Coffee Financial Performance

While the company has not yet released its financial statements as a public company, its past performance offers some insights into its financial potential. In 2020, the company reported revenue of $163 million, up from $80 million in 2019. The company also reported a net income of $11.7 million in 2020, up from $3.3 million in 2019.

In the previous year, 2022 net revenue was $301.30M showing a 29.30% YOY increase with a dollar $99.2 million gross profit. Making a 10.6% increase that resulted in 32.9% net revenue.

Future Potential of Black Rifle Coffee Stock

Many analysts predict that Black Rifle Coffee company stock (BRCC) has significant growth potential due to its unique branding, loyal customer base, and expanding distribution channels. As the company continues to expand its product offerings and reach new markets, there is potential for the stock price to continue to rise.

How to buy Black rifle coffee company Stock (BRC Inc.) stock?

If you’re interested in investing in Black Rifle Coffee Company (BRCC), it’s important to understand the steps involved in buying stocks. By following these steps, you can make informed decisions and potentially benefit from the growth of this exciting company.

Research BRCC – Take the time to learn about the company’s history, vision, and growth potential. Review the company’s financials, including revenue and profit margins, to assess its financial health. This research will help you make an informed decision about whether to invest in BRCC.

Find a Brokerage Firm – Once you’ve completed your research, you’ll need to find a brokerage firm that offers access to private company stocks. Some popular brokerage firms include AngelList, SharesPost, and EquityZen. Compare the fees and services of each firm to find the best one for your needs.

Subscription Agreement – After you’ve selected a brokerage firm, you’ll need to complete some paperwork. This typically involves verifying your identity, filling out an investment profile, and signing a subscription agreement.

Investment Amount – Next, you’ll need to decide how much money you want to invest in BRCC stocks. The amount you invest will determine the number of shares you receive. Be sure to carefully consider your investment amount and only invest what you can afford to lose.

Once you’ve invested your money, you’ll need to wait for the investment to close. The length of time it takes can vary from a few weeks to a few months, depending on the brokerage firm and the level of interest in the investment.

Monitor Investments – Finally, it’s important to monitor your investment regularly. This includes tracking the company’s performance, attending investor meetings, and staying informed about any news or events that may impact the company’s value.

Stocks to Watch – Rivian Stock 2025 | Lucid Stock | Dow Jones |

Brcc Third Quarter Results

Black Rifle Coffee Company, a popular specialty coffee brand, has released its third-quarter 2022 financial results, highlighting impressive revenue growth despite facing some challenges.

In the last quarter of 2022, the company reported a 26% increase in net income, reaching $75.5 million compared to $60.1 million in the same quarter of the previous year. This growth was even more significant when we exclude the RTD creation issue, as net income increased by 27% to $76.1 million.

The Direct-to-Customer (DTC) channel, which is a significant revenue driver for the company, showed a 2% increase to $38.1 million in the last quarter of 2022 from $37.5 million in the same quarter of 2021. However, the standout performer was the discount revenue, which soared by 66% to $32.2 million from $19.5 million in the same quarter of 2021. If we exclude the RTD creation issue, discount revenue increased by 69% to $32.8 million.

The company’s Station revenue also experienced a remarkable growth of 65% to $5.2 million in the last quarter of 2022 from $3.1 million in the same quarter of 2021. This growth was primarily driven by an increase in the company’s owned store count, which expanded to eleven in the last quarter of 2022 from four owned stations in the same quarter of 2021.

However, despite the impressive revenue growth, the company’s net benefit decreased year-over-year to $23.9 million, representing a 32% gross margin. Nevertheless, when we exclude the RTD creation issue, the net benefit increased by 14% to $27.4 million. Moreover, the gross margin decreased by 830 basis points to 32% from 40% in the last quarter of 2021. Excluding the RTD creation issue, the gross margin decreased by 403 basis points to 36% from 40% in the same quarter of 2021.

Black Rifle Coffee Company fourth quarter Reports

The price target of black Rifle Coffee (Quotes) was cut from $14 to $19 at Deutsche Bank.& Ranges ($4.95 – $5.08)& shares(BRCC -.51%) hit all-time low stock of black rifle

Black Rifle Coffee Company, a rapidly growing premium coffee brand founded to support Veterans, active-duty military, first responders, and a broad customer base, has announced that it will report its fourth quarter and full-year fiscal 2022 financial results on March 15, 2023. The Salt Lake City-based company traded on the NYSE as BRCC, has gained popularity for its unique mission-driven approach and high-quality coffee, which has resonated with consumers, investors, and analysts. Download PDF

Black Rifle Coffee Company IPO Price

black rifle coffee price: An IPO by Black Rifle Coffee Company (BRCC) valued the company at about $1.7 billion. In a deal expected to generate up to $150m for the coffee business, the parent company of BRCC.

"Our entry into the public market represents a significant milestone as we continue to serve premium coffee and media to those who love America." Evan Hafer, Chief Executive Officer and Founder of BRCC

It operates a digital-first retail coffee business but has also been seeking to grow its few brick-and-mortar stores through franchising in recent years.

Black Rifle Coffee Company filed for its IPO in 2021 and went public on November 18th, under the ticker symbol BRCC. The IPO was priced at $15 per share, with the company offering 6,250,000 shares of common stock.

The offering raised approximately $93.75 million in gross proceeds for the company, which it plans to use for general corporate purposes, including expanding its business and product offerings.

Is Black Rifle Coffee Stock a Good Buy?

Are you considering investing in Black Rifle Coffee Company? This premium coffee company has gained a loyal customer base and is expanding its product offerings and distribution channels. Here are five reasons why investing could be a smart move:

The company has seen explosive growth in recent years. In 2019, Black Rifle Coffee Company generated $247 million in revenue, up from $33 million in 2016. This growth has been fueled by strong demand for its products and aggressive expansion into new markets.

Unique branding and loyal customer base: With its patriotic branding and mission to support veterans, BRCC has differentiated itself in the crowded coffee market. This could help it build long-term customer relationships and translate into sustained growth and profitability.

Expanding distribution channels: Black Rifle Company has been partnering with major retailers such as Target and Walmart to increase its market share. The company has also been expanding its direct-to-consumer sales through its website and social media channels. As it continues to invest in these channels, it could increase its reach and grow its customer base.

Strong financials: In 2020, the company reported revenue of $163 million, up from $80 million in 2019, and a net income of $11.7 million, up from $3.3 million in 2019. These figures demonstrate its ability to grow its revenue and maintain profitability.

Potential for growth: It is not content to rest on its laurels and is expanding its product offerings to include energy drinks and snacks. As the company introduces new products and enters new markets, it could drive significant revenue growth and boost its stock price.

Positive social impact: BRCC actively hires veterans, and its mission to support veterans could be seen as a positive social impact for investors who value social responsibility.

Pros & Cons of Investing In Black Rifle Coffee Company

Investing in stocks can be a great way to grow your wealth over time, but it’s not without its pros and cons. Here’s what you need to know before you decide to invest in the stock market.

Pros of Investing in Stocks:

- Potential for High Returns: Stocks have historically outperformed most other asset classes over the long term. While there are never any guarantees, the potential for high returns is one of the biggest advantages of investing in stocks.

- Diversification: Stocks offer investors the opportunity to diversify their portfolios across various sectors, industries, and regions. By spreading your investments across different companies, you can reduce the risk of any single investment hurting your overall portfolio.

- Liquidity: Unlike some other investments, such as real estate or private equity, stocks can be bought and sold quickly and easily. This means you can react to changes in the market or your own financial situation more easily.

Cons of Investing in Stocks:

- Volatility: While stocks can offer high returns, they can also be incredibly volatile. Prices can rise and fall rapidly, and it’s not uncommon for investors to experience significant losses in short periods of time.

- Complexity: Investing in stocks can be complicated, especially for beginners. There are a lot of different factors to consider, including company financials, market trends, and political events. It’s important to do your research and stay up-to-date on market news.

- Risk of Fraud: Unfortunately, the stock market is not immune to fraud. Some companies may misrepresent their financials, and there have been cases of insider trading and other illegal activities. It’s important to be vigilant and only invest in companies you trust.

black rock coffee dtc

Black Rock Coffee is a widely acclaimed coffee bar free and available in Arizona, California, Colorado, Idaho, Oregon, Texas, and Washington. Does it provide contactless delivery? So the answer is YES Black Rock Coffee Bar (UnionUlster “DTC“) (7850 E Union Ave) provides contact-free delivery on all orders above $35 with Grubhub with its official website (https://br.coffee/).

Why Is BRC Inc. Stock Dropping? – A big factor in the decline in stock is that they are having some difficulty with their brand identity. The company was founded by military veterans and has close links to conservative right-wing politics within America, which could be one reason for this issue.

Latest News Today

- Black Rifle Coffee News: (BRCC) to Engage at the D.A. Davidson 6th Annual (CGC) – Source

- BRC Inc. Announces its 4th Quarter and Full Year 2022 Financial Results – Source

Black Rifle Coffee Review

FAQ- Black rifle coffee company stocks

What is the New Symbol of Black Rifle Coffee Company Stock?

BRCC is the Ticker Symbol of Black Rifle Coffee Company.

What is the current Price of Black Rifle Coffee Company Stock?

$5.34 is the current Price of Black Rifle Coffee Company( ▲.20 Change & .40% High)

Will Black Rifle Coffee Stock Price Rise?

Yes, Black Rifle Coffee Company Stock will certainly rise from $5.34 – $50 in the long-term 10 years forecast if the price continues its rally.

Is Black Rifle a Good Stock to Buy?

Yes, 100% it is a good stock to buy as it is moving slowly & steadily but with constant progress.

what is the black rifle coffee stock symbol on Nasdaq?

NYSE: BRCC is the black rifle coffee stock symbol on Nasdaq.

What is Black Rifle Coffee’s stock price target?

$14 from $19 is the Black Rifle Coffee Stock Price Target at Deutsche Bank

what are black rifle coffee (BRCC) share price forecasts?

In the next year, BRCC’s stock price is expected to reach $10.08 on average, ranging from $5.00 to $19.00.

What are Wall Street analysts predicting that Brc’s share price?

By Mar 16, 2024, Wall Street analysts predict Brc’s share price to reach $11.83.

What is Black Rifle Coffee Stock Price Prediction (BRCC)- BRC inc Forecast by CNNMoney.com

There are 6 analysts offering 12-month price forecasts for BRC Inc, with a median estimate of 9.00, a high estimate of 10.00, and a low estimate of 5.00. The median estimate represents a +79.64% increase from the last price of 5.00.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.