Can AMD Stock Reach 200:Analysts are bullish on AMD with a ‘Strong Buy‘ rating, and a Street-high target price of $200 indicates over 63% a growth potential from current levels. With a market capitalization of $197.65 billion, and 90% YTD gain.

On Thursday,(NASDAQ: AMD) analysts at Mizuho Securities reiterated their buy rating on the stock and increased the short-term price target to $235 from $200.

There is also a question in mind of investors How high can Advance Micro Devices Stock (AMD) can go?

Analyst Research for Advanced Micro Devices, Inc. Common Stock (AMD) price target is updated by 11 analysts with 12-month price forecasts for AMD stock have an average target of 190.00, with a low estimate of 121 and a high estimate of 275. The average target predicts an increase of 16.48% from the current stock price of 163.28.

While such projections indicate confidence in AMD’s potential, predicting stock movements involves uncertainties. Achieving a 63% climb from the current valuation to reach $200 per share would depend on various factors, including sustained business performance, market conditions, and industry dynamics.

Table of Contents

About Advanced Micro Devices (AMD) Stock Overview

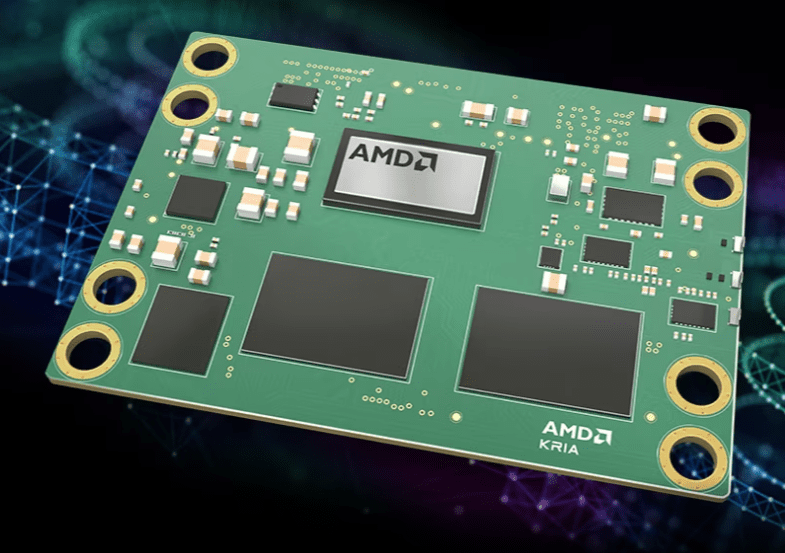

Advanced Micro Devices, Inc. (AMD) is a leading semiconductor company specializing in the design and production of cutting-edge computer processors and graphics processing units (GPUs). As a major player in the semiconductor industry, AMD’s stock performance is closely watched by investors and enthusiasts alike.

Known for its innovative CPUs and Radeon graphics technology, AMD provides alternatives to competitors like Intel and Nvidia. The company’s processors power a wide range of computing devices, from desktops and laptops to servers and gaming consoles. AMD has earned recognition for delivering competitive performance and advancing technology in the semiconductor space.

Investors interested in AMD stock can monitor its market performance, financial results, and technological advancements to make informed decisions. Stay updated on AMD’s latest developments to stay informed about the dynamic landscape of semiconductor stocks.

Advanced Micro Devices (AMD)Q3 Earnings

AMD’s Q3 earnings showcased impressive results, beating expectations with a 4% YoY revenue increase to $5.8 billion. The client segment’s strong performance offset weaknesses in gaming and embedded segments, contributing to a 42% rise in revenue. AMD’s consistent EPS growth, reaching $0.70, reflects its financial stability.

Although net cash from operating activities declined, the company maintains a robust cash balance of approximately $5.8 billion, ensuring ample liquidity. Additionally, the reduction in long-term debt levels from $2.5 billion to $1.7 billion demonstrates prudent financial management.

About Advanced Micro Devices (AMD) Stock Forecast

Analysts providing 12-month price forecasts for Advanced Micro Devices Inc have set a median target of $135.00. The next quarter’s sales forecast for AMD is projected at $6.14 billion, and the company anticipates an improvement in profit. Advanced Micro Devices (AMD) boasts a Smart Score of 10, derived from the analysis of 8 unique datasets, including Analyst Recommendations. As of the latest market data:

- Opening price: $120.00

- High: $124.76

- Low: $119.95

- Market capitalization: $19.79 trillion

- P/E ratio: 965.94

- 52-week high: $132.83

- 52-week low: $60.05

About Advanced Micro Devices (AMD) Stock Forecast 2024

In the analysts’ predictions for Advanced Micro Devices (AMD) stock in 2024, the forecast for the beginning of January is $207.159. The maximum value is projected to reach $236.150, with a minimum estimate of $202.412.

About Advanced Micro Devices (AMD) Stock Forecast 2025

Advanced Micro Devices (AMD) stock price prediction for 2025 indicates that shares could reach an all-time high of $257.45 and end the year with a maximum price of $287.45. This forecast suggests a substantial increase of 137.62% from the current price of $122.51 (+3.35, +2.81%), presenting potential growth opportunities for investors considering a long-term strategy with AMD.

AMD Stock Forecast 2025 walletinvestor

According to WalletInvestor, Advanced Micro Devices Inc (AMD) is considered a potentially profitable investment option. As of November 24, 2023, the AMD stock is quoted at $122.510 USD. The long-term forecast indicates an expected increase, with a projected stock price of $124.984 USD by November 15, 2028. Over a 5-year investment period, the potential revenue is estimated to be around +2.02%, suggesting that a $100 investment today could be up to $102.02 in 2028.

About Advanced Micro Devices (AMD) Stock Forecast 2030

Based on latest experts analysis for AMD stock forecast it could surge to $498.96 by 2030, reflecting a remarkable 2,64.11% increase if it maintains its current 10-year average growth rate from the current price.

Read Related Topics: CRDL Stock Price Forecast 2025, 2030 Growth Analysis | Shopify Stock Forecast 2024, 2025, 2030 Growth Chart | Why is Home Depot Stock Dropping: will HD Stock reach $700

Can AMD Stock Reach $200 Share price?

Based on latest analysts rating signaling answer to big question Can AMD Stock Reach $200 USD as YES, AMD stock will reach high target of $200 suggesting a substantial 63% potential upside,on an average the majority of analysts are optimistic and have a “Strong Buy rating for AMD.” Despite a more conservative median target of $131.90, reflecting a 7.7% upside,

AMD is on a winning streak, doubling its CPU market share from 17.5% in 2016 to an impressive 35% today. In a showdown with Intel, AMD’s AI upgrades are set to boost its CPU dominance even more. While gaming revenues faced a temporary setback due to the prolonged console cycle, the outlook for the segment into early 2024 seems a bit subdued.

What is AMD’s position in the AI market?

AMD is strategically positioned to benefit from the AI boom, projected to reach $738 billion by 2030.

How is AMD incorporating AI capabilities into its gaming chips?

AMD is integrating AI capabilities into its gaming chips to enhance performance and stay competitive in the market.

What growth driver does AMD’s enterprise solutions offer in the AI space?

AMD’s enterprise solutions, particularly the MI300X chip, serve as a compelling growth driver in the AI space.

What makes the MI300X chip stand out in the AI landscape?

The MI300X chip boasts an exceptional 192 GB memory capacity, surpassing Nvidia’s competitor, the H100, making it a standout choice for large language and AI models.

How does AMD plan to challenge Nvidia’s market dominance in AI?

Despite delivering superior performance, AMD’s MI300X comes with a significantly more affordable price tag, positioning AMD to challenge Nvidia’s market dominance.

What investments has AMD made in its ROCm software stack for AI?

AMD has made significant investments in its ROCm software stack, establishing it as a viable competitor to Nvidia’s CUDA software.

How is AMD fostering AI adoption among enterprises?

AMD has developed a PyTorch/TensorFlow Code Environment for AMD GPUs to address the dominance of CUDA-based code on GitHub and foster a more robust AI ecosystem.

How optimistic are analysts about AMD’s stock in 2025?

Analysts’ optimism regarding AMD stock in 2025 is suggested by the forecasted all-time high of $257.45

can AMD Stock hit $200 milestone?

Analysts strongly believe that AMD’s stock can hit the $200 milestone, backed by a “Strong Buy” consensus and a high target price.

Is amd stock a buy sell or hold?

The current analyst consensus leans heavily towards “Buy” for AMD stock, indicating positive sentiment and growth potential. With a majority of analysts giving it a “Strong Buy” rating, AMD seems to be viewed favorably for investment.

Can AMD Stock reach 200 Dollar?

YES, AMD will rise to $200 by 2025, $235 in 2026, $290 in 2027, $330 in 2029, $370 in 2031, $400 in 2033 and $450 in 2035, and $500 by 2040.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.