Get a Long-term WBD Stock Forecast 2025 and discover the potential returns of Warner Bros Discovery (WBD) stock. Explore expert insights, fundamental and technical analysis, and make informed investment decisions in the entertainment sector.

Discover the Warner Bros Discovery (WBD) stock forecast for 2023 to 2030 and explore the potential returns it offers. With insights based on fundamental and technical analysis, find out if WBD is a good investment in the entertainment sector.

Also learn about the company overview, key stats, and expert opinions to make informed decisions. Get the latest forecast and explore the growth potential of WBD stock. Read now for valuable insights and projections.

Key Factors Influencing the WBD Stock Forecast 2025 market price

- The financial performance of WBD, including revenue growth, profitability, and debt levels, holds substantial influence over its stock forecast.

- Additionally, factors such as market growth, technological advancements, regulatory changes, and the competitive landscape can significantly impact WBD’s performance and stock outlook.

- Macroeconomic conditions, including interest rates, inflation, GDP growth, and consumer sentiment, also play a crucial role in shaping the overall stock market, consequently affecting WBD’s stock forecast.

- Moreover, market sentiment and expectations hold considerable weight in determining the prices of Warner Bros Discovery stocks.

- By taking into account these key factors, investors and analysts can gain valuable insights into the potential trajectory of WBD’s stock in 2025 and make well-informed decisions based on the prevailing market conditions and industry dynamics.

Introduction to Warner Bros Discovery (WBD)

Warner Bros Discovery (WBD) is a prominent multinational media and entertainment company resulting from the merger of WarnerMedia and Discovery, Inc. The merger, anticipated to finalize in mid-2022, is subject to regulatory approvals.

As a powerhouse in the industry, Warner Bros Discovery unites renowned brands like Warner Bros Studios, HBO, CNN, Cartoon Network, Discovery Channel, and Animal Planet. With a global focus, WBD aims to lead the direct-to-consumer streaming market by providing an extensive range of captivating content across various platforms.

Leveraging its vast content library, production capabilities, and strong brand recognition, Warner Bros Discovery competes with other major players in the evolving digital landscape. This merger marks a significant milestone in the media and entertainment realm, creating endless entertainment possibilities for audiences worldwide.

The Explosive Growth and Multi-Trillion Market Capitalization of the Media and Entertainment Industry

The media and entertainment industry has experienced remarkable growth over the past century (100 Years), largely driven by advancements in digital technology. This has allowed the industry to reach billions of people worldwide, leading to faster growth compared to many other sectors.

According to data from CompaniesMarketCap, the total market capitalization of entertainment companies currently exceeds $1.5 trillion, highlighting the immense scale and significance of the industry. This places the media and entertainment sector among the largest industries globally, reflecting its substantial economic impact and market value.

Companies like Walt Disney, Comcast, Netflix, and Warner Bros Discovery have emerged as industry leaders, contributing to the industry’s overall success. With a total market capitalization exceeding $1.5 trillion, the entertainment sector is a significant player in the global economy, poised for further expansion and innovation in the years to come.

How could you miss these stocks: Rivian Stock | Gesi Stock | SIRC | Ring ENERGY (REI)

Warner Bros. Discovery, Inc. NASDAQ: WBD

Historical Performance Analysis of Warner Bros. Discovery, Inc. (NASDAQ: WBD)- Series A chart to track its stock Price Today. According to analysts’ consensus price target of $23.83, Warner Bros. Discovery has a forecasted upside of 68.4% from its current price of $12.67. wbd stock Nasdaq stock long-term price forecast is targeted at $18.00 for 1 year.

| Prev Close | $13.13 |

| Open | $13.09 |

| Days Range | 12.58 – 13.10 |

| 52 Week Range | 8.82 – 17.65 |

| Volume | 45,478,635 |

| Avg. Vol. (3m) | 20,057,168 |

| 1 Year Change | -9.99% |

| Market Cap | 31.18B |

| P/E Ratio & EPS | -3.70 (-3.70) |

| Dividend Yield | N/A – N/A |

Is WBD a good stock to buy

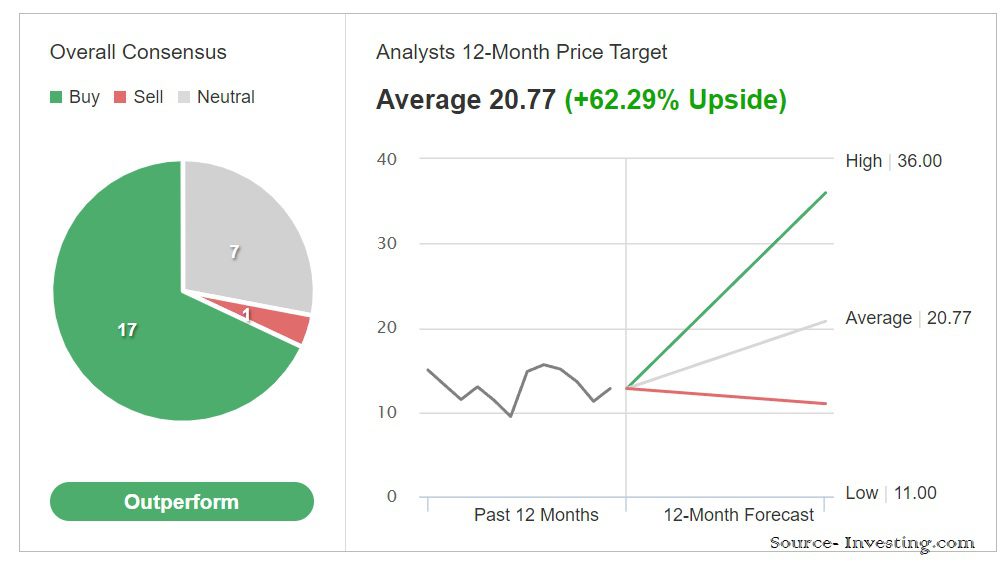

According to 18 stock analysts, the average 12-month stock price forecast for Warner Bros. Discovery stock is $23.22, which predicts an increase of 59.97%. The lowest target is 12 and the highest is 38. On average, analysts rate Warner Bros. Discovery (WBD)stock as a buy.

WBD 12-Month Price Target

The Analyst’s ratings for Warner Bros. Discovery (WBD) are considered a good stock to buy, as indicated by the “Buy” rating given by an average of 18 stock analysts. This positive rating suggests that WBD has the potential to outperform the market in the next twelve months.

| Moving Averages | NEUTRAL | BUY (6) | SELL (6) |

| Technical Indicators | STRONG BUY | BUY (6) | SELL (2) |

Long-Term WBD Stock Forecast 2025

Based on the median growth of the Warner Bros. Discovery, Inc. stock in the last 10 years, the WBD stock price Today is $12.80 forecast for the beginning of next year is $ 15.63 and will be ranked higher by the year 2030

| Year | WBD Stock Prediction |

|---|---|

| 2023 | 12.50 |

| 2024 | 20.63 |

| 2025 | 25.95 |

| 2026 | 30.39 |

| 2027 | 34.15 |

| 2028 | 37.05 |

| 2029 | 40.11 |

| 2030 | 42.60 |

wbd stock forecast 2023

In 2023, the overall performance of WBD stock is anticipated to be positive. Although the stock may face challenges surpassing its all-time high, it holds the potential for favorable short-term returns.

Based on our fundamental analysis, technical analysis, and current market conditions, the projected price target for WBD stock in 2023 ranges from $12.50 to $24. Should the stock price dip below $13 or $11, it presents an attractive opportunity for long-term investors.

While the market sentiment may influence price fluctuations beyond our target range, we expect the overall performance of WBD stock to be favorable in 2023.

wbd stock Forecast 2024

Based on the top 10 analysts the average price target of $20.63 for WBD stock price prediction with a high forecast of $36.00 and a low forecast of $12.00. They predict Warner Bros Discovery’s shares could reach $20.63 by the end on 2024

wbd stock Forecast 2025

WBD’s recent financial performance has been impressive, setting the stage for potential new highs in 2025. Analysts project WBD’s total profit to exceed $18 billion in that year, which will likely attract interest from new investors.

The overall performance of the wbd stock price prediction 2025 is expected to be outstanding. After a considerable period, WBD stock has the potential to surpass the significant milestone of $30.

According to our fundamental analysis and considering the current market conditions, the projected price range for WBD stock forecast in 2025 is $21.09 to $34.19. It’s worth noting that market fluctuations can cause deviations from this range, but overall positive performance is anticipated for WBD stock in 2025.

While market behavior may lead to fluctuations above or below this price range, the overall outlook for WBD stock in 2025 is positive.

wbd stock forecast 2026

The WBD stock price prediction for the year 2026 is expected to be $30.39 at the minimum level and $28.63 at the maximum level. The opening and closing prices will be $28.63 and $30.39 respectively.

wbd stock forecast 2027

Based on the future analysis the WBD stock price prediction for the year 2027 is expected maximum price to be $34.15 & at the minimum level and $30.43 at the maximum level. The opening and closing prices will be $34.15 and $30.43 respectively.

wbd stock forecast 2028

By the start of the year 2028, the WBD Stock Forecast 2028 is a maximum expected price to be 37.05 and the minimum price to be 31.23.

wbd stock forecast 2029

According to the price prediction for 2029, the high price be $40.11 and the low price be $36.01 by Stock Market Analysis.

wbd stock Forecast 2030

In 2030, the Warner Bros. Discovery, Inc. stock will reach $ 42.60 if it maintains its present 10-year Compound Annual Growth Rate. WBD stock prediction for 2030 expands stock rally 40.89% from its current price.

Expert Opinion on wbd stock Forecast 2025

Over the past 3 months, 9 Wall Street analysts have provided their predictions for Warner Bros’s price in the next 12 months. The average price target among them is $20.21, with the lowest prediction at $16.50 and the highest at $27.00. These forecasts indicate a 31.23% increase over the current list price.

According to 31 stock analysts, it is projected that WBD stock will experience a price increase of 35.13% over the next 12 months. The lowest target price is $8.08, while the highest target price is $42.

FAQ – wbd stock forecast 2025

What is the WBD Stock forecast for 2025?

Based on our analysis and considering Warner Bros. Discovery, Inc. stock the current market conditions, the projected price range for WBD stock forecast in 2025 is $21.09 to $34.19.

What is the expected performance of WBD stock in the next 5 years?

According to analysts, the long-term price outlook for WBD stock is bullish. Our Warner Bros Discovery stock price prediction suggests a range of $60 to $80 based on fundamental analysis.

What is the Symbol of Warner Bros. Discovery, Inc?

WBD is the ticker symbol of Warner Bros. Discovery, Inc. Series A Common Stock on NASDAQ.

What is WBD Stock Forecast 2030?

42.60 is WBD stock prediction for 2030 expanding stock rally by 40.89% from its current price if it maintains its 10 years annual growth.

DISCLAIMER: it’s crucial to conduct thorough research and consider your own financial goals and risk tolerance before making any investment decisions.