Today, we discover Newmont Corporation (NEM: NYSE) NEM Stock Price Predictions and Forecasts for 2024, 2025, 2030, 2040, 2050, 2060, and further. Review the comprehensive technical and fundamental analysis report to understand how the stock market will likely perform in the upcoming years.

Table of Contents

Read: NVR Stock Forecast 2025 Price Prediction for 2030, 2040

A brief overview of Newmont Corporation (NEM)?

Newmont Corporation, based in Greenwood Village, Colorado, is the world’s largest gold mining company. Founded in 1921, it operates gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname. Besides gold, Newmont also mines copper, silver, zinc, and lead.

In 2019, Newmont moved significantly by acquiring Canadian mining company Goldcorp for $10 billion. With around 31,600 employees and contractors worldwide, Newmont is the only gold company listed on the Standard & Poor’s 500 stock market index.

Company Profile

| Company Name | Newmont Corporation |

|---|---|

| Formerly | Newmont Mining Corporation, Newmont Goldcorp Corporation |

| Traded As | NYSE: NEM, S&P 500 component, TSX: NGT, ASX: NEM |

| Industry | Metals and Mining |

| Founded | 1921 (103 years ago) |

| Headquarters | Greenwood Village, Colorado, U.S. |

| Key People | Thomas R. Palmer, President/CEO |

| Products | Gold, copper, silver, zinc, lead |

| Revenue | US$11.487 billion (2020) |

| Operating Income | US$51 million (2022) |

| Net Income | US$429 million (2022) |

| Number of Employees | Decrease to 14,300 |

| Subsidiaries | Goldcorp, Oroplata S.A., Newmont Nusa Tenggara, South Kalgoorlie Gold Mine |

| Website | newmont.com |

Newmont Corporation (NEM) Fundamental Analysis

| Open | $40.97 |

| High | $41.95 |

| Low | $40.93 |

| Market Cap | 48.19B |

| P/E Ratio | – |

| Dividend Yield | 2.39% |

| CDP Score | A- |

| 52-Week High | $45.92 |

| 52-Week Low | $29.42 |

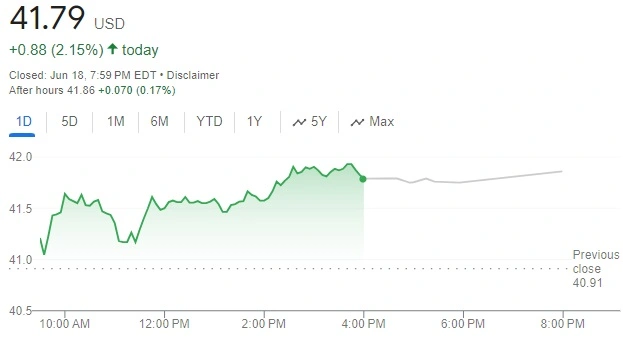

Newmont Corporation (NEM) Share Price Growth Chart

NEM Stock Forecast and Price Target By Trading View

According to the Trading View analyst’s forecast, the NEM average price target is 48.33 USD with a high forecast of 54.00 USD and a low forecast of 40.00 USD.

Long-Term NEM Stock Price Prediction 2024, 2025, 2030, 2040, 2050

Our NEM stock forecast indicates Newmont Corp. stock price prediction will reach $47.72 by year-end of 2024, 57.50 in 2025, 68.10 by 2030, 88.65 in 2035, $102.40 in 2040, $160 in 2045, $210 by 2050, and $300 by 2060.

NEM Stock Price Prediction 2024

| Year | NEM Stock Price Prediction 2024 |

|---|---|

| 2024 | $41.40 – 47.42 |

Based on our latest market research, NEM Stock Forecast in 2024 will reach a record-high average price target of $47.72 per share with a moderate upside forecast of 14.19% from the current price.

| Positive Indicators | Neutral or Negative Indicators |

|---|---|

| The current Newmont Corp forecast predicts a price increase of 14.19% to $47.72 by December 25, 2024. | The Fear & Greed Index suggests some market fear, and the overall sentiment is neutral. |

| The stock trades below the predicted price as of June 19, 2024, potentially indicating a buying opportunity. | The stock price has fallen over the past year. |

| 8 out of the last 30 days were green days for NEM stock. | Technical analysis indicators are mixed, with some suggesting buy and some suggesting sell. |

NEM Stock Price Prediction 2025

| Year | NEM Stock Price Prediction 2025 |

|---|---|

| 2025 | $47.42 – $57.50 |

NEM stock price prediction forecasts for Newmont Corporation in 2025 is priced at an average trading price of $57.50 per share. NEM Stock price forecasts a whopping 38.31% increase from the current price with a price assuming Newmont shares will continue growing at the average yearly rate observed over the last 10 years.

NEM Stock Price Prediction 2030

| Year | NEM Stock Price Prediction 2030 |

|---|---|

| 2030 | $46.55 and $68.91 |

Forecasts based on the latest market sentiments indicate Nem’s price prediction for 2030 to reach a low forecast of $46.55 & a high forecast of $68.91 by 2030. Newmont Corporation will grow 62.50% from its current price.

NEM Stock Price Prediction 2035

NEM stock forecasts an impressive increase of 112.14% by 2035, potentially reaching a price target of $88.65 per share. If this Newmont Corporation stock prediction for 2035 comes true, it signifies substantial growth from its current price, highlighting a lucrative investment opportunity.

NEM Stock Price Prediction 2040

| Year | NEM Stock Price Prediction 2040 |

|---|---|

| 2040 | $84.50 to $102.40 |

We believe NEM stock forecasts a significant price increase of 145% to an average price target of $102.40 by 2040. The Newmont Corporation share price could range from a low forecast of $84.50 to a high forecast of $102.40 by 2040. If these predictions hold true, NEM stock will present a lucrative opportunity for long-term investors, with substantial returns over the next 16 years.

Newmont Corporation (NEM) Dividend Cut for FY (fiscal year)

| Year | Dividends per Share (USD) | Dividend Yield (%) | Payout Ratio (%) |

|---|---|---|---|

| 2017 | 0.56 | 1.29 | 14.71 |

| 2018 | 1.04 | 1.74 | 29.63 |

| 2019 | 2.20 | 3.55 | 151.13 |

| 2020 | 2.20 | 4.66 | – |

| 2021 | 1.60 | 3.87 | – |

NEM Stock Price Prediction 2050

According to the technical analysis, the NEM stock forecast in 2050 is expected to reach an average price target of $210, and the minimum cost of Newmont Corporation will be $192.44. The maximum NEM price can reach is $240 from its current price.

NEM Stock Price Prediction 2060

According to our current NEM stock forecast for 2060, the cost of 1 NEM share will be priced at $300 per share in 2060 with a rise of 618% from Newmont Corporation’s current price.

Who owns the maximum of stocks of NEM (Newmont Corporation)?

Newmont Corporation (NEM) does not have one dominant shareholder who owns a majority stake in the company. Instead, the ownership of NEM is widely distributed among various institutional investors. Institutional investors include large financial entities such as investment firms, mutual funds, pension funds, and hedge funds. Based on the information provided, institutional investors collectively hold more than 90% of NEM’s stock.

On the other hand, retail investors, who are individual investors buying and selling stocks for their personal portfolios, likely hold a smaller percentage of NEM’s shares compared to institutional investors. The exact percentage held by retail investors isn’t specified but is generally less significant than that held by institutional investors.

Conclusion: Can I BUY or Hold Newmont Corporation (NEM) Stock for the long term?

Newmont Corporation (NEM) appears to be a strong candidate for long-term investment, Newmont has a consensus rating of Moderate Buy which is based on 4 buy ratings, 6 hold ratings, and 1 sell rating, particularly for those interested in the stability and potential of the gold mining industry. Holding the stock could result in substantial gains over the next few decades.

What is the cost of 1 NEM share in 2025?

According to the latest nem stock forecast for 2025, the cost price of 1 NEM stock will be valued at $ 57.50 per share in 2025. NEM buyback /repurchase program may be discontinued at any time.

What is the 2030 New Stock Forecast?

Newmont (NEM) Stock Price Prediction in 2030 is expected to grow exponentially at 112.14% with an average price target range of $46.55 and $68.91 by 2030

What is the NEM Forecast price target for 2024?

The current NEM forecast predicts a price increase of 12.19% to $42.42 by June 25, 2024. The Newmont stock is currently priced below the predicted price, potentially showing a BUY opportunity.

Disclaimer: These stock price projections are based on past performance and market trends. They are provided for informational purposes and do not constitute financial advice or guarantees.