On average, the HD Stock Forecast for 12 months is $354.03. Home Depot’s price prediction 2025 will hit $415 in 2024 and then $485 by the middle of 2025.

However, Home Depot’s share price could rise to $530 in 2026, $597 in 2027, $675 in 2029, $777 in 2030, $845 in 2033, and $1000 in 2035.

Table of Contents

Home Depot Stock (HD) Finacial Outlook

In the quarter ending October 2023, Home Depot reported a revenue of $37.71 billion, showing a year-over-year increase of 2.99%. The net income for the same period was $3.81 billion, reflecting a significant growth of 12.19%. Diluted earnings per share (EPS) stood at $3.81, representing a notable increase of 10.14%. The net profit margin also saw improvement, reaching 10.1%, compared to the previous year’s 9.5%.

Regarding earnings calls for October 2023, Home Depot outperformed expectations with a 1.35% beat on EPS and 0.28% on revenue. Home Depot, Inc. stands out as a robust blue-chip stock, boasting a rich history, making it an excellent prospect for long-term compounding.

Related: Best Home Depot Black Friday deals 2023 | Netflix (NFLX) Stock Price

| Quarterly Financials (USD) | Oct 2023 | Y/Y |

|---|---|---|

| Revenue | $37.71B | 2.99% |

| Net Income | $3.81B | 12.19% |

| Diluted EPS | $3.81 | 10.14% |

| Net Profit Margin | 10.1% | 9.5% |

| Earnings Calls | Previous | EPS | Revenue |

|---|---|---|---|

| Oct 2023 | Beat 1.35% | Beat 0.28% | – |

Home Depot Stock (HD) Price Forecast

| Open | $344.21 |

| High | $347.30 |

| Low | $343.22 |

| Market Cap | $343.44B |

| P/E Ratio | 22.13 |

| Dividend Yield | 2.42% |

| 52-Week High | $354.92 |

| 52-Week Low | $274.26 |

Home Depot (HD) stock is expected to have a price target of $385.92, based on forecasts from 28 Wall Street analysts. The predictions range from $310.00 to $440.00, indicating a potential 6.78% increase from the current price of $361.42.

Home Depot’s stock has a beta of 1.03, indicating a moderate correlation with the overall market. The revenue per employee is $325.94K, reflecting the company’s efficiency in generating income. The price-to-earnings (P/E) ratio is 22.24, and the earnings per share (EPS) is $15.58.

Investors also benefit from a yield of 2.41%, with a dividend payout of $2.09. The ex-dividend date for the latest dividend was on November 29, 2023. Short interest in Home Depot’s stock is reported at 9.56 million shares as of December 15, 2023, constituting 0.96% of the float. The average trading volume is 3.43 million shares, providing insight into the stock’s liquidity.

Related Home Depot News: Why is Home Depot Stock Dropping: will HD Stock reach $700

Longterm HD Stock Price 2024, 2025, 2026, 2027, 2029, 2030, 2033, 2035

| Year | High Price | Low Price | Average Price |

|---|---|---|---|

| 2024 | $415 | $400 | $407.50 |

| 2025 | $485 | $425 | $455.00 |

| 2026 | $530 | $510 | $520.00 |

| 2027 | $597 | $540 | $568.50 |

| 2029 | $675 | $601 | $638.00 |

| 2030 | $777 | $710 | $743.50 |

| 2033 | $845 | $800 | $822.50 |

| 2035 | $1000 | $990 | $995.00 |

HD Stock Forecast 2024

Home Depot price started in 2024 at $345.45. Today, Home Depot traded at $346.59, so the price decreased by 0.9% from the beginning of the year. The forecasted Home Depot price at the end of 2024 is $383 – and the year-to-year change is +16%. The rise from today to year-end: +16%.

HD Stock Forecast 2025

Based on our latest analysis, there is a positive outlook for Home Depot stock in 2025! With a high forecast of $485 and a year-to-year change of +45%, there’s a strong expectation for growth. The rise from today to the year-end, with a +12% increase, also suggests a favorable trend.

Based on our forecasts, a long-term increase is expected, the home depot stock prediction 2025 prognosis for 2025-12-27 is $485 with an average price of $455 and a low estimate of $425 from its current price of $345.08 from today.

HD Stock Forecast 2029

The forecasted Home Depot stock 5-year forecast by our analysts at the beginning of 2029 is $675 – and the year-to-year change is +45%. The average HD Stock (“HD” ) future stock price will be 675 USD and the low price will be $601 from today.

HD Stock Forecast 2030

The forecasted Home Depot price at the end of 2030 is $777 – and the year-to-year change is +62%. The rise from today to year-end: +15% the average price is $ 743.50 with a low estimate of $ 710 from the current price of $345.45 from today.

HD Stock Forecast 2033

Home Depot stock 10 years forecast from today in 2033 is $845 with a YOY change of +25% showing a rise of 11% from today with an average price of $822.50 and a low estimate of $800 from the current price.

HD Stock Forecast 2035

Home Depot stock, currently priced at $346.55, is anticipated to experience substantial growth by the middle of 2035, reaching a high forecast of $1000 and a low estimate of $990. The long-term average price is expected to be $995.00, signaling a positive trajectory from its current valuation.

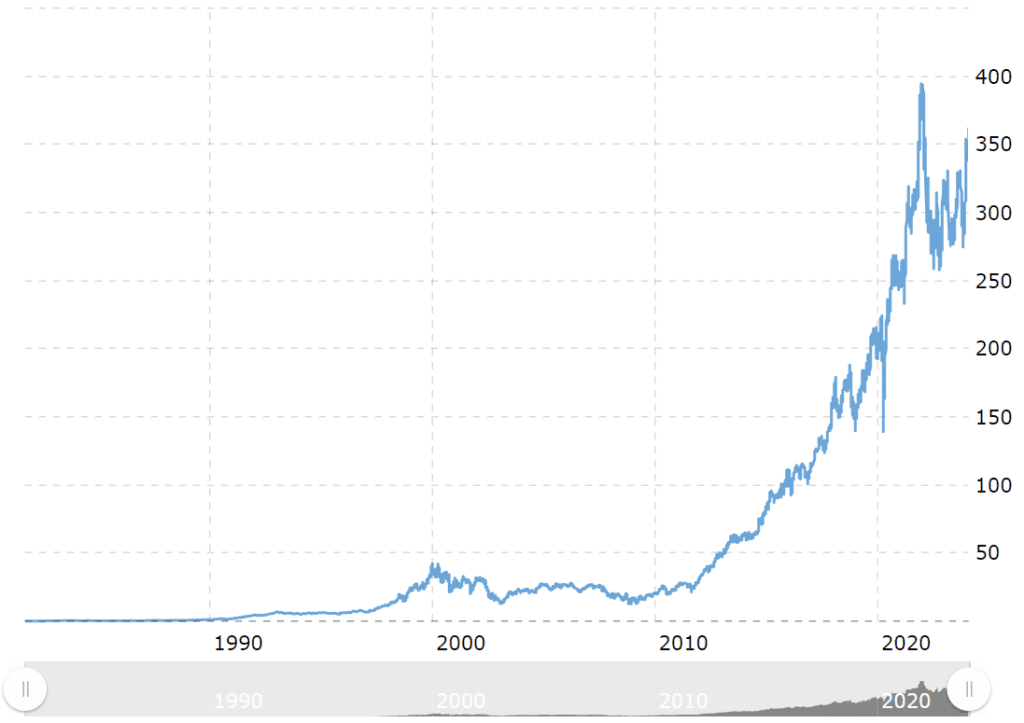

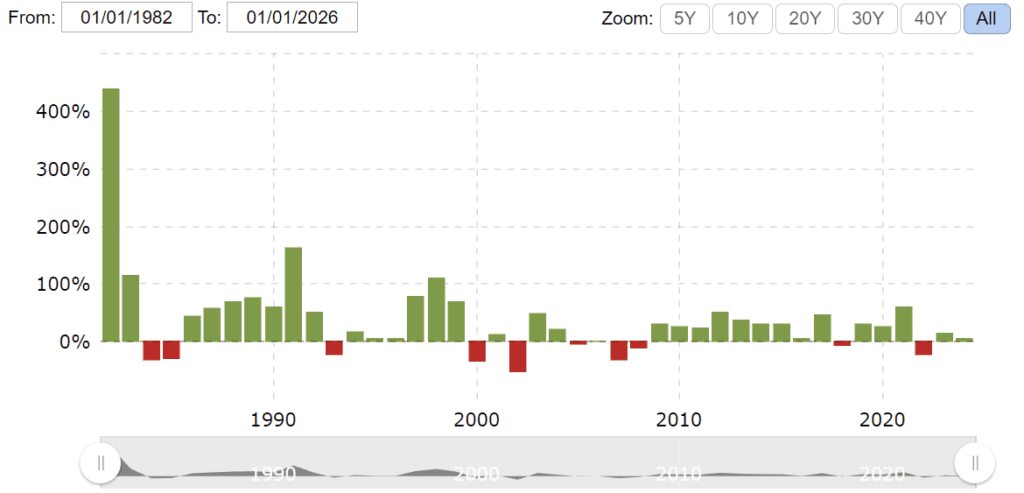

HD Stock Price History Chart Since 1981 (last 43 Years)

| Home Depot Historical Share Price Overview | (Adjusted for Splits and Dividends) |

|---|---|

| Latest Closing Stock Price (Jan 19, 2024) | $362.41 |

| All-Time High Closing Price (Dec 07, 2021) | $394.99 |

| 52-Week High Stock Price | $362.96 (0.2% above current) |

| 52-Week Low Stock Price | $274.26 (24.3% below current) |

| Average Stock Price (Last 52 Weeks) | $309.93 |

We are charting the daily historical share prices and data for Home Depot since 1981, factoring in adjustments for splits and dividends.

| Year | Average Stock Price | Year Open | Year High | Year Low | Year Close | Annual % Change |

|---|---|---|---|---|---|---|

| 2024 | 350.9592 | 345.0800 | 362.4100 | 338.2600 | 362.4100 | 4.58% |

| 2023 | 303.9838 | 307.3440 | 354.0000 | 274.6146 | 346.5500 | 12.77% |

| 2022 | 297.8093 | 387.8377 | 391.8238 | 257.8396 | 307.2954 | -21.98% |

| 2021 | 306.7226 | 245.3703 | 394.9938 | 233.2933 | 393.8834 | 59.50% |

| 2020 | 228.6734 | 199.4367 | 268.5158 | 139.1154 | 246.9508 | 24.55% |

| 2019 | 185.6796 | 152.4047 | 215.4911 | 149.0457 | 198.2746 | 30.54% |

| 2018 | 164.8899 | 162.5754 | 187.9453 | 139.7905 | 151.8832 | -7.32% |

| 2017 | 132.8044 | 113.5129 | 164.5900 | 112.8537 | 163.8724 | 44.61% |

| 2016 | 108.5003 | 108.4639 | 116.0641 | 92.5588 | 113.3185 | 3.54% |

| 2015 | 95.3339 | 83.8891 | 111.3271 | 81.8776 | 109.4404 | 28.54% |

| 2014 | 68.5521 | 65.1094 | 85.1381 | 59.5130 | 85.1381 | 30.25% |

| 2013 | 58.4770 | 49.3556 | 65.3635 | 48.8589 | 65.3635 | 35.92% |

| 2012 | 41.2227 | 32.0615 | 50.5918 | 32.0615 | 48.0883 | 50.34% |

| 2011 | 27.0639 | 26.1042 | 32.1224 | 21.3719 | 31.9854 | 23.40% |

| 2010 | 22.6976 | 20.5546 | 26.3561 | 19.6011 | 25.9193 | 24.97% |

| 2009 | 17.6133 | 16.6696 | 20.9991 | 12.4349 | 20.7410 | 30.42% |

| 2008 | 17.3646 | 17.4162 | 20.6230 | 12.6569 | 15.9028 | -11.50% |

| 2007 | 23.6995 | 26.6864 | 27.1347 | 17.3028 | 17.9698 | -31.14% |

| 2006 | 24.5906 | 26.3184 | 28.0599 | 21.3053 | 26.0951 | 1.01% |

| 2005 | 25.4582 | 27.2348 | 27.9110 | 22.2288 | 25.8334 | -4.35% |

| 2004 | 23.4015 | 21.9394 | 27.6146 | 20.6865 | 27.0074 | 21.47% |

| 2003 | 18.8444 | 15.4516 | 23.4598 | 12.4830 | 22.2338 | 49.05% |

| 2002 | 23.2757 | 31.1016 | 32.1386 | 14.6601 | 14.9175 | -52.62% |

| 2001 | 28.1347 | 28.0159 | 32.8995 | 20.2217 | 31.4843 | 12.06% |

| 2000 | 32.0730 | 39.9513 | 42.0119 | 21.4269 | 28.0959 | -33.32% |

| 1999 | 27.1158 | 23.9651 | 42.1330 | 22.0214 | 42.1330 | 68.97% |

| 1998 | 16.3159 | 11.8856 | 25.0858 | 11.4549 | 24.9350 | 108.44% |

| 1997 | 9.2045 | 6.6277 | 12.1782 | 6.4753 | 11.9629 | 76.90% |

| 1996 | 6.8723 | 6.3638 | 7.8828 | 5.5740 | 6.7626 | 5.44% |

| 1995 | 5.7576 | 6.0686 | 6.6530 | 4.9306 | 6.4135 | 4.26% |

| 1994 | 5.7118 | 5.1645 | 6.3800 | 4.8819 | 6.1515 | 16.85% |

| 1993 | 5.7913 | 6.5424 | 6.6551 | 4.7280 | 5.2644 | -21.77% |

| 1992 | 4.9434 | 4.5430 | 6.7927 | 4.0204 | 6.7298 | 50.62% |

| 1991 | 3.0047 | 1.6816 | 4.5927 | 1.5550 | 4.4680 | 162.25% |

| 1990 | 1.4410 | 1.1067 | 1.9205 | 1.0261 | 1.7037 | 58.71% |

| 1989 | 0.8490 | 0.6060 | 1.1178 | 0.5647 | 1.0735 | 74.35% |

| 1988 | 0.5006 | 0.3853 | 0.6157 | 0.3370 | 0.6157 | 69.33% |

| 1987 | 0.3873 | 0.2324 | 0.5359 | 0.2324 | 0.3636 | 57.47% |

| 1986 | 0.2214 | 0.1646 | 0.2809 | 0.1420 | 0.2309 | 43.06% |

| 1985 | 0.1883 | 0.2212 | 0.2583 | 0.1373 | 0.1614 | -29.58% |

| 1984 | 0.2361 | 0.3228 | 0.3471 | 0.1614 | 0.2292 | -32.73% |

| 1983 | 0.2924 | 0.1590 | 0.4068 | 0.1533 | 0.3407 | 114.28% |

| 1982 | 0.0723 | 0.0295 | 0.1881 | 0.0294 | 0.1590 | 438.98% |

Why is HD Stock Dropping/falling?

Home Depot stock is experiencing a decline due to a slowdown in consumer interest in home improvement. The softening customer demand has prompted Home Depot to revise its fiscal year outlook, leading to a drop in the stock’s value. This downward trend has not only impacted the home-improvement retailer’s shares but has also had a broader effect, contributing to a decline in the Dow Jones Industrial Average.

Who are the major shareholders of Home Depot stock?

The primary stakeholders comprise Vanguard Group Inc., BlackRock Inc., State Street Corp, and Capital World Investors.

What hd stock prediction 2025?

According to the latest long-term forecast, hd stock prediction 2025 will hit $ 415 by the end of 2024 and then $485 by the end of 2025. Home Depot will rise to $530 within 2026, $597 in 2027, $675 in 2029, $777 in 2030, $845 in 2033 and $1000 in 2035.

Is HD a good stock to buy?

For HD Stock Forecast based on 7 analysts’ ratings Home Depot stock has received a consensus rating of 5 buy 1 Sell and 0 hold.

Is Home Depot part of Warren Buffett’s portfolio?

Yes, Berkshire Hathaway is part of Warren Buffett’s portfolio in Home Depot Stake.

Is Home Depot in financial trouble now?

Home Depot faced a year-over-year decline of approximately 3.5% in revenue during the first half of 2023, dropping from $83 billion to $80 billion.

What is HD Stock Forecast?

According to 28 Wall Street analysts, the average 12-month price target for Home Depot is $385.92, with predictions ranging from $310.00 to $440.00. This represents a potential 6.78% increase from the current price of $361.42.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.