Why is Home Depot Stock Dropping: because of the 4% drop in price in Q4 and predicted that sales might dip in 2024, especially in the US.

Why is Home Depot Stock Dropping?

Home Depot, a home improvement retailer, experienced a decline in its stock prices after reporting lower-than-expected sales for the fourth quarter of the year. Additionally, the company provided a less positive outlook for its sales in the upcoming year due to anticipated slowing demand.

Table of Contents

The Federal Reserve’s aggressive interest rate hikes since 2022, aimed at combating inflation, have led to a rise in mortgage rates and a subsequent dampening of home sales. After reaching a peak of 7.08% in November 2022, rates have gradually declined in 2023.

As of the week ending March 30, the 30-year fixed-rate mortgage averaged 6.32%, a slight decrease from the previous week’s 6.42%. However, it remains higher than the 4.67% recorded a year ago, indicating the lingering impact of the Federal Reserve’s actions on mortgage rates.

About Home Depot Stock (HD) Company Overview

Home Depot, Inc., commonly known as Home Depot, is a leading American multinational in home improvement retail. It specializes in selling tools, construction products, appliances, and services, including fuel and transportation rentals. As the largest home improvement retailer in the United States, Home Depot serves as a one-stop shop for a wide range of home-related needs.

Home Depot operates more than 2,322 stores across the United States, including Puerto Rico, the U.S. Virgin Islands, and Guam. Additionally, it has a presence in Canada and Mexico. The company caters to two main customer groups:

- Do-it-yourself (DIY) Customers: These homeowners purchase products for their projects and installations. They enjoy taking on tasks and completing home improvement projects independently.

- Professional Customers (Pros): This group comprises professional renovators, remodelers, general contractors, maintenance professionals, handymen, property managers, and specialized tradespeople like electricians, plumbers, and painters. Pros rely on Home Depot for their professional needs in the construction and renovation industry.

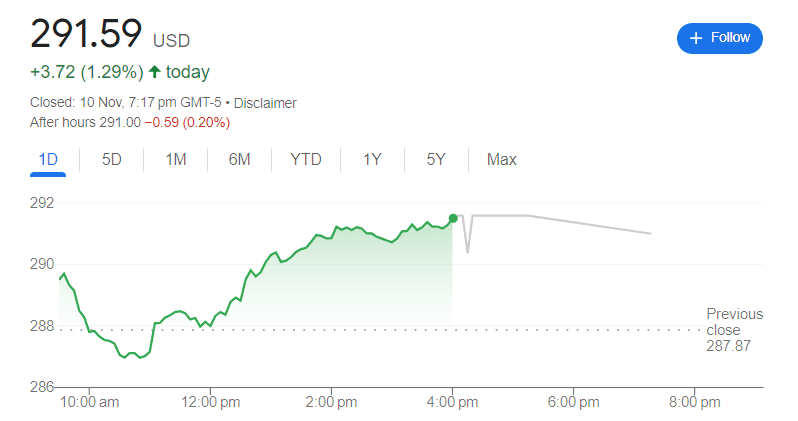

Home Depot Stock Price Today

| Open | $289.23 |

| Day High | $291.59 |

| Day Low | $286.79 |

| Prev Close | $291.59 |

| 52 Week High | $347.25 |

| 52 Week High Date | 12/13/22 |

| 52 Week Low | $274.26 |

| 52 Week Low Date | 10/27/23 |

| Market Cap | $291.609B |

| Shares Out | 1.00B |

| 10 Day Avg Volume | 3.05M |

| Dividend | $8.36 |

| Dividend Yield | 2.87% |

| Beta | 0.93 |

| YTD % Change | -7.68 |

| RATIOS/PROFITABILITY | |

| EPS (TTM) | $16.02 |

| P/E (TTM) | 18.20 |

| Fwd P/E (NTM) | 19.16 |

| EBITDA (TTM) | $26.13B |

| ROE (TTM) | 2,065.27% |

| Revenue (TTM) | $154.876B |

| Gross Margin (TTM) | 33.49% |

| Net Margin (TTM) | 10.48% |

| Debt To Equity (MRQ) | 3,154.01% |

Why is Home Depot Stock Dropping Today

Why is Home Depot Stock Dropping: Home Depot’s shares initially dropped 4% to 10% following the fiscal 2023 first-quarter earnings report but recovered to a 1.4% decline by midday. While beating earnings per share expectations through a share repurchase plan, a substantial revenue miss and reduced guidance caught investors’ attention.

The revenue of $37.26 billion fell short of the expected $38.3 billion, marking the largest miss since 2002. CEO Ted Decker attributed the lower sales to lumber deflation and adverse weather, especially impacting the Western division.

The full-year sales guidance was adjusted to a decline of 2% to 5%, and the previous mid-single-digit drop in earnings per share is now projected between 7% and 13%. Investors, focusing on the long term, pushed the stock off its morning lows.

Strained Consumer: Home Depot is experiencing a drop in stock due to a consumer base facing financial difficulties. When consumers are strained, they tend to cut back on discretionary spending, impacting the sales of non-essential items like home improvement products.

Lower Traffic: The decline in fiscal second-quarter same-store sales by 2% is a direct result of reduced foot traffic in Home Depot stores. Fewer people visiting the stores means fewer sales, contributing to the overall drop in stock.

Macroeconomic Factors: Home Depot attributes part of its stock decline to broader economic factors, specifically high inflation. Inflation can lead to increased costs for the company, impacting its profit margins and, consequently, its stock performance.

Future Expectations: The management’s anticipation of a 2% to 5% drop in comparable store sales (comps) for the year signals a cautious outlook. This expectation could be influenced by a combination of current economic conditions, consumer behavior, and the company’s internal assessments.

Home Depot’s fourth-quarter Performance

Revenue Growth

The fourth-quarter revenue grew by a modest 0.4% year-over-year (y-o-y), reaching approximately $35.8 billion. However, this fell short of the consensus analyst estimate by $170 million.

Earnings Per Share (EPS)

Despite the revenue challenges, the earnings per share increased by 3% y-o-y to $3.30, surpassing the average analyst forecast of $3.21. This suggests that while revenue growth was sluggish, the company improved its profitability.

Comparable-Store Sales

The comparable-store sales saw a decline of 0.3%, indicating a slowdown from the prior quarter’s 4% boost. This dip is attributed to declining home prices and a slowdown in home sales, highlighting the impact of the real estate market on Home Depot’s performance.

How to Buy Home Depot Stock

To buy Home Depot stock online, follow these steps:

- Choose an Online Broker: Opt for a broker capable of trading on the New York Stock Exchange. Suggested brokers include Interactive Brokers, eToro, and Fidelity.

- Open a Brokerage Account: Like opening a bank account, this step is typically done online through your chosen broker.

- Deposit Funds: Put money into your brokerage account using methods like bank transfer, personal check, debit card, or digital wallets like PayPal.

- Purchase Home Depot Shares: Log in to your online broker, search for Home Depot stock, specify the number of shares you want, and click buy.

What is the minimum amount I need to invest in Home Depot (HD) stock?

To invest in Home Depot stock, you’ll need at least the price of one share, which is currently $291.59. Keep in mind that stock prices change in real-time during market hours. Additionally, certain brokers might have a minimum deposit requirement to open a trading account. Verify these details with your broker for accurate information.

What is the dividend history of Home Depot?

Home Depot (HD Stock) has a strong dividend history, paying dividends for the last 29 years. The recent dividend payouts are as follows:

- 08/17/23: $2.09

- 05/18/23: $2.09

- 02/21/23: $2.09

- 11/17/22: $1.90

- 08/18/22: $1.90

- 05/19/22: $1.90

- 02/22/22: $1.90

- 11/18/21: $1.65

These dividends are distributed quarterly and in cash. Additionally, the annualized dividend per share has experienced a growth of 11% in the last twelve months, showcasing a positive trend in Home Depot’s dividend payouts.

Latest Home Depot (HD) Company News

The Home Depot is set to host its Third Quarter Earnings Conference Call on November 14, offering stakeholders an opportunity to gain insights into the company’s financial performance and strategic updates. READ MORE

The latest investment advice suggests considering Walmart as a stock to buy and Home Depot as a stock to sell this week, as reported by Investing.com.

Billionaire Bernard Marcus, co-founder of Home Depot, has endorsed Donald Trump. Marcus, a prominent figure in the business world, has publicly expressed his support for Trump in a notable endorsement. Read More

What is the dividend yield of Home Depot stock?

The dividend yield of Home Depot Inc. stock is 2.9041%

How often does Home Depot pay dividends?

Home Depot pays dividends four times a year. The payment months are March, June, September, and December.

why is Home Depot stock dropping?

According to Motley Fool Sales at Home Depot were disappointing in the recent quarter, mainly due to lumber deflation and adverse weather conditions.

Will Home Depot (HD) Stock reach $700 again?

Predicting the future price of Home Depot (HD) stock, especially reaching $700, is challenging. The current HD Stock forecast for 2023 suggests an average 12-month price of around $341.16, with a high estimate of $384.00123. Achieving $700 per share soon seems unlikely based on these predictions.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.