Discover the latest Campbell Soup Company share price target, CPB Stock Forecast 2025, 2030, 2035, 2040, 2050, 2060, news, quotes, history, and CPB price prediction.

Table of Contents

KEY TAKEAWAYS

Campbell Soup Company (NYSE: CPB) is currently trading at 43.49 USD, up 0.70 USD (1.64%) price today. Analysts recommend holding the stock with an average target price of $46.45, based on 21 ratings. The company is considered CPB a “Strong Value Company,” with share prices expected to grow by approximately 6.28% and a consensus rating of “Hold” based on three-month calculations.

Some analysts believe the intrinsic value of the CPB Stock Forecast in 2024 could fall by -1.00% and reach an average price target of $43.60 per share rising from $42.00 to $43.80 by 22 June 2024. However, most expert forecasts an exceptionally strong and bullish EPS outlook for Campbell Soup Company (CPB), anticipating an average EPS forecast of $3.35 for fiscal year 2025.

Swift Overview of CAMPBELL SOUP CO (CPB) Company

Campbell Soup Company (NYSE: CPB)and its subsidiaries produce and sell a wide array of food and drinks across the USA and around the globe. Split into Meals & Beverages and Snacks, Campbell’s Meals & Beverages side serves up soups like Campbell’s and Swanson, sauces like Prego, and beverages like V8. Meanwhile, the Snacks team delivers favorites like Pepperidge Farm cookies, Goldfish crackers, and Snyder’s of Hanover pretzels.

Company Profile

| Company Name | Campbell Soup Company |

|---|---|

| Founded | 1869, Camden, NJ |

| CEO | Mark Clouse |

| Trade (TICKER) | NYSE (CPB) |

| Founder | Joseph A. Campbell |

| Headquarters | Camden, NJ |

| Number of employees | 14,500 (2023) |

| Revenue History (2020-2023) | 8.691B in 2020), (), ($8.562B in 2022), ($9.357B in 2023), |

| Website | www.campbellsoupcompany.com |

CAMPBELL SOUP CO CPB Fundamental Analysis

| Previous Close | $42.79 |

| Open | $42.77 |

| Day’s Range | $42.51 – $43.53 |

| 52 Week Range | $37.94 – $46.97 |

| Volume | 2,572,612 |

| Avg. Volume | 2,562,938 |

| 1y Target Est | $46.82 |

| Market Cap (intraday) | $12.984B |

| Beta (5Y Monthly) | 0.19 |

| PE Ratio (TTM) | 17.61 |

| EPS (TTM) | 2.47 |

| Earnings Date | Aug 29, 2024 – Sep 2, 2024 |

| Forward Dividend & Yield | 1.48 (3.40%) |

| Ex-Dividend Date | Jul 3, 2024 |

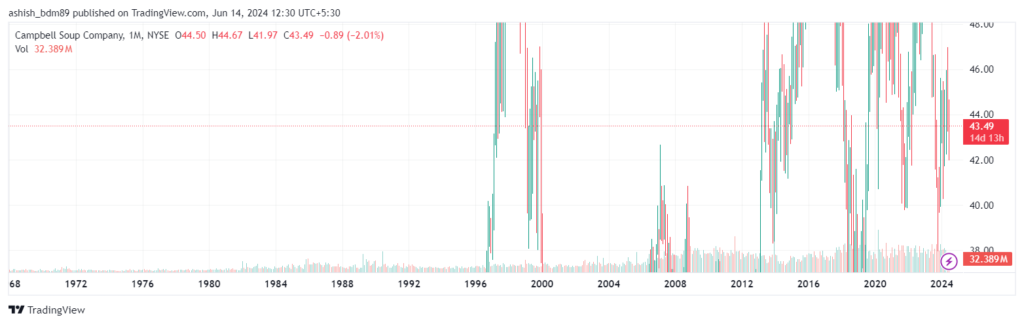

Campbell Soup Company (CPB) Stock Price History Chart

Long-Term Expert Insights for CPB Stock Forecast for 2024, 2025, 2030, 2035, 2040, 2045, 2050, 2060

According to our current CPB stock forecast, the value of Campbell Soup shares in 2024 will reach $46.50, CPB price will hit $52 by the end of 2025, and then $79.85 by the end of 2030, $99.10 by 2035, $115 in 2040, $150 in 2045, $200 in 2050, $500 in 2060. Below is the updated table with the growth rate calculated for each year from 2024 to 2060.

| Year | CPB Stock Price | Change (%) |

|---|---|---|

| 2024 | $43.49 | 7.10% |

| 2025 | $52 | 19.45% |

| 2030 | $79.85 | 53.17% |

| 2035 | $99.10 | 24.10% |

| 2040 | $115 | 16.16% |

| 2045 | $150 | 30.43% |

| 2050 | $200 | 33.33% |

| 2060 | $500 | 150.00% |

CPB Stock Forecast 2024

coincodex

According to CoinCodex experts, the estimated CPB stock forecast price of Campbell Soup shares will drop by -1.12% and reach $ 42.38 per share by June 13, 2024.

CPB Stock Forecast 2025

The average Campbell Soup stock forecast CPB’s earnings for 2025 a whopping growth of 12.66% and reach an average price target of $52 per share from the last price of $43.15.

Wall Street

Wall Street analysts, on average, predict Campbell Soup Co’s share price could reach $45.91 by June 10, 2025. The average stock price prediction for Campbell Soup Co forecasts a potential upside of 6.52% from its current CPB share price of $43.10.

Trading View

On the other hand analysts on TradingView, the price target for CPB (Campbell Soup Co.) is $46.41. The maximum estimate for the stock price is $51.00, while the minimum estimate is $42.00. These estimates reflect varying expectations among analysts regarding the future performance and valuation of Campbell Soup Co.’s stock.

CPB Stock Forecast 2030

In 2030, Campbell Soup stock will reach an average price of $79.85 per share. CPB stock will grow 53.17% from its current price if Campbell Soup stock keeps growing at its current annual growth rate over the past 10 years.

CPB Stock Forecast 2035

Campbell Soup Company’s stock price target is expected to reach an average price of $90.12 per share in 2035. CPB stock will range between a high prediction of $ 90.10 and a low estimate of $55.53. Campbell Soup Co. might be a good choice for investors because it has earned a lot of money because of its strong earnings and fundamental analytics.

MarketWatch

According to analyst estimates on MarketWatch, Campbell Soup Company (CPB) in 2035 forecast a median price of $47.00, with a high of $51.00 and a low of $42.00. The average price target is $46.51, which is a 4.89% growth from the current price.

CPB Stock Forecast 2040

In 2040, Campbell Soup has a 16.16% upside potential based on our forecast indicates that CPB Stock could reach an average price target of $115 per share, with a max price of around $135.85. This implies CBP trading ranges from $115 to $135.85 in 2040.

CPB Stock Forecast 2050

Campbell Soup Company (CPB) stock is expected to surge by 2050, reaching an average price target of $183.10, a +181.10% change from its current value. The CPB stock forecasts a low price of $112 and a high price of $200.

CPB Stock Forecast 2060

Based on our latest Campbell Soup Company stock prediction for 2060, We believe CPB stock will be priced at an average price target of $11.50 from its current value.

Is CPB a good stock to buy

Campbell Soup Company (CPB) stock is categorized among the strongest value stocks because of its impressive earnings and valuation fundamentals by Zacks and VGM Style Scores. CPB has an average earnings per share surprise of 3.9% as mentioned by Yahoo Finance.

Conclusion: IS Campbell Soup (CPB) a good long-term investment?

Campbell Soup Company (CPB) presents a solid investment opportunity, particularly for those looking for value stocks with stable long-term growth potential. CPB is a #3 (Hold) on the Zacks Rank, with a VGM Score of B. Despite a mixed short-term outlook with minor fluctuations, the long-term forecasts are optimistic, suggesting substantial growth over the next few decades.

Campbell Soup Co. has a consensus rating of Hold which is based on 5 buy ratings, 14 hold ratings, and 6 sell ratings. With its strong earnings, consistent performance, and robust fundamental analytics, CPB is well-positioned for sustained value appreciation, making it a good hold for investors aiming for steady returns.

Why is Campbell’s Soup rising?

Yes, Campbell Soup Company is highly profitable. In the fiscal second quarter, the company reported a net income of $203 million, with quarterly revenue of $2.46 billion.

What is the CPB stock forecast?

Based on the insights from 15 Wall Street analysts over the last 3 months, the average 12-month price target for Campbell Soup is $46.07. The high forecast is $49.00, and the low forecast is $42.00. This average price target indicates a potential 7.49% increase from the last recorded price of $42.86.

Is Campbell Soup Company a Hold?

Campbell Soup Co. has a consensus rating of Hold which is based on 5 buy ratings, 14 hold ratings, and 6 sell ratings.

What is Campbell Soup Company ( CPB ) Dividend Date & History?

Yes, Campbell Soup Company (CPB) pays dividends quarterly. The company pays a dividend of $0.37 per share, resulting in an annual dividend yield of 3.45%. The upcoming ex-dividend date for CPB is July 3, 2024.