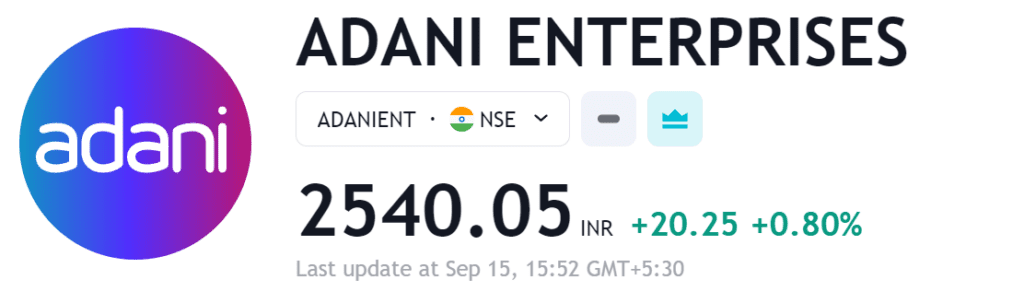

Explore Adani Enterprises’ share price targets for potential investment decisions. Gain insights into projected price movements and expert forecasts for Adani Enterprises stock in 2023, 2025, and 2030.

After the Hindenburg Research report, the Adani stock plummeted by nearly 75%. With SEBI’s recent clearance of the group, Adani stocks are finally showing signs of an upward movement. Shares of Adani Enterprises gained over 55% in the past week.

- The Adani Enterprise’s share price target in 2023 has an average target price is around INR 2600.85, the minimum price is around INR 2157.50, and the maximum price may hit INR 2900.85.

- In 2025, the first target for Adani Enterprises is projected to be at 2600. The second target could potentially reach its all-time high level of 3000.

| Open | 2,519.80 |

| Day High | 2,558.00 |

| Day Low | 2,514.20 |

| Prev Close | 2,519.80 |

| 52 Week High | 4,190.00 |

| 52 Week Low | 1,017.45 |

| Market Cap | 34,607.66M |

| Shares Out | 1,140M |

| 10 Day Avg. Volume | 4.92M |

| Dividend (Yield) | 1.20 (0.05%) |

| YTD % Change | -34.02 |

Adani Enterprises Ltd Share (ADANIENT) Price Target 2023

| Year | Adani Enterprises share price Forecast |

|---|---|

| 2023 | INR 2157.50 – INR 2900.85 |

Adani Enterprises (NSE: ADANIENT) is a major player in industries like renewable energy, infrastructure, logistics, and mining. Their diverse portfolio and strategic investments make them a significant force in these sectors. Actively seeking growth opportunities, Adani Enterprises shows a strong dedication to innovation and contributing to India’s economic progress.

The Adani Enterprises share price Target for 2023 is estimated to rise to an average target price of approximately INR 2600.85. The projected range includes a minimum price of around INR 2157.50 and a potential maximum of INR 2900.85.

Adani Enterprises Ltd Share (ADANIENT) Price Target 2024

| Year | Adani Enterprises share price Forecast |

|---|---|

| 2024 | INR 2200 – INR 2700 |

Adani Enterprises boasts a robust financial position, providing a solid foundation for future growth. The steady increase in share capital indicates a strong equity base. Moreover, the significant growth in reserves & surplus signifies enhanced profitability and the capacity to retain earnings. With a consistently expanding net worth, Adani Enterprises showcases notable financial strength and stability.

In the first quarter of 2024, Adani Enterprises’ share price target is anticipated to range from an average price target of INR 2500 to a maximum price of INR 2700. The minimum price target may fall to 2200 from the last closing price of 2540.85 in 2023.

Adani Enterprises share price target 2025

| Year | Adani Enterprises share price Forecast |

|---|---|

| 2024 | INR 2350 – INR 3000 |

Adani Enterprises exhibits strong financial performance, evident in its consistent revenue growth and increased returns to shareholders. The company has demonstrated steady growth in sales turnover, indicating its ability to generate higher revenue from business operations. This is a positive indicator of their financial health.

Furthermore, Adani Enterprises has succeeded in augmenting its net profit over time, showcasing improved profitability after factoring in expenses. This bodes well for investors, as it suggests the potential for higher returns on their investments. Overall, the company’s financial outlook appears favorable.

In 2025, the expected targets for Adani Enterprises are 2600 for the first and a potential reach to its all-time high level of 3000 for the second target.

Adani Enterprises Ltd Financial Performance

| PREV. CLOSE | OPEN | HIGH | LOW | CLOSE* | VWAP |

|---|---|---|---|---|---|

| 2,519.80 | 2,519.80 | 2,558.00 | 2,514.20 | 2,540.05 | 2,539.19 |

About Adani Enterprises Limited

Adani Enterprises Limited, a global integrated infrastructure company based in India, encompasses a diverse range of businesses. These include integrated resource management, mining services, commercial mining, new energy ecosystem, data centers, airports, roads, copper, digital services, Fast-Moving Consumer Goods (FMCG), and more. The company’s operations are categorized into segments like integrated resource management, mining services, commercial mining, new energy ecosystem, airports, roads, and others.

In the domain of integrated resource management, Adani Enterprises offers comprehensive procurement and logistics services. Within the mining sector, the company holds contracts for mining services across nine coal blocks, with a capacity exceeding 100 million metric tons annually. Additionally, the Airport segment covers activities related to airport construction, operations, and maintenance. The New Energy Ecosystem focuses on cell and module manufacturing, while the Road segment handles the construction, operations, and maintenance of road assets.

Let us gain about Indian Stocks to invest: IRCTC Share Price Target and Tour Packages List 2023 | JIO Financial Services Share Price Target 2023, 2025, 2030

Adani Enterprises Limited (ADANIENT)SEBI Latest News NSE/BSE

The Congress party is urging SEBI (Securities and Exchange Board of India) to take action against Adani Group companies and has called for an investigation by a Joint Parliamentary Committee (JPC). READ MORE

The next hearing in the Adani-Hindenburg case is scheduled for October 13th, as reported.

The next hearing for the Adani-Hindenburg case is slated for October 13th, as reported by Business Today. The Supreme Court will be reviewing a recent status report submitted by market regulator Sebi. The petitioner has alleged that Sebi withheld crucial information from the court and neglected alerts from the DRI.

Gautam Adani has reportedly acquired 2.4 crore shares of Adani Energy from the open market.

Promoters of Adani Energy Solutions, including billionaire Gautam Adani, have increased their stake in the company from 70.41% to 72.56% over the past month, according to a recent regulatory filing. The filing suggests that Adani and other promoters may have acquired nearly 2.4 crore shares between August 16 and September 14, as reported by the Economic Times. Data on the BSE site indicated that promoter holding at the end of the quarter ending in June was at 68.28%.

Conclusion

Adani Enterprises operates in the coal mining and electricity industry, which contributes to a promising business model. In the future, the company has the potential to provide substantial returns on investment. If you are considering investing in this stock, allocating some funds could potentially yield favorable returns in the foreseeable future. Investing in stocks carries inherent risks, and it’s crucial to make informed choices based on your financial goals and circumstances.

FAQ

What is adani enterprises share price target 2027?

The stock price target for Adani Enterprises Limited ADANIENT in 2027 is 2427.13 on the downside and 2770.93 on the upside.

What is the future price Target of Adani Enterprises?

According to current Adani Enterprises Ltd Future share price live INR 2,537.00 as per NSE: ADANIENT.

What is the Market Cap of Adani Enterprises?

Adani Enterprises share/Stock price Live NSE/BSE is ₹2,537.90 as of 16 Sep ’23 with the latest market cap of 2.89LCr.

Who is the CEO of Adani Enterprises Ltd?

Gautam Adani is the Executive Chairman of the Board Adani of Enterprises

What is Ex Dividend Date for Adani Enterprises?

Ex Div Date for Adani Enterprises Ltd. was in July 07/07/2023.

What is Adani Enterprises Stock Price in 2023?

The latest Adani Enterprises Share Price target for 2023 is expectedd to reach an average price Rs 2650.85 with a price range of 2100 to 2900.85 in 2023 from its current price 2,540.05

What is Gautam Adani Known for?

Gautam Adani is an Indian billionaire who famous for establishment and expansion of the Adani Group, which is a multinational industrial conglomerate.

Are Adani enterprises Shares overvalued?

There are reports suggesting that Adani Group stocks may have been artificially overvalues by approximately 88% through various manipulative practices.

Is Adani enterprises share good to buy Now?

The Adani enterprises share good to-buy as long as the outlook is optimistic as long as it stays above Rs 2,200. There’s a potential for an upward movement towards Rs 2,800.

मैं आज क्या अदानी पावर का शेयर खरीद सकता हूं?

हाँ, आप एक ब्रोकरेज फर्म के माध्यम से अडानी पावर लिमिटेड के शेयर खरीद सकते हैं। इसके लिए आपको एक वित्तीय ब्रोकर की सेवाओं का उपयोग करना होगा जो शेयर खरीदने और बेचने की प्रक्रिया को संचालित करता है।

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.