Currently, the Ethereum price is $1,784.12, down 0.49% over the past 24 hours. The recent price action left Ethereum’s market capitalization at $216,600,252,241.38. Ethereum is the community-run technology powering the cryptocurrency ether (ETH) and thousands of decentralized applications.

Ethereum has shown 52.12% growth over the past year. CoinDesks Digital Asset Classification Standard (DACS) classifies Ethereum as a Smart Contract Platform.

What is the difference between Ethereum and Bitcoin?

Launched in 2015, Ethereum builds on Bitcoin’s innovation, introducing a new way for people to use digital money without payment providers or banks. It is also programmable

allowing users to deploy decentralized applications on its network, creating a highly versatile blockchain that can be used for a wide range of purposes.

This flexibility brings with it great potential for innovative ideas to take flight on the Ethereum network. In contrast to Bitcoin’s limited usage as just a payment network, Ethereum could be better thought of as an open marketplace offering financial services, games, social networks, and other apps that protect your privacy and won’t censor you.

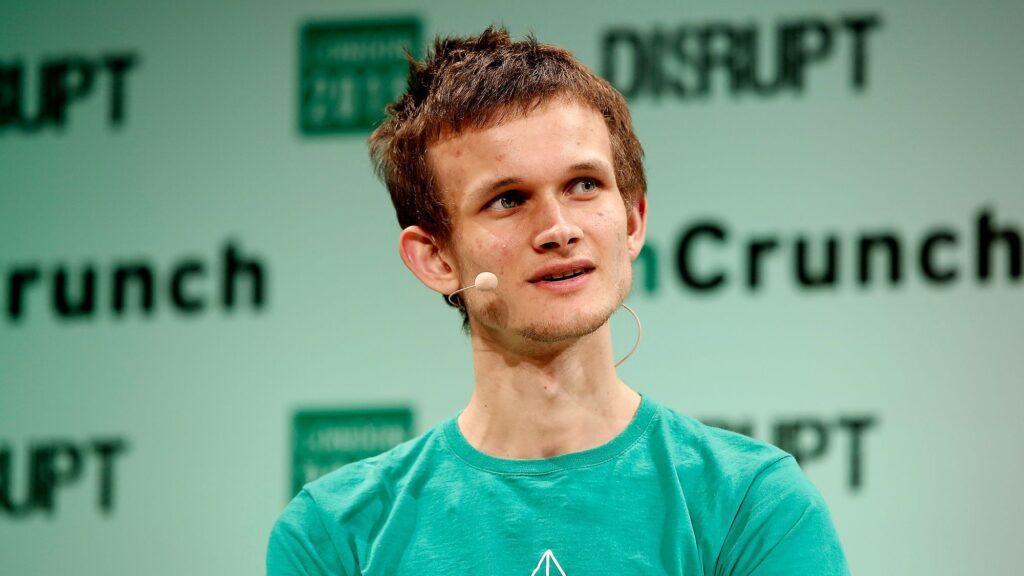

Ethereum (ETH)cofounder & History

Ethereum, proposed by computer programmer Vitalik Buterin in 2013, is a blockchain-based software platform enabling users to send and receive value globally using its native cryptocurrency, ether. In addition, Ethereum provides developers with the capacity to build specialized applications known as “decentralized applications” or “dapps” that are self-sustaining due to smart contracts.

A smart contract is a code-based program that is stored on the Ethereum blockchain and executes certain functions automatically when certain conditions are met.

The purpose can be anything from sending a transaction upon the occurrence of a certain event to granting a loan once collateral is deposited. Ethereum smart contracts form the basis for all dapps as well as all dapps created on other blockchains.

Ethereum price

It was in August 2014 that Ethereum launched its native token, ether. Over $16 million was raised for the project from the sale of 50 million ETHs for $0.31 each. There is no limit to the number of ether that can enter circulation because Ethereum’s cryptocurrency has an unbounded supply, unlike many other cryptocurrencies.

As stated on the project’s website, ether has had an inflation rate of about 4.5%. It was initially mined with the “genesis block,” yet since then the rewards for new blocks have been reduced twice,

in contrast to Bitcoin’s halving events that are preprogrammed. Rather, Ethereum Improvement Proposals (EIPs) are made by members of the community and voted on by the rest of it. The following is an overview of Ether’s issuance schedule.

Block 0 to Block 4,369,999: 5 ether

Block 4,370,000 to 7,280,000: 3 ether (changed via EIP-649)

The Merge (Formerly Ethereum 2.0)

Last year marked a significant milestone for the Ethereum blockchain, the backbone of the cryptocurrency industry, with the successful implementation of “The Merge,” a long-awaited and frequently delayed technical upgrade.

This event, previously known as Ethereum 2.0, was highly anticipated within the crypto community. The major shift from the energy-intensive proof-of-work consensus mechanism to the more eco-friendly proof-of-stake model was a change that generated widespread excitement. This transition aimed to address a key concern of the public regarding the sustainability of cryptocurrencies.

Additionally, ETH 2.0 was designed to tackle the scalability challenges that have been impacting the Ethereum network. Presently, Ethereum employs an algorithm that randomly selects a block creator. This selection is made from participants who have staked their Ether (the native coin of the Ethereum blockchain) in exchange for the opportunity to validate transactions and receive compensation.

The likelihood of being chosen to create a new block increases with the amount of Ether staked. The fundamental purpose of a consensus-based blockchain is to eliminate the need for centralized intermediaries to verify transactions.

In the absence of true decentralization, one must question whether Ethereum’s other challenges are justified. Notably, the Ethereum blockchain is known for experiencing congestion during peak hours, leading to delayed transaction processing and fluctuating transaction costs, often referred to as “gas fees.” The implementation of The Merge has not altered how gas prices are calculated or enforced, and during peak periods,

they can be prohibitive for users attempting smaller transactions (in May 2022, average daily gas fees soared to nearly $200). Another noteworthy development in Ethereum’s evolution is its first hard fork – Shanghai.

What’s unique about ETH?

Ethereum (ETH) plays a pivotal role as the primary currency within the Ethereum network. Whether you’re engaging in transactions or utilizing Ethereum-based applications, you’ll encounter ETH as the mode of exchange.

This inherent value exchange serves as an incentive for block producers, motivating them to process and validate the actions undertaken on the network.

Ethereum Price Prediction 2025

The year 2025 looks like a very promising year for Ethereum as many experts predict the prices to reach a median of $6000 to $10,000 but the prices also remain speculative and it will be quite interesting to see how the crypto market performs in the coming years. but if we are optimistic anything is possible in the cryptocurrency market.

but as said we suggest all our readers do thorough research before investing.

| month | minimum price | average price | maximum price |

|---|---|---|---|

| February 2025 | $6688.24 | $6900.00 | $7884.32 |

| March 2025 | $6915.50 | $7174.36 | $8189.59 |

| April 2025 | $7140.25 | $7373.78 | $8536.69 |

| May 2025 | $7360.65 | $7603.56 | $8285.87 |

| June 2025 | $7592.89 | $7836.89 | $9138.36 |

| July 2025 | $7820.63 | $8045.69 | $9451.57 |

| August 2025 | $8040.54 | $8296.96 | $9765.62 |

| September 2025 | $8295.23 | $8522.78 | $10076.65 |

| October 2025 | $8446.56 | $8720.56 | $10390.65 |

| November 2025 | $8750.69 | $8980.65 | $10704.65 |

| December 2025 | $8956.59 | $9211.78 | $11017.65 |

| december 2025 | $9172.90 | $9440.69 | $11330.65 |

ETH fuels and secures Ethereum

There are many cryptocurrencies and lots of other tokens on Ethereum, but there are some things that only ETH can do.

The Role of Validators: Guardians of Trust

Validators serve as the verifiers and guardians of the Ethereum network, ensuring the integrity of every transaction. Through a randomized selection process, validators are chosen to propose blocks of transactions. In recognition of their crucial role, validators are rewarded with small increments of newly minted ETH.

Upholding Security and Decentralization

The contributions of validators, alongside the capital they commit, serve as the bedrock of Ethereum’s security and resilience against centralized control. ETH, in essence, fuels the entire Ethereum ecosystem, enabling it to function as a decentralized and trustless platform.

Staking ETH: Enhancing Security and Earning Rewards

When you stake your ETH, you actively participate in fortifying the security of the Ethereum network. In this system, the potential risk of losing staked ETH acts as a powerful deterrent against malicious actors. By staking your assets, you not only contribute to the network’s integrity but also stand to reap rewards for your active involvement.

Conclusion: Harnessing the Power of ETH for a Secure Ethereum Ecosystem

ETH, as the lifeblood of Ethereum, underpins its functionality and security. Engaging with ETH, whether through transactions or staking, is a crucial step in not only ensuring the network’s robustness but also in unlocking the potential for earning rewards.

It’s imperative to approach ETH transactions and staking with a mindful understanding of the risks involved, as well as the significant role it plays in the Ethereum ecosystem.

FAQ

What is ETH used for?

“Ethereum offers a dynamic platform empowering users to create diverse and secure digital solutions. Its native token, while primarily serving as a blockchain maintenance incentive, also doubles as a potential form of payment for tangible goods and services, contingent on merchant acceptance. This dual-purpose nature underscores Ethereum’s versatility in the digital realm.”

What does ETH mean in money?

Ether functions as a cryptocurrency within the Ethereum network. Meanwhile, “gas” is a concept utilized by Ethereum developers and the community to quantify the computational power, denominated in ether, required for tasks like transaction validation and securing the blockchain. This means that, in practice, they are interconnected: transactions involve gas fees, paid in the form of ether (ETH).

Is ETH a good investment?

Ethereum’s long-term performance is relatively untested when compared to established assets like gold, stocks, or bonds. Long-term investors should avoid assuming that Ethereum’s impressive historical performance will necessarily translate into future returns. It’s crucial to be cautious and never invest funds in Ethereum that you’re not prepared to potentially lose in a worst-case scenario.

What kind of currency is ETH?

ETH is a cryptocurrency. It is scarce digital money that you can use on the internet – similar to Bitcoin. If you’re new to crypto, here’s how ETH is different from traditional money.

What is the ETH anticipated performance for 2023?

According to analysts, there is a prevailing belief that Ethereum will make a resurgence, surpassing the $2,000 milestone by the conclusion of 2023.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.