XPeng stock price prediction reveals that the share price has been slipping in the last three trading sessions. To reverse the market trend, XPENG stock price must accumulate buyers at $9.45. In the past 24 hours, XPeng Inc stock has lost 3.57% of its market capitalization. Trading volume is below average, which indicates lower stock accumulation rates.

Xpeng stock price preparing to reverse the current declining rate of the XPENG share over the daily time frame chart. To turn this trend around and get back on track, XPEV stock must lure more investors to gain traction. Since June 2022, it has been a downward spiral for XPeng’s share price which is now trying to break the current downtrend over the daily time frame chart. Though there has recently been a surge in XPeng Inc’s stock, it needs sufficient trading volume to sustain its value on the daily chart. (XPEV: NYSE)

Shares of XPeng (NYSE: XPEV) have been lagging since June, with the stock dropping nearly 70%. The OEM is struggling financially, with decreases in revenue and narrow margins being compounded by geopolitical tensions. Deliveries have also taken a hit due to a resurgence of Covid-19 in main cities, power shortages, and a weakening economy in China. While the near future may look grim, the situation does appear attractive from a speculative standpoint; after eight weeks of losses, shares are sitting at all-time lows in deeply oversold territory.

- About XPeng (NYSE: XPEV) Stock

- xpeng stock hong kong

- XPeng Inc. (9868. HK)

- XPeng Inc (XPEV) Price Target

- XPEV Analyst Ratings

- NYSE: XPEV

- xpeng stock news

- XPENG VS NIO Cars

- xpeng projected growth

- Bid Price and Ask Price

- Xpeng Products

- xpeng stock price prediction 2025

- xpeng stock price prediction 2030

- Conclusion

- FAQ – XPeng Inc stock price

About XPeng (NYSE: XPEV) Stock

XPeng was co-founded in 2014 by Xia Heng and He Tao, two former executives of GAC Group with extensive experience in auto technology and R&D. Leading investors included the founder of UCWeb and ex-Alibaba executive He Xiaopeng – now XPeng’s Chairman – as well as Lei Jun from Xiaomi. Other prominent Chinese and international investors such as Alibaba, Foxconn, and IDG Capital furthered the funding round in 2018, resulting in Joseph Tsai – Alibaba’s VP – joining the corporate board.

XPeng Inc. creates and sells smart electric cars in China, offering SUVs labeled the G3 and G3i, four-door sports sedans referred to as P7s, and family sedans referred to as P5s. In addition, they provide a range of services such as sales contracts and maintenance, supercharging, vehicle leasing and insurance agency, ride-hailing, technical support and auto financing, music subscription, and more. Founded in 2015, the company is based in Guangzhou.

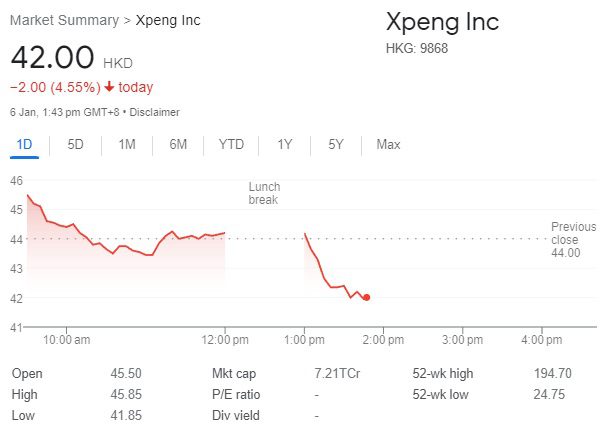

xpeng stock hong kong

Market Summary> Xpeng Inc

42.00 HKD

XPeng Inc. (9868. HK)

41.050-2.950 (-6.70%)

As of 01:55 PM HKT. Market open.

| Previous Close | 44.000 |

| Open | 45.500 |

| Bid | 41.000 x N/A |

| Ask | 41.050 x N/A |

| Day’s Range | 40.900 – 45.850 |

| 52 Week Range | 24.750 – 194.700 |

| Volume | 24,821,087 |

| Avg. Volume | 24,389,945 |

| Market Cap | 70.42B |

| Beta (5Y Monthly) | 2.90 |

| PE Ratio (TTM) | N/A |

| EPS (TTM) | N/A |

| Earnings Date | N/A |

| Forward Dividend & Yield | N/A (N/A) |

| Ex-Dividend Date | N/A |

| 1y Target Est | 64.72 |

XPeng Inc (XPEV) Price Target

| Avg. Price Target | Inflated Price Target | Deflated Price Target | Topside Avg Price Target |

|---|---|---|---|

| $15.96 | $36.40 | $4.25 | 37.85% |

XPEV Analyst Ratings

Based on the smart analysis for the answer to is xpeng stock a good buy by the top 10 analysts the average price target is around $15.96. The deflated Price target is $4.25 to a high of $36.40. The average price target for the Xpeng increase of 37.85% from the last closing price of $11.60

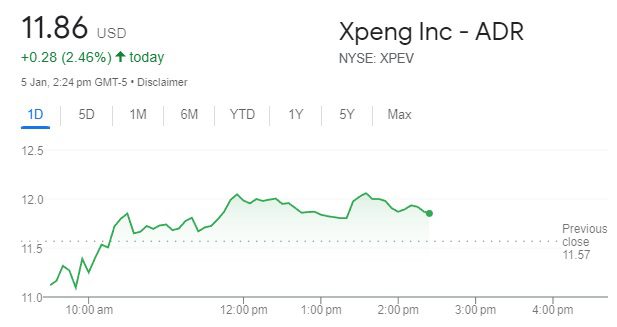

NYSE: XPEV

XPeng Inc. American depositary shares, each representing two Class A ordinary shares (XPEV): xpeng stock price today

KEY DATA – Xpeng stock forecast

| Exchange | NYSE |

| Sector | Consumer Discretionary |

| Industry | Auto Manufacturing |

| 1 Year Target | $12.00 |

| Today’s High/Low | $12.09/$11.06 |

| Share Volume | 17,270,218 |

| Average Volume | N/A |

| Previous Close | $11.56 |

| 52 Week High/Low | $49.72/$6.18 |

| Market Cap | 10,171,229,822 |

| Forward P/E 1 Yr. | -8.63 |

| Earnings Per Share(EPS) | $-1.42 |

| Annualized Dividend | N/A |

| Ex-Dividend Date | N/A |

| Dividend Pay Date | N/A |

| Current Yield | N/A |

xpeng stock news

XPeng & NIO See Similar Sales Growth In 2022, Flip-Flopped Q4 Trends: From 2021-2022, XPeng and NIO had similar year-over-year growth rates. Their charts look almost identical. However, NIO’s total went from a lower total in 2021 to a higher total in 2022 than XPeng’s. (NEWS SOURCE CLEAN TECHNICA)

China EV maker XPeng pops 45% despite posting wider than expected loss; deliveries expected to fall– (NEWS SOURCE – CNBC )

G9 has been listed as one of the best EVs to watch out for in 2023 (Source wired)

XPENG VS NIO Cars

For the first time since July, XPeng (XPEV) deliveries jumped to 11,292 in December, up 94% from November. 4,020 G9 SUVs were delivered, up 160% from November. the XPeng (XPEV) Q4 deliveries demise in at 22,204, down from 29,570 in Q3, beating XPeng’s forecast of 20,000-21,000.

As a result, Nio delivered 15,815 vehicles in December, up 51% from a year earlier and nearly 12% from November’s record 14,178. For 2022, deliveries are up 34% to 122,486. Nio recently downed its Q4 delivery, 38,500-39,500 vehicles in Q4, with well-determined targets of 43,000-48,000, facing Covid-related matters. The amended goal hinted at December deliveries of 14,263-15,263 EVs.

xpeng projected growth

In order to record quarterly sales growth in Q4 relative to Q3, XPeng needs to deliver 10,000 vehicles per month on average; in order to achieve year-over-year growth, deliveries would need to average 14,000 vehicles per month, over 60% higher than the September sales figure. The question boils down to demand, as Guangzhou and Wuhan both have production capacities that could support such growth.

As we move into the next year 2023, XPeng is planning to launch an average of one new EV each quarter with the capacity to deliver over two hundred and fifty thousand units, depending on consumer demand. The OEM has its sights set on making their G9 model more popular than the P7 – aiming for a solid ten thousand monthly in sales. Still, none of this would be possible if P7 and P5 deliveries dip due to the expansion. With XPeng projected to deliver an average of eighteen thousand vehicles every month in 2023, they will still reach a total of over two hundred and sixteen thousand throughout the year.

In regards to 2023, XPeng is poised to experience a high-volume ramp with multiple vehicles entering the market. Moreover, their commanding lead in-vehicle tech, ADAS (XPILOT, City NGP), should allow them to differentiate themselves from competing brands. With one of the most comprehensive ADAS platforms in China and evolving semi-autonomous functions, XPeng also offers industry-leading charging times in their G9 model (200km range in just 5 minutes). The G9’s next-gen software and hardware – XPILOT 4.0 for level 4 autonomous driving capability and X-EEA 3.0 for advanced electric and electronic architecture with quick OTA upgrades – highlights their commitment to cutting-edge technology.

however, XPeng is expected to encounter multiple catalysts. Among them are a return to delivery growth due to increased capacity and a growing vehicle lineup, revenue growth matching delivery growth, and a technical rebound from oversold levels after four months of selling pressure.

Bid Price and Ask Price

The bid & ask refer to the price at which an investor is willing to buy or sell a stock. A bid represents the highest price a buyer is currently willing to pay, whereas an ask represents the lowest price a seller is currently willing to sell. A bid’s size is the number of shares you are willing to buy at that price, and an ask size is the number of shares you are willing to sell at that price.

The bid-ask spread can be used as an indicator of a stock’s liquidity, or how simple it is to purchase and sell. Usually, a thinner spread implies higher liquidity, which means that more buyers and sellers are ready to negotiate. Whereas a thicker spread shows lower liquidity, with fewer investors willing to discuss prices. This information can help you choose whether to place a market order or limit order when trading, making it easier for you to get the best price and complete the transaction successfully.

| Bid * Size | Ask Size |

|---|---|

| $11.87 * 1600 | $11.88 * 1239 |

Xpeng Products

The prices of XPENG P7 WINGS begin at RMB 252,900 ($39,730/€36,530/£30,410) for the single motor iteration with a 60.2 kWh battery and increase to RMB 429,900 ($67,550/€62,095/£51,690) for the 4WD Performance version in China.

XPilot 3.5, developed in-house, is positioned as the most advanced autonomous driving system in its class, one of the XPENG P5 key innovations. XPeng Motors describes it as a Navigation Guided Pilot with 32 sensors, including two dual-prism lidar units, 12 ultrasonic sensors, five millimeter-wave radars, 13 cameras, and a positioning unit.

As the price increases, each version has an added feature that isn’t present in the other. Xpeng’s G3i is a pure electric compact SUV with a maximum power of 145 kilowatts and a maximum torque of 300 Newton meters.

This XPENG G9 all-electric SUV has 551 horses, LiDAR sensors under the high beams, air suspension, etc. It can tow up to 1,500 kilos, and deliveries are expected to begin in 2022.

xpeng stock price prediction 2025

The xpeng stock price prediction 2025: for the beginning of January, is 24.92. The maximum value is 27.10, and the minimum value is 24.04. Marking Averaged XPeng stock price for month 25.41. Price at the end 25.57, change for January 2.61%.

xpeng stock price prediction 2030

XPeng will start 2030 at $69.04, rise to $70.49 within the first half of the year, and finish 2030 at $72.01. That is about +523% from today’s price of $69.04.

Conclusion

XPeng Inc stock price is on a negative trend with decreased prices in the past three trading sessions. Over the last week, it has dropped by 5.05%, while a month ago it had increased by 37.64%. The technical indicators are pointing towards ongoing downward momentum on the daily chart, with MACD below the crossing line after a bearish crossover. XPeng Inc investors should wait for support at lower levels before expecting any recovery of their stock price.

FAQ – XPeng Inc stock price

What is an Xpeng price target?

Based on the smart analysis for the answer to is xpeng stock a good buy by the top 10 analysts the average price target is around $15.96. The deflated Price target is $4.25 to a high of $36.40.

why is xpeng stock dropping?

The average price target for the Xpeng increased by 37.85% from the last closing price of $11.60.

how to buy xpeng stock?

Pick a brokerage

Decide how many shares you want to buy

Choose your order type

Market order

Execute your tradeShould I buy XPEV stock?

Yes, one should buy xpeng stock for 2023 as top 10 analysts the average price target is around $15.96. The deflated Price target is $4.25 to a high of $36.40

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.