Are you curious about Tesla Stock Price Forecast 2030 and the coming years 2023 – 2050? This article provides insights and predictions to help you understand whether investing in Tesla (NASDAQ: TSLA) is a wise investment. Before making any investment decisions, it’s crucial to conduct thorough research and consider all possible outcomes. You can find valuable information in our TSLA stock price prediction article, allowing you to make informed choices.

Regardless of your stance on Tesla, Elon Musk, or the stock itself, conducting extensive research is essential. Potential investors should assess whether Tesla stock has the potential for a good return on investment. Understanding how Tesla’s stock price may perform in the future enables investors to align their investment goals. For a convenient and commission-free option to purchase Tesla shares, check out eToro.

- About Tesla, Inc. Common Stock (TSLA)

- Tesla Inc. (TSLA) Stock Overview

- TESLA Price Chart & P/E Ratios

- Tesla (TSLA)NEWS & ANALYSIS

- What affects the price of TESLA Stock (TSLA)?

- Tesla Stock Forecast & Price Target

- Tesla Stock Price Prediction 2023 – 2050

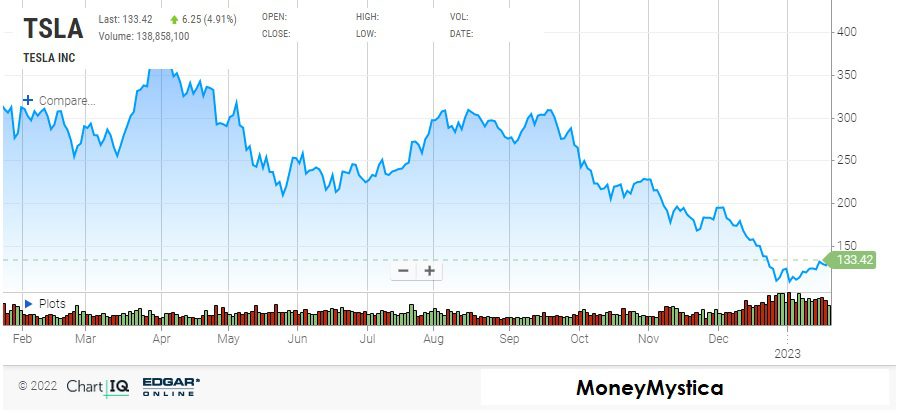

- Tesla Stock Forecast 2022

- Tesla Stock Forecast 2023

- Long-term TESLA Forecast

- Expert Review on Tesla Price Forecast

- Tesla Stock Price Forecast 2024

- Tesla Stock Forecast 2025

- Tesla Stock Price Forecast 2030

- Tesla Stock Price Prediction 2040

- Tesla Stock Price Prediction 2050

- TESLA Stock Strong Sell Strong Buy Sell Neutral Buy

- FAQ – Tesla Stock Price Forecast 2030

About Tesla, Inc. Common Stock (TSLA)

Tesla’s stock price today is $241.05 USD. As per the real-time long-term forecast, Tesla’s price will hit $440 by the end of 2023 and then $694 by the end of 2024. Tesla Inc. (TSLA) market cap can be worth $2.5 trillion in 2030. Tesla’s stock price can range between $630 to $742 in 2025 Tesla’s share price has been on a roller coaster ride in recent years, but what does the future hold for the electric car maker? Tesla faces stiff competition from other automakers who are also investing in electric vehicles, so it will need to continue to innovate to stay ahead.

Tesla Inc. (TSLA) Stock Overview

According to Tesla’s vision, the company will “create the most compelling car company of the 21st century by driving the transition to electric vehicles,” and its mission is to “deliver compelling mass-market electric cars as quickly as possible in order to accelerate sustainable transport.” As Tesla’s ecosystem grew, it used a transitional business model. Explore TSLA products, people, and the supply chain’s impact on a world powered by solar energy, running on batteries, and being transported by electric vehicles.

| Exchange | (TSLA: NASDAQ) |

| Sector | Consumer Discretionary |

| Industry | Auto Manufacturing |

| 1 Year Target | $200.00 |

| Today’s High/Low | $133.51/$127.3466 |

| Share Volume | 138,858,136 |

| Average Volume | 135,547,995 |

| Previous Close | $127.17 |

| 52 Week High/Low | $384.29/$101.81 |

| Market Cap | 421,307,331,746 |

| P/E Ratio | 41.22 |

| Forward P/E 1 Yr. | 35.52 |

| Earnings Per Share(EPS) | $3.24 |

| Annualized Dividend | N/A |

| Ex-Dividend Date | N/A |

| Dividend Pay Date | N/A |

| Current Yield | N/A |

TESLA Price Chart & P/E Ratios

Financial analysts and individual investors use PE Ratio and PEG ratios to determine the financial performance of a business entity when making investment decisions.

Tesla (TSLA)NEWS & ANALYSIS

Musk on trial says his tweets don’t always affect Tesla stock – In a trial over Musk’s 2018 interest in taking Tesla Inc private, which shareholders allege cost them millions in trading losses, Musk said investors don’t always react to his Twitter messages as he expects.

In his testimony, Musk talked about Twitter, a social media platform he bought in October. He called it the most democratic way to communicate but added that his tweets did not always affect Tesla stock in the way he anticipated.

Elon Musk Sold Tesla Shares Before Company Acknowledged Weakness-

Late last year, after a wave of news reports pointing to sagging demand for his company’s vehicles, Tesla Inc. TSLA 4.91%increase; green up pointing triangle Chief Executive Elon Musk sold almost $3.6 billion of his shares in the electric-car maker.

On Jan. 2, Tesla announced fourth-quarter vehicle deliveries that were significantly below the company’s most recent forecast investors. The news sent Tesla’s stock price plunging when markets opened the next day. (SOURCE- WALL STREET JOURNAL)

What affects the price of TESLA Stock (TSLA)?

In addition to the demand for electric vehicles, there are a number of other factors that have an impact on Tesla. Below is a brief summary of all the most important factors.

EV SALES – New vehicles are Tesla’s main business, so demand is vital. Climate awareness and the practicalities of owning an electric car and charging it plays a role in that demand. For Tesla to meet investor expectations, it must keep increasing its sales figures.

SUPPLY CHAIN – The manufacturing of a Tesla involves a lot of moving parts, both literally and metaphorically. In addition to raw materials, the supply chain includes lithium batteries and semiconductors, and shortages can slow down production and hurt sales.

ELON MUSK – Musk has crafted a cult of personality that has helped Tesla succeed, but it also means that even his tweets – such as a poll on whether he should sell stock – can move the stock price.

BITCOIN – It is likely that Tesla’s stock price will be affected at least somewhat by a major slump or spike in Bitcoin’s price. Tesla bought a lot of Bitcoin in 2021, so the price of the cryptocurrency could influence Tesla’s balance sheet quite significantly.

COMPETITION – Tesla needs to maintain its competitive edge (NIO) in order to keep growing its stock price since more EV manufacturers are entering the market than ever before.

Tesla Stock Forecast & Price Target

Are you an investor looking to stay ahead of the curve with your stock portfolio? Then you won’t want to miss this blog post where we take a look at Tesla’s stock forecast and explore how it could shape your financial strategy. We’ll analyze the trends in the market, evaluate potential risks, and discuss strategies that could help you maximize gains while minimizing losses.

Tesla Stock Price Prediction 2023 – 2050

According to our Tesla stock forecast, the next five years show promising growth. From 2025 to 2029, we anticipate a significant increase in Tesla’s stock price, with a projected movement from $630 to $1,480, representing a 136% increase. Specifically, Tesla is expected to start 2025 at $630 and reach $742 within the first half of the year, ending the year at $858, resulting in a 230% increase from the present value.

Looking further ahead, in the period from 2030 to 2034, As per our fundamental analysis, technical analysis, and stock market analysis we forecast a rise in Tesla’s stock price from $1,480 to $1,870, indicating a 30% increase. Tesla is forecasted to start 2030 at $1,480, climbing to $1,500 within the first half of the year, and finish 2030 at $1,550. This represents a 489% increase from the current price.

For the shorter term, our forecast for 2023-2024 suggests a positive outlook. Starting at $124.18 in 2023, Tesla is projected to reach $440 by the end of the year, reflecting a 255% year-to-year change. Additionally, we expect Tesla to reach $367 in the middle of 2023 and climb to $580 in the first half of 2024. By the end of 2024, the stock price is predicted to reach $694, representing an 185% increase from the current price.

Tesla Stock Forecast 2022

The Tesla stock could reach $1200 by 2022 if it grows 35% over the next year. According to a group of more than 30 analysts, that’s the average growth estimate. However, not everyone agrees; one of the most bearish predictions comes from JP Morgan’s analysts, who set their target at $250 in December 2022.

Tesla Stock Forecast 2023

Tesla’s stock price has increased by 118% from the beginning of the year, starting at $124.18 and reaching $290.54. Based on our forecast, we anticipate further growth in Tesla’s stock price, with a projected price of $440 by the end of 2023, representing a year-to-year change of +255%. From the current price, we expect the stock to rise by approximately 70% by the end of the year, reaching $440. Additionally, in the middle of 2023, our forecast indicates a price of $350 per Tesla share.

Long-term TESLA Forecast

The Tesla stock is predicted to trade between $1000 and $5000 in the long run. It is important to note that predictions beyond the next couple of years are more speculative, but it is possible to estimate the size of the electric vehicle market and price Tesla accordingly. In the next decade, the following are some potential price targets.

Expert Review on Tesla Price Forecast

Here are some views on the stock you can use in conjunction with hard numbers elsewhere in this article to form your own opinion.

We’re beginning to believe that not only will Tesla take that biggest share of the electric vehicle market, we believe that it could take 20% to 25% share of the total auto market in five years,” (soruce)

Cathie Wood, ARK Investment Management

The Tesla you’ll likely see over the next 12 to 18 months would demonstrate the capabilities of the trillion dollar Tesla, emphasizing step-changes in manufacturing, cost reduction […] expansion in capacity, model lineup and services offerings.”

Adam Jonas, Morgan Stanley

Tesla Stock Price Forecast 2024

ARK Investment Management had a price target of $1400 for 2024, which they have since suggested might be too low. Tesla expects to increase sales by 50% every year, which would help the company grow its share price into thousands of dollars if it continues to do so.

Tesla Stock Forecast 2025

According to our Tesla stock forecast, we anticipate positive performance in the next two years. By 2025, Tesla stock has the long-term potential to provide a minimum of 5X returns from the current price. Furthermore, we project that Tesla Inc. could reach a market capitalization of $1.2 trillion this year. Based on our fundamental, technical, and industry analysis, the higher price target for Tesla stock in 2025 by ending is $858, while the average price is estimated to be around $742. However, it’s important to note that in a bearish market environment, the minimum price level for TSLA stock could be around $642.

Tesla Stock Price Forecast 2030

Tesla maintains its top position in the electric vehicle segment currently. Possibly, we may see a great change in price in 2030. The price may reach a maximum of $2490. On the other hand, the year’s lowest price may be around $2353. So we cannot say that the price crosses $2500, but the nearest average may be around $2421.

Tesla Stock Price Prediction 2040

As long as all goes well, it may reach $15,629. At the same time, the lower rate may be $13,699. According to the formula, Tesla stock prices may reach $14,664 by 2040. Because until the end of the Tesla Stock Price Forecast 2040, the formula may return a high result.

Tesla Stock Price Prediction 2050

If we look at Tesla’s stock price forecast 2050 after ten years 2050, the maximum price may be $25,576, and the minimum possible price will be $24,316. Hence, the total average of twelve months could be approximately $23,478.

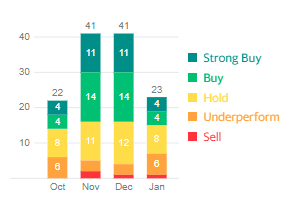

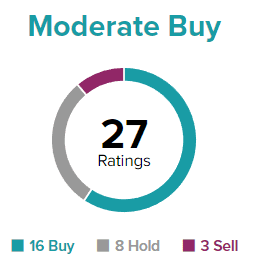

TESLA Stock Strong Sell Strong Buy Sell Neutral Buy

According to Yahoo Finance, the analysis recommends it as a strong buy.

According to TipRanks The average price target for Tesla is $188.21 with a high forecast of $300.00 and a low forecast of $85.00. The average price target represents a 41.07% change from the last price of $133.42.

FAQ – Tesla Stock Price Forecast 2030

When will Tesla’s turnover reach $1000 billion?

Tesla’s turnover is expected to reach $1000 billion in 2028-29.

Is Tesla stock predicted to go up?

The median price forecast for Tesla Inc for the next 12 months is 194.00, with a high estimate of 436.00 and a low estimate of 85.00. This represents a +58.54% increase from Tesla Inc’s last price of 122.37.

Why Tesla stock is falling?

As a result of Musk’s acquisition of Twitter, Twitter has $12.5 billion in debt, plus about $3 billion in negative cash flow over the course of 2022.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.