Monster Beverage Corporation (MNST) is a top player in the energy drink world, known for popular brands like Monster Energy, Reign, NOS, and Full Throttle. The company has been growing fast lately, thanks to its strong brand, loyal fans, cool new products, and global reach. If you’re into stock trading, checking out the latest MNST stock quote, history, news, and other key info can help you make better decisions.

MNST Stock Forecast indicates Monster Beverage Corporation’s (MNST) stock price prediction will reach an average price target is $64.00 a 0.46% growth, recommending MNST as a Strong Buy.

KEY TAKEAWAYS:

Monster Beverage Corporation (MNST) opened at $52.24 today, with a high of $52.73 and a low of $52.02. The company has a market cap of $54.89 billion and a P/E ratio of 33.21. It does not currently offer a dividend yield. MNST holds a CDP score of B-, with a 52-week high of $61.22 and a 52-week low of $47.13.

Short-term calculated price predictions forecast MNST stock price could reach an average price of $70 per share by mid-year and reach a high of $87 by the end of 2025, indicating a potential 22.14% upside. However, the low end of the forecast could see a drop of $44 from its current price.

Table of Contents

Monster Beverage Corp’s (MNST) Overview

Monster Beverage Corp was founded in 1935 by Hubert Hansen as Hansen’s Juices, a company that produced natural fruit juices and sodas. The company changed its name to Hansen Natural Corporation in 1998 and shifted its focus to energy drinks and alternative beverages.

Today, Monster Beverage Corp, headquartered in Corona, California, is the world’s second-largest energy drink company by revenue. It operates through three main segments: Monster Energy Drinks, Strategic Brands, and Other. CEO Rodney Sacks, who joined Hansen Natural Corporation in 1990 and became chief executive in 1996, leads the company. Top shareholders include The Coca-Cola Company, Vanguard Group, BlackRock, and State Street.

Monster Beverage Corp has achieved numerous milestones, such as launching the first Monster Energy drink in 2002, acquiring brands like NOS, Full Throttle, Burn, Mother, and Relentless, forming a strategic partnership with The Coca-Cola Company in 2015, expanding its global presence to over 150 countries, and introducing innovative products like Monster Hydro, Monster Ultra, Monster MAXX, and Monster Espresso.

Monster Beverage Corp earns revenue from energy drinks and concentrates across three segments: Finished Products, Concentrate, and Other. In 2023, Finished Products accounted for 92%, Concentrate for 7%, and Other for 1% of the company’s revenue.

| Region | Percentage of Total Revenue |

|---|---|

| North America | 69% |

| Europe | 16% |

| Asia Pacific | 7% |

| Latin America | 4% |

| Middle East and Africa | 3% |

| Other regions | 1% |

Monster Beverage Corp Fundamental Analysis

| Previous Close | $52.45 |

| Open | $52.28 |

| Bid | $52.67 x 800 |

| Ask | $52.72 x 800 |

| Day’s Range | $52.02 – $52.73 |

| 52 Week Range | $47.13 – $61.23 |

| Volume | 16,679,418 |

| Avg. Volume | 8,116,252 |

| Market Cap (intraday) | $55.231B |

| Beta (5Y Monthly) | 0.76 |

| PE Ratio (TTM) | 33.35 |

| EPS (TTM) | $1.58 |

| Earnings Date | Aug 1, 2024 – Aug 5, 2024 |

| Forward Dividend & Yield | — |

| Ex-Dividend Date | — |

| 1y Target Est | $62.76 |

MNST Stock Historical Performance, Financials, Growth, and Valuation Metrics Analysis

MNST Stock Trading Data

Monster Beverage stock, traded under the ticker symbol MNST, is listed on the Nasdaq Global Select Market (NASDAQ). Trading occurs in US dollars (USD) and follows the Nasdaq exchange hours, from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays, excluding US market holidays. Additionally, the stock offers pre-market and after-market trading sessions, spanning from 4:00 a.m. to 9:30 a.m. ET and from 4:00 p.m. to 8:00 p.m. ET, respectively.

MNST Stock Split

Monster Beverage (MNST) has undergone six stock splits in its history, with the most recent one on March 28th, 2023. If you purchased one MNST share after February 29th, 1988, it is equivalent to 0.0052 MNST shares.

| Date | Split |

|---|---|

| 2023-03-28 | 2:1 |

| 2016-11-10 | 3:1 |

| 2012-02-16 | 2:1 |

| 2006-07-10 | 4:1 |

| 2005-08-09 | 2:1 |

| 1988-02-29 | 1:50 |

Monster Beverage Stock Dividend History

No, Monster Beverage (MNST) has not paid a dividend within the past 12 months. The company does not currently pay a dividend and is not expected to in the near future. The historical dividend payout and yield for Monster Beverage (MNST) since 1971 indicate no dividend payments. As of June 07, 2024, the current TTM (Trailing Twelve Months) dividend payout for Monster Beverage (MNST) is $0.00, and the dividend yield is also 0.00%.

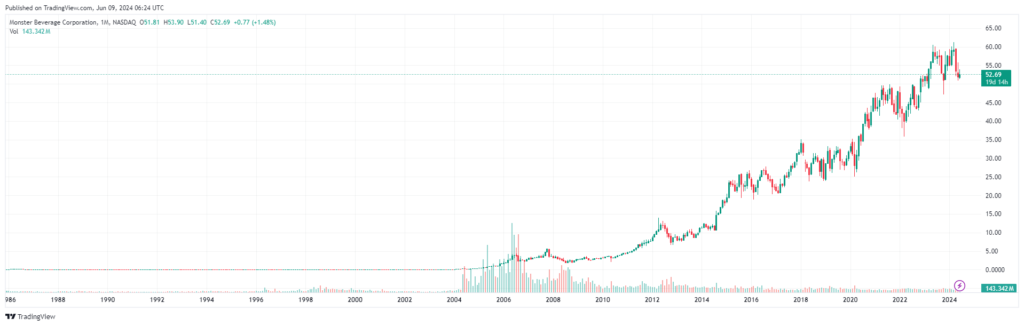

Monster Beverage Corp (MNST) Historical Quotes

Below is the MNST share price chart, displaying the historical prices for MNST stock (MNST) at Nasdaq. Access comprehensive stock prices and stock quotes for a complete financial overview.

| Date | Close/Last | Volume | Open | High | Low |

|---|---|---|---|---|---|

| 06/07/2024 | $52.69 | 18,586,480 | $52.24 | $52.73 | $52.02 |

| 06/06/2024 | $52.45 | 35,094,390 | $53.89 | $53.90 | $51.9201 |

| 06/05/2024 | $52.00 | 36,709,510 | $52.18 | $52.50 | $51.76 |

| 06/04/2024 | $52.19 | 26,337,580 | $51.83 | $52.28 | $51.50 |

| 06/03/2024 | $51.89 | 26,613,810 | $51.81 | $52.085 | $51.3975 |

| 05/31/2024 | $51.92 | 20,482,850 | $51.21 | $51.945 | $50.89 |

| 05/30/2024 | $51.24 | 15,555,750 | $52.30 | $52.35 | $50.98 |

| 05/29/2024 | $52.13 | 14,571,400 | $51.465 | $52.30 | $51.31 |

| 05/28/2024 | $51.65 | 10,855,720 | $52.50 | $52.50 | $51.42 |

| 05/24/2024 | $52.70 | 7,137,661 | $52.80 | $53.03 | $52.67 |

MNST Stock Price Prediction

According to our current MNST stock forecast by Trading View, The average price target is $63.85 with a high forecast of $69.00 and a low forecast of $56.00. The average price target represents a 21.10% change from the last price of $52.69.

Long-Term Expert Insights on MNST Stock Price Forecast 2024, 2025, 2030, 2035, 2040, 2045, 2050, 2060

The Monster Beverage Corp. (MNST) trades at a historic low from where a potential long opportunity is available depending on the current price Prediction.

The forecasted Monster Beverage price will hit $57.00 by the end of 2024, MNST can reach $87.00 by 2025, $115 by 2030, $155 in 2035, $220 by 2040, $375 by 2045, $480 by 2050, and $550 by 2060.

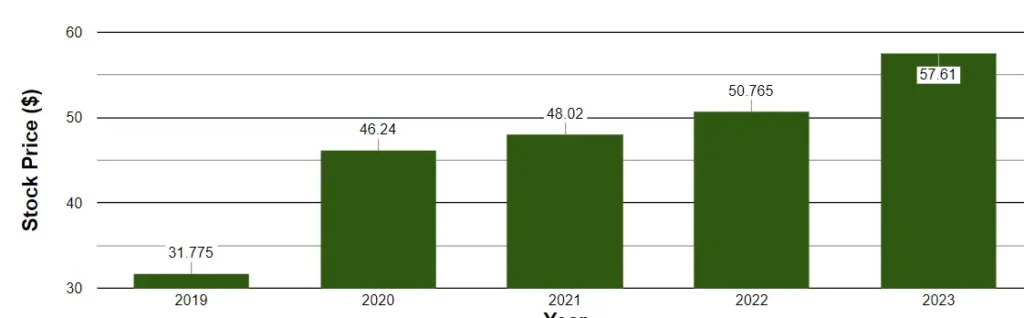

MNST Stock Forecast 2024

According to our analysis and extensive market research by our team of experts, MNST shares will reach a record-high average price of $57 per share in 2024.

MNST Stock Forecast 2025

Monster Beverage Corp. (MNST) stock price targets in 2025 are highly volatile, leading MNST shares to climb to an average price target of $87 per share in 2025. This Monster Beverage forecast for 2025 depends on revenue/earnings growth (8.9% and 10.7%) and EPS (12% per year) from the current price.

MNST Stock Forecast 2030

According to Nasdaq, analysts project that the global energy drink sector could be worth $177.58 billion by 2030, representing a compound annual growth rate (CAGR) of 8.3%. The Motley Fool also predicts that global energy drink sales will increase at an 8.3% annual rate through 2030 and that Monster Beverage (MNST) could grow even faster due to its leading market share and history of outpacing the industry average.

The MNST stock price forecast for 2030 is $115 per share. Stock in Monster Beverage Corp is projected to rise in value as time goes on, thanks to rising interest in the global energy drink sector and consumer priorities shifted towards health and wellness.

MNST Stock Forecast 2035

Monster Beverage will start 2035 at $115, then soar to $59.15 within the first six months of the year, and reach an average price target of $120.25 by the end of 2035. That means +27% from today.

MNST Stock Forecast 2040

Monster Beverage stock (MNST) is forecasted to grow earnings and project a bullish quote in 2040, with an average price target of $220. This MNST stock price prediction represents an increase of approximately 317.54% from its current price of $52.69.

MNST Stock Forecast 2045

Monster Beverage Corporation (MNST) share prices will skyrocket its growth revenue to 607.66% in 2045, with an average price target of $374. This MNST stock price prediction will reach the highest price of $ 374 and low estimates of $150 from its current value of $52.69.

MNST Stock Forecast 2050

Using QTEC’s growth rate of 15.2%, MNST would be worth approximately $2,093.19 by 2050. Using the historical growth rate of the S&P 500, MNST would be valued at approximately $306.92 by 2050.

MNST Stock Forecast 2060

Monster Beverage Corporation’s (MNST) stock price will reach an average price of $500 and could hit a maximum of $550 and could hit a minimum of $272 by 2060.

MNST Financial Forecast

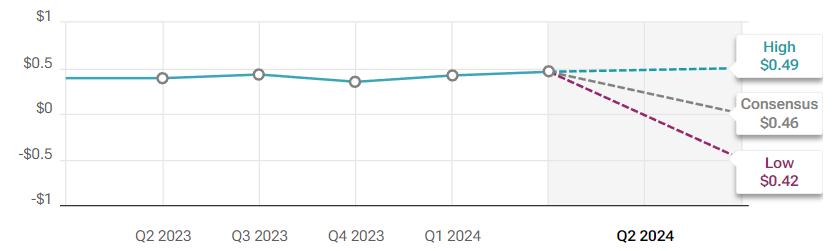

MNST Earnings Forecast is projected to earn $0.46 per share next quarter, with a range of $0.42 to $0.49, surpassing its previous quarter’s EPS of $0.42, yet historically, it has only exceeded its earnings estimate 25.00% of the time in the past year, compared to its industry’s 64.75% success rate, indicating an underperformance relative to its overall industry during the last calendar year.

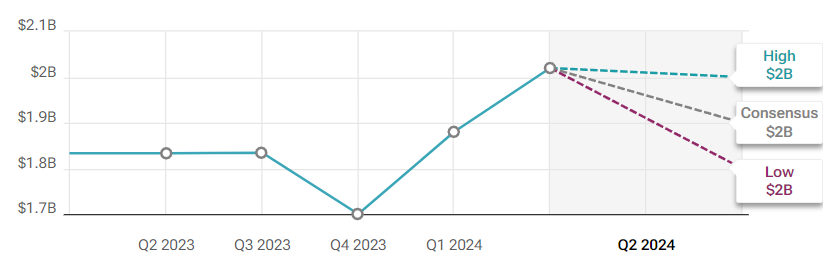

In the upcoming quarter, MNST Sales Forecast is expected to achieve sales of $2.03 billion, within a range of $1.91 billion to $2.11 billion, surpassing the previous quarter’s $1.90 billion. However, over the past year, MNST has failed to beat its sales estimates, unlike its industry, which succeeded 55.63% of the time, reflecting an underperformance by MNST compared to its industry throughout the last calendar year.

Conclusion: Is Monster Beverage stock (MNST) a buy, Sell or Hold

Here’s the information presented in a table format:

| Source | Rating | Details |

|---|---|---|

| ZACKS | Overvalued | Value Score of D (bad pick for value investors) |

| Wallstreezen | Strong Buy | 1 sell rating, 6 hold ratings, 13 buy ratings |

| TipRanks | Moderate Buy | 8 buy ratings, 5 hold ratings, and 1 sell ratings |

At the current price, Monster Beverage Corporation (MNST) is considered overvalued by ZACKS. However, Wall Street analysts are recommending MNST as a Strong Buy, with 1 sell rating, 6 hold ratings, and 13 buy ratings for the stock. According to TipRanks, Monster Beverage has a consensus rating of Moderate Buy.

How high can MNST Stock rise?

Monster Beverage Corporation has a 22.50% upside potential, based on the analysts’ average price target.

What is MNST stock forecast CNN?

MNST Stock Forecast (CNN)

Price Momentum: MNST trades mid-range within its 52-week range and below its 200-day moving average.

Price Change: MNST shares rose by $0.25 (0.49%) since the last market close, closing at $52.69. However, it dropped $0.19 in after-hours trading.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.