How to find the cheapest auto insurance on Reddit: As far as car insurance rates are concerned, USAA, Auto-Owners, Westfield, Geico, and Travelers offer the lowest rates. Those with a DUI conviction might not be able to get cheap car insurance from Geico, for example, Geico offers great rates for many drivers, but not for those with a DUI conviction. In order to get the best car insurance quotes, you still need to shop around.

- On average, USAA offers the cheapest car insurance for good drivers, drivers with DUIs, and those who have been in accidents. USAA auto insurance is only available to service members and their families.

- In terms of auto insurance for good drivers, Auto-Owners hold the No. 2 spot.

- According to our analysis, Geico is the third cheapest car insurance for good drivers, as well as the cheapest rate for poor credit drivers.

5 Reasons Why you need a car insurance

- It is required by state law

Obligation protection is necessary for drivers in each state aside from New Hampshire and Virginia. The base substantial injury and property harm inclusion you’re expected to have changes by state, yet you should have some to work a vehicle legitimately. Driving without protection can bring about fines or a suspension of your permit.

While impact and exhaustive protection aren’t legitimately needed, you actually may need to buy the two of them assuming that you’re renting or supporting your vehicle. Banks commonly expect you to get crash and extensive inclusion to safeguard the speculation they’re making into the vehicle you drive.

- To help Protect your finances

Impact inclusion monetarily safeguards your vehicle on the off chance that you’re in a mishap — regardless of whether you’re to blame. This incorporates crashes with different vehicles or articles. It likewise covers single-driver mishaps, so you’re secured in the event that you steered into a tree or turned over all alone.(how to find the cheapest auto insurance on reddit)

Far-reaching inclusion monitors your vehicle against the harm it can support while not being driven. This can incorporate robbery, defacement, and weather conditions harm. Impact and far-reaching inclusion are typically purchased together since having both makes a total type of inclusion for your vehicle regardless of whether you’re in the driver’s seat.

- To satisfy loan or lease requirements

In the event that a vehicle you’re renting gets obliterated, the bank would have to recover its misfortunes on its speculation since they footed a large portion of the bill. Since you’re probably not going to have sufficient money lying around to pay your bank for the harmed vehicle, they can rather depend on the insurance agency.

- To help protect your vehicle

Risk protection is ordinarily separated into two fundamental areas of inclusion: substantial injury and property harm. Substantial injury inclusion will pay for wounds you’re lawfully obligated for in a mishap, including hospital expenses and a few lost wages of the individual who got injured.

- To help protect you & your family

Auto risk insurance covers the other drivers’ vehicle harm and clinical costs after an auto crash up to your contract’s cutoff points. Your vehicle insurance agency will take care of the expenses of individuals you hit in the event that you’re tracked down answerable for the mishap. You’d simply pay your deductible, and your insurance agency foots the remainder of the bill up to your arrangement’s maximums.

Consider it like this. Assuming you were simply driving your vehicle regularly and one more vehicle crashed into you, harming your vehicle and harming you and your travelers, you’d presumably believe the individual that hit you should pay for the harm they caused. That is the motivation behind responsibility protection.

Top Rated Car Insurance Companies

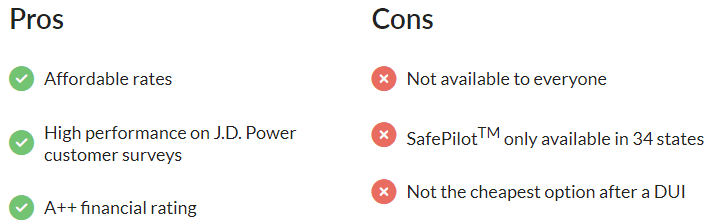

USAA

The best insurance agency in our appraisals. As indicated by our 2022 review, USAA clients report the most elevated level of consumer loyalty and are probably going to recharge their strategies and prescribe USAA to different drivers. USAA additionally has the least rates in our review, beating the public normal by 35% .

USAA insurance items, including auto, property holders, and tenants contracts, are simply accessible to individuals from the tactical local area. Thusly, not all drivers will be qualified for inclusion through this guarantor.

Pro & Cons USAA

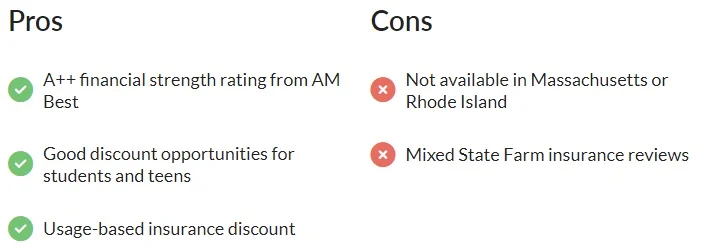

State Farm

The No. 2 in our rating and has better than expected scores in every one of our sub ratings including Cases Taking care of and Client Dedication. It likewise did well in our Least expensive Vehicle Insurance Agency of 2022 rating. Its normal expenses for drivers with not exactly flawless driving records were the least in our rating for those unfit to get a strategy from USAA.

Pro & Cons State Farm

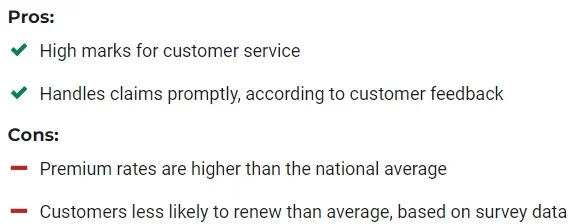

Farmers

Ranked at No. 3 in our rating and ties for top spots in a considerable lot of our subratings. It holds ties for No. 1 in Cases Taking care of and negative. 2 in Client support and Client Steadfastness. Ranchers loses focuses contrasted with different safety net providers in our rating is for Probably going to be Restored, where its score of 4.0 is underneath the class normal of 4.2. It additionally has one of the most costly typical yearly paces of the organizations that made our evaluations.

Pro & Cons Farmers

NationWide

Nationwide climbed two spots since our 2021 examination, tying for the No. 3 spot. Cross country has the second-most elevated scores in our Client Faithfulness and Probably going to be Suggested subratings or more normal scores in every one of the other subrating classifications. Cross country likewise has sub optimal rates for certain drivers, particularly those with a decent driving record or unfortunate credit.

Pro & Cons State Farm

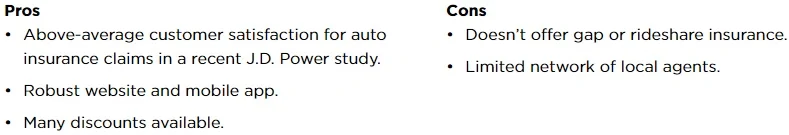

Geico

In the No. 3 spot of the current year’s evaluating is Geico with normal scores in all cases in classes like Client assistance, Cases Taking care of, and Client Dedication. Where it stands apart is in its expenses, which procure it the No. 2 spot in our rating of the Least expensive Vehicle Insurance Agency of 2022. Its rates are simply behind first class USAA for high schooler and senior drivers as well as those with unfortunate credit.

Pro & Cons Gieco

Should You Use Life Insurance as an Investment?

It’s feasible to believe life coverage to be speculation assuming that you have a strategy that forms cash esteem. Cash esteem approaches are by and large promoted as one more method for setting aside or putting away cash for retirement. These strategies assist you with developing a pool of capital that acquires an interest. This premium accumulates on the grounds that the insurance agency is putting away that cash for its own advantage, similar to banks. Thusly, they pay you a rate for the utilization of your cash.

However, taking into account the pace of return that you could earn is significant. On the off chance that you take the cash from the constrained investment funds program and put it in a record reserve, for instance, you might understand better returns. For individuals who miss the mark on discipline to contribute routinely, a money esteem insurance contract might be valuable. A restrained financial backer, then again, could produce better yields by putting the cash they would pay toward charges on the lookout.

Cheapest Auto Insurance for Seniors

Among senior drivers ages 70 and 80, USAA has the cheapest car insurance. Auto-Owners has the cheapest insurance for seniors without military affiliation, which USAA requires. The best car insurance for seniors depends on where you live and other factors such as your driving history.

Among seniors, car insurance rates increase, on average, by 10% from age 60 to 70. By age 80, rates may be 23% higher than they were at age 70 and 34% higher than they were at age 60.

Methods of Calculating Life Insurance

Most insurance agencies say a sensible sum for life coverage is six to multiple times how much yearly compensation. Assuming you duplicate by ten, in the event that your compensation is $50,000 each year, you’d decide on $500,000 in inclusion. Some suggest adding an extra $100,000 in inclusion per kid over the 10x sum.

One more method for working out how much life coverage is required is to duplicate your yearly compensation by the number of years left until retirement. For instance, in the event that a 40-year-old right now makes $20,000 per year, they will require $500,000 (25 years × $20,000) in disaster protection.

The way of life strategy depends on how much cash that survivors would have to keep up with their way of life assuming the protected party kicks the bucket. You take that sum and increase it by 20. The perspective here is that survivors can take a 5% withdrawal from the passing advantage every year — what could be compared to the way of life sum — while financially planning the demise benefit head and procuring 5% or better. This sort of computation is here and there known as the human existence esteem (HLV) approach.

Another system is called DIME (obligation, pay, contract, instruction). This is intended for a negligible measure of inclusion that will cover family costs in case of a less than ideal passing. With the DIME approach, your inclusion ought to be sufficient to cover your extraordinary obligations in general (counting your home loan), pay for your children’s schooling, and swap your pay for as numerous years until your kids arrive at 18 years of age.

FAQ – How to Find the Cheapest Auto Insurance on Reddit

why car insurance is important?

If you cause a car accident, you may be held responsible for the costs associated with it. These may include legal fees, the injured person’s medical expenses, or their lost income if their injuries leave them unable to work. Liability coverage may help pay for these costs

how much life insurance do I need at 60?

Consider getting up to 30X your income between the ages of 18 and 40; 20X income at age 41-50; 15X income at age 51-60; and 10X income for age 61-65.

how much life insurance do i need for my child

To give your child a healthy amount of financial security, you might consider $25,000 to $50,000 in coverage – a nice leg up on the future. The more coverage you buy, the bigger the policy’s cash value can become

cheapest car insurance in california ?

In California need $15,000 of bodily injury liability insurance per person (up to $30,000 per accident) and $5,000 of property damage liability insurance. Collision, comprehensive and gap insurance may also be required by a lender or lessor if your vehicle is financed.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.