Azta stock, today Azenta stands as a separate company, formerly known as Brooks Automation. Specializing in precision automation and cryogenic storage solutions specifically for the semiconductor market, they have since extended their expertise to biopharma customers. Azenta provides services ranging from research to clinical development, including sample management and automated storage; they are well-versed in genomic services. With a current market value of $4.4bn, Azenta is a formidable life sciences company building upon its past success.

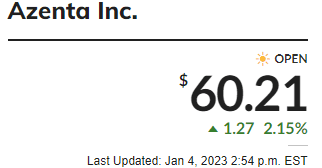

The Current price of Azenta as per MarketWatch as last updated on January 4, 2023, is $60.21 with a rise in azta stock of 2.15%. azenta brooks

The company has more than 12,000 customers around the world, with operations in 100 countries. Pharmaceutical and biotechnology companies, clinical research hospitals, academic institutions, and government agencies are among the clients. In addition to providing sample procurement and sourcing services, we also provide informatics and data software, sample repository solutions, and genomic sequencing services for companies that do not have in-house capabilities.

Company Profile Azenta Life Science

Azenta, Inc., established in 1978 and headquartered in Chelmsford, Massachusetts, provides life science sample exploration and management solutions to the life sciences market in North America, Europe, China, the Asia Pacific, and globally. It operates two reportable segments: Life Sciences Products and Life Sciences Services.

The former offers automated cold sample management systems for compound and biological sample storage; equipment for sample preparation and handling; consumables; and instruments to assist customers with managing samples throughout their research discovery and development processes.

The latter provides comprehensive sample management programs, integrated cold chain solutions, informatics, laboratory processing, laboratory analysis, and biospecimen procurement, along with other support services — all designed to advance scientific exploration and aid drug development. Azenta serves numerous life science customers such as pharmaceutical companies biotechnology companies biorepositories research institutes etc.

It formerly went by the name of Brooks Automation but changed it to Azenta in December 2021 & wisely in the azta conference 2021.

Nasdaq: azta

Azenta, Inc. (AZTA) Key Data

| Exchange | NASDAQ-GS |

| Sector | Health Care |

| Industry | Medical/Dental Instruments |

| 1 Year Target | $77.00 |

| Today’s High/Low | $60.465/$58.56 |

| Share Volume | 336,385 |

| Average Volume | 830,023 |

| Previous Close | $58.94 |

| 52 Week High/Low | $104.01/$37.61 |

| Market Cap | 4,137,718,556 |

| P/E Ratio | 2.12 |

| Forward P/E 1 Yr. | 178.61 |

| Earnings Per Share(EPS) | $28.32 |

| Annualized Dividend | $0.40 |

| Ex-Dividend Date | Dec 2, 2021 |

| Dividend Pay Date | Dec 23, 2021 |

| Current Yield | 0.68% |

Bid Price & Ask Price

The bid & ask refers to the price at that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest amount that a buyer is currently willing to buy

The Bid Price for AZTA Stock is ( Size $59.90 300) & The Ask for AZTA Stock is * Size$59.94 * 2

azenta life sciences stock price

The company makes around 63% of its ~$550mn revenue from the services segment, while 37% comes from the products segment. Its revenue over the past four years has increased significantly, nearly doubling in the last 4-5 years from $334 million to $389 million, $514 million to $514 million.

In the last decade, azenta company has spent around 1 billion in more than 10 acquisitions, which include cold storage companies to gene sequencing companies. The company has been able to increase its return on invested capital to more than its weighted average cost of capital in just 4-8 years.

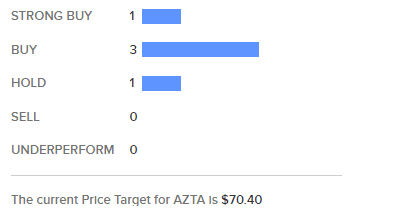

ANALYST CONSENSUS & TRENDS

azenta STOCK Price 2022

The year 2022 for azenta stock was well of with acquisitions in cold storage sectors and the price range for the stock was around 115.57. it was a steady stock but for many new investors, it was a steady stock with some returns on their investment.

azenta STOCK Price 2023

As per our analyst prediction for the year 2023, this year could be the best year for this stock and investors are keeping a very keen eye on where will this stock go estimates suggested prices will be somewhere around 178.61 & azta stock forecast Growth of 34.64%. but before you go all out on this stock you should see its price history because predictions are not always accurate.

azenta STOCK Price 2024

as per our expert analysis, the year 2024 will also be a good year for azenta the stock will be on the rise, stock can reach the 185 mark, and will continue to dominate and benefit the investors

azenta STOCK Price 2025

| Date | opening price | closing price | minimum price | maximum price | change |

|---|---|---|---|---|---|

| January 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -55959.89 %▼ |

| February 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -23550.26 %▼ |

| March 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -31433.69 %▼ |

| April 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -41944.91 %▼ |

| May 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -41944.91 %▼ |

| June 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -31433.69 %▼ |

| July 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -55959.89 %▼ |

| August 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -31433.69 %▼ |

| September 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -41944.91 %▼ |

| October 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -55959.89 %▼ |

| November 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -23550.26 %▼ |

| December 2025 | 0.000001 | 0.000001 | 0.000001 | 0.000001 | -55959.89 %▼ |

FAQ – azenta life science

Is Azenta a good buy?

Based on 4 buy ratings, no hold ratings, and no sell ratings, Azenta has a consensus rating of Buy.

Is Azenta, Inc. listed on NASDAQ or NYSE?

YES, Azenta, Inc. is listed on the NASDAQ as (NASDAQ: AZTA)

What is Azenta, inc. (AZTA) Symbol?

Azenta, Inc.’s stock symbol is AZTA, and currently trades under NASDAQ. Its current price per share is approximately $60.06.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.