If you’re pondering whether it’s the right time to BUY Nio Inc – ADR (NYSE: NIO) in 2023, our comprehensive guide has you covered. Discover why NIO is capturing attention with insights into its innovative electric vehicles, market performance, financial analysis, and expert opinions on whether now is the opportune moment to buy. Stay informed and make sound investment decisions with our in-depth exploration.

Investors might consider BUY NIO STOCK for the long term, as expert analysis Nio Stock Forecast to rise $13.50 by 2024, $17.59 by 2025, $39.19 by 2030, and $84.03 by 2035. 📈 NIO’s current stock details: Open – $7.62, High – $7.71, Low – $7.42, Market Cap – $1.25T, 52-wk High – $16.18, 52-wk Low – $7.00.

As one of China’s foremost electric vehicle manufacturers, NIO has surged ahead in recent years, earning acclaim for its innovative technology, stylish designs, and dedication to sustainability. Dive into the details and navigate the investment landscape with confidence.

- Discover the exciting world of Nio Inc. – ADR

- Why Invest in NIO Stock?

- NIO Stock Forecast 2023 – 2025 – 2030 – 2040 -2050

- Nio Stock Forecast 2023

- NIO Stock Forecast 2025

- NIO Stock Forecast 2030

- NIO stock Forecast 2040

- NIO stock price 2050

- Factors Influencing NIO Stock Price Performance

- Is it the Right Time to Buy NIO Stock

- Can Nio Stock Reach a 1000 US dollar share price?

- Conclusion – BUY NIO STOCK

- Future of electric vehicles

- FAQ

Discover the exciting world of Nio Inc. – ADR

NIO Inc., formerly known as Next EV Inc., is a Chinese company at the forefront of designing, developing, manufacturing, and selling smart electric vehicles. Specializing in electric SUVs and sedans catering to five to six passengers, NIO goes beyond just vehicles.

Apart from its innovative vehicle lineup, NIO offers power solutions to enhance the electric vehicle ownership experience. This includes Power Home, a home charging solution, and Power Swap, a battery swapping service.

Providing a comprehensive range of services, NIO ensures customer satisfaction. This encompasses repair, maintenance, and bodywork services through NIO service centers and authorized third-party service centers. The company offers insurance coverage, repair and routine maintenance, roadside assistance, data packages, auto financing, and financial leasing options.

NIO extends its reach into energy and service packages, design and technology development, manufacturing of e-powertrains, battery packs, and components, as well as sales and after-sales management activities. The company also introduces NIO Certified, a service that inspects, evaluates, acquires, and sells used vehicles.

Established in 2014 and headquartered in Shanghai, China, NIO Inc. has become a key player in the electric vehicle industry, revolutionizing transportation with its innovative and smart electric vehicles.

Why Invest in NIO Stock?

In recent years, NIO has become a major player in the electric vehicle industry, experiencing substantial growth in sales and market capitalization. In 2020, NIO delivered over 43,700 vehicles, with a remarkable year-over-year increase of 112.6%, and generated $2.49 billion in revenue, marking a 107.8% surge. NIO’s stock price has also seen significant appreciation, soaring over 1,500% from January 2019 to January 2022. As of October 10, 2022, the stock was priced at $13.76, with technical experts predicting a rise to $26.90 by the end of 2022.

NIO Stock Forecast 2023 – 2025 – 2030 – 2040 -2050

Nio Stock Forecast 2023

Analysts offering 12-month price forecasts for NIO Inc. have a median target of $12.31, with the average price target at $13.49 and a high forecast of $19.20.

NIO Stock Forecast 2025

Based on the latest long-term forecast, NIO stock is anticipated to trade at a minimum price of $50 and a maximum price of $55 in January 2025. The average forecasted share price is expected to be between $50 and $55 by 2025. The market forecasts signify epic growth of the stock from nearly $5 billion to over $22 billion, strengthening its position in the market.

NIO Stock Forecast 2030

NIO’s share price is anticipated to experience a steady and gradual rise, with projections reaching up to $170 by the year 2030.

NIO stock Forecast 2040

Estimates project that in 2040, NIO’s stock may open at $967.95, and close at $1108.06, with an average price of $1024.94 during the year.

NIO stock price 2050

In 2050, estimates suggest NIO’s stock might open at $1500, and close at $2150, with an average price of $1890 throughout the year.

Factors Influencing NIO Stock Price Performance

A Rise in Electric Car Demand:

Nio’s (NIO) success as an electric vehicle designer, developer, and manufacturer is closely tied to the growing demand for electric cars. The market for electric vehicles (EVs) has experienced significant growth in recent years, potentially benefiting Nio’s (NIO) share price if the demand continues to increase.

Competitive Landscape:

With the increasing number of businesses entering the electric vehicle market, competition has intensified. Nio (NIO) faces tough competition from renowned electric vehicle manufacturer Tesla, its main rival in the industry. To achieve success, Nio (NIO) will need to effectively position itself and defend its market share against competitors.

Chinese Retail Sector:

As Nio’s (NIO) headquarters are based in Shanghai, China holds a pivotal role as its primary market. The success of Nio (NIO) heavily relies on the demand from Chinese customers. While Nio (NIO) does export some vehicles, sustained growth in the Chinese retail sector and the country’s continued momentum in the electric vehicle market will likely drive Nio’s (NIO) sales upward.

Manufacturing Partnership:

In order to meet the demand for its cars, Nio (NIO) has partnered with Jianghuai Automobile Group, a state-owned company in China. This partnership enables Nio (NIO) to produce up to 240,000 vehicles annually under a three-year contract, valid until 2024. Should the agreement not be renewed, Nio (NIO) would face the challenges of significant investment and a lengthy construction process to establish its own manufacturing facility.

Is it the Right Time to Buy NIO Stock

Yes, Based on 19 analysts giving stock ratings to Nio Inc. (NIO) in the past 3 months suggests a STRONG BUY

Can Nio Stock Reach a 1000 US dollar share price?

Reaching $1,000 a share for NIO is theoretically possible, but it would require substantial profit growth, share repurchases, and surpassing the market cap of competitors like Tesla. However, achieving such a milestone (Can NIO stock reach $1,000?) seems unlikely.

Conclusion – BUY NIO STOCK

Nio’s stable of other electric vehicles — the ES8, ES6, EC6, and ET7 — Hsiao sees the ES7 contributing to a bright future for Nio after it gets through Q2 and its “margin pressure.”

Future of electric vehicles

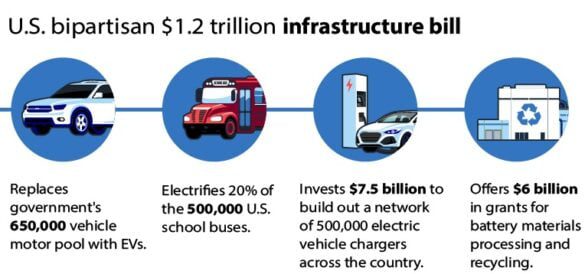

It is no secret that the future of the automotive industry will be in electric and alternatively powered vehicles. New U.S. President Joe Biden has been a big advocate of electric vehicles and, among other things,

plans to spend $400 billion to add a new fleet of American government vehicles that are battery-powered. Additionally, according to the Society of Automotive Engineers of China, approximately half of all vehicles sold in China will run on alternative energy by 2035.

The Edison Electric Institute has also estimated that the number of electric on the road in America will go from 1 million to 19 million between 2018 and 2030. It is one of the fastest-growing markets in the world and since Nio is one of the bigger players in the electric vehicle game, this bodes very well for their company.

FAQ

-

Is NIO a good stock to buy?

Analysis indicates it is a good stock to buy for several reasons, including:

NIO is one of the early EV producers so it can take advantage of Early Bird benefits.

The unique technology involves swapping batteries rather than using charging stations.

Compared to other EV manufacturers, car prices are less competitive

& have a variety to choose from in segments like Hatchback, Sedan, SUV, and Sports. -

Is it possible for NIO stock to reach $1000?

As per our price prediction and analysis, the NIO stock price will be around or over $1000 by 2040. NIO stock can reach $1000 easily in the long run. In 2040, if you buy 10 NIO stocks for $20 each, your investment will cost just $200, but in 2040 it will cost you $10k.

-

How much is an NIO car cost?

Nio’s new mass-market brand, which is expected to launch in 2024, will feature models priced between 200,000 and 300,000 yuan, around $29,000 to $44,000,

-

What is Nio’s price target?

The 30 analysts offering 12-month price forecasts for NIO Inc have a median target of 27.82, with a high estimate of 66.23 and a low estimate of 18.60. The median estimate represents a +162.31% increase from the last price of 10.61.

-

Will NIO cars be sold in the US?

NIO has announced its plans to expand into the U.S. market by 2025. According to Electric-Vehicles.com, NIO plans to enter the U.S. market alongside other western markets by the end of 2025.

-

should I buy nio stock now?

Bottom line: Nio stock is not a buy right now. However, it could be soon, so check back for updates. To find the best stocks to buy or watch,

-

how to buy nio stock?

The China EV startup sees deliveries ramping up on new models and markets. Here’s what NIO earnings and chart say about buying Nio stock now.

-

how to buy nio stock in US?

Open a stock trading account. Use our comparison table or choose from our Top Picks. ; Confirm payment details. Fund your account and take advantage of any …

-

where to buy nio stock?

You can buy NIO Inc (NIO) stock and many other stocks or ETFs on Stash. Purchase fractional shares with any dollar amount.

-

can nio stock reach $1000?

based on our research nio stock is a must-watch stock and the stock can reach the $1000 mark by the end of the year 2040 but as it is a generous price prediction, it is very much possible that nio can touch that golden mark before 2040