Bitcoin Price Prediction 2025: In the past 24 hours, Bitcoin’s price has changed by 5.61%, As of Oct. 31, 2023, BTC is at $34,457, market capitalization of $673.1 billion and a market volume of $17.06 billion.

So far this year, Bitcoin’s price has changed by 72.13%. As the world’s first decentralized cryptocurrency, Bitcoin uses public-key cryptography to record, sign, and send transactions over the Bitcoin blockchain without the oversight of a central authority.

In April 2023, Bitcoin touched the crucial resistance at $30,000, marking its first time since June 10, 2022. After dipping to $26,000, it has surged to $34,457. Experts suggest Bitcoin needs to maintain the $31,000 level to potentially reach $60,000 by the end of 2023. Despite a 50% dip from its all-time high, Bitcoin’s recovery is underway, fueled by factors like the U.S. banking crisis, a weakening dollar index, and subdued inflation. This resurgence indicates that the recent U.S. financial turmoil has heightened interest in cryptocurrencies.

Bitcoin, the original cryptocurrency, has seen its price fluctuate wildly over the past few years. From a high of almost $20,000 in December 2017, the price of Bitcoin fell to around $3,200 just one year later. In 2019, the price has recovered somewhat but remains well below its all-time high. What will happen to the price of Bitcoin in the future?

That’s hard to say for sure. Some experts have made predictions about what they think will happen to the price of Bitcoin over the next few years. These predictions range from $0 to $1 million per Bitcoin by 2025! It’s impossible to know for sure what will happen to the price of Bitcoin. However, by understanding some of the factors that can affect the price of Bitcoin, you can make a more informed prediction about where it might go in the future.

- About Bitcoin (BTC)

- Can Bitcoin Reach $100,000 by 2023?

- Price History of Bitcoin 2009 – 2022

- How much Tom Brady Loose in Bitcoin?

- Bitcoin Price Today, BTC to USD live, Marketcap & Chart

- What was the original purpose of bitcoin?

- What factors affect the Bitcoin price?

- How to Buy Bitcoin

- Bitcoin Technical Analysis

- Bitcoin Price Prediction (BTC)

- Bitcoin Price prediction 2023

- Bitcoin Price prediction 2024

- Bitcoin Price prediction 2025

- Top 10 Unknown Facts About Bitcoin

- Future Growth of Bitcoin

- FAQ – Bitcoin Price Prediction 2025

About Bitcoin (BTC)

What is bitcoin’s price history?

The latest Bitcoin halving took place on May 11, 2020, coinciding with the mining of block 630,000. Bitcoin price history is a measurement of the market value of one bitcoin over time. It is measured by the closing price of one bitcoin in US dollars on a particular day. The first recorded price of bitcoin was on October 5, 2009, when it was traded for $0.008 per bitcoin. On November 28, 2017, the price of one bitcoin reached an all-time high of $11,856.76.

Can Bitcoin Reach $100,000 by 2023?

In April 2023, Bitcoin reached a critical resistance at $30,000, a milestone not seen since June 10, 2022. After briefly dipping to $26,000, it has surged impressively to $34,457. According to crypto experts, for Bitcoin to potentially reach $60,000 by the end of 2023, it needs to maintain and surpass the $31,000 level.

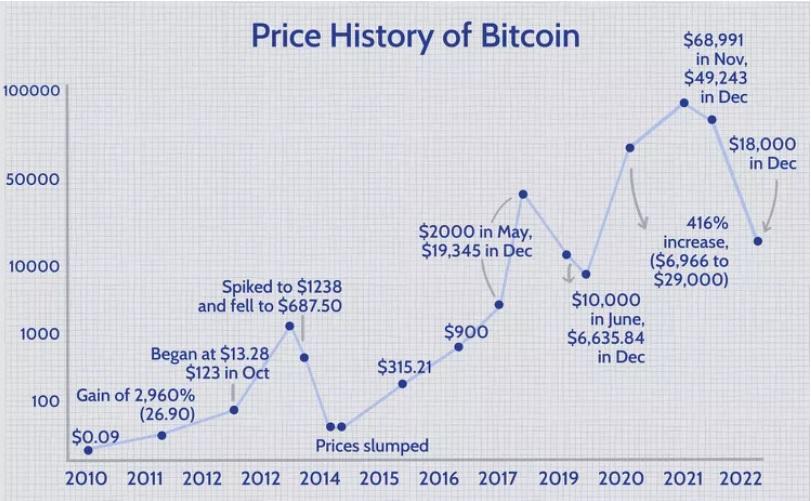

Price History of Bitcoin 2009 – 2022

In 2010, the value of one bitcoin jumped from just a fraction of a penny to $0.09, making it one of the most volatile cryptocurrencies on the market. This article offers insight into Bitcoin’s volatility and some reasons why its price behaves the way it does.

Bitcoin’s price changes reflect investor enthusiasm and dissatisfaction with its promise. Satoshi Nakamoto, the anonymous Bitcoin inventors, designed it to be used in everyday transactions. Bitcoin gained mainstream traction as an exchange method. It attracted traders who bet against its price changes. Investors turned to Bitcoin to store value, generate wealth, and hedge against inflation. Institutions created investment instruments based on Bitcoin.

In January 2022, Bitcoin began losing steam, and its price story changed again. Investors and traders bet on an ever-increasing price in anticipation of riches. Here is a quick Sneak Peak at the Price history of Bitcoin With respect to ascending Years.

How much Tom Brady Loose in Bitcoin?

New England Patriots owner Robert Kraft and his former golden boy Tom Brady lost their entire investment in the cryptocurrency exchange FTX trading on Monday after it went bankrupt losing £26billion

Price History Of Bitcoin from the Year 2009-2015

In three months, Bitcoin’s price rose from $1 to a peak of $29.60 by June 7, 2011, a gain of 2,960%. Bitcoin had a price of zero when it was introduced in 2009. On July 17, 2010, its price jumped to $.09. By April 13, 2011, the price had jumped to $29.60, a gain of 2,960%.

By mid-November, Bitcoin’s price had bottomed out at $2.05, following a sharp recession in cryptocurrency markets. Its price rose from $4.85 on May 9 to $13.50 by August 15 of the following year.

While Bitcoin experienced a generally uneventful year in 2012, 2013 saw significant price gains. During the first quarter of 2013, Bitcoin traded at $13.28 and reached $230 on April 8. Several weeks later, on July 4, its price dropped to $68.50 after an equally rapid deceleration.

Bitcoin’s price spiked to $1,237.55 in October 2013 and then fell to $687.02 three days later. Bitcoin’s price fell through 2014 and touched $315.21 in 2015.

Price History Of Bitcoin from the Year 2016-2022

In 2016, Bitcoin’s price steadily rose to over $900 by the end of the year. In 2017, the price of Bitcoin hovered around $1,000 until it crossed $2,000 in mid-May, then skyrocketed to $19,345.49 on December 15.

In 2018, and 2019, Bitcoin’s price moved sideways, with brief bursts of activity. For example, the price reached $10,000 in June 2019 but fell to $6,635.84 by mid-December.

In 2020, the economy shut down due to the COVID-19 pandemic. Bitcoin’s price burst into action once again. The cryptocurrency started the year at $6,965.72. Investors’ fears about the global economy were amplified by the pandemic shutdown and government policies.

In December 2020, Bitcoin’s price reached just under $29,000, an increase of 416% from the start of the year.

In 2021, Bitcoin exceeded its 2020 price record in less than a month, hitting $40,000 by Jan. 7, 2021. Coinbase, a cryptocurrency exchange, went public in April 2021, causing Bitcoin prices to reach new all-time highs of over $60,000. In April 2021, Bitcoin reached its peak of $63,558 due to institutional interest, which propelled its price further upward.

By the summer of 2021, prices had fallen by 50%, hitting $29,796 on July 19. September saw another bull run, with prices reaching $52,693, but a big drawdown brought the price down to $40,710.

After reaching a new all-time high of $68,789 on Nov. 10, 2021, Bitcoin closed at $64,995. In mid-December 2021, Bitcoin fell to $46,164. As investors were frightened by inflation and the emergence of a new variant of COVID-19, Omicron, the price fluctuated more.

Impact of Covid-19 on Bitcoin Cryptocurrency

Bitcoin stands out from conventional currencies due to its digital convenience, decentralization, and other factors. While there are certain benefits, extreme volatility and the effect of externalities can lead to fluctuations in value.

The current situation with the coronavirus has had a significant effect on Bitcoin prices as global economic instability mounts. To figure out how the crisis is influencing this cryptocurrency, research into its correlations may prove illuminating.

The price of Bitcoin continued to decrease between January and May 2022, reaching $47,445 by the end of March before falling further to $28,305 on May 11. Bitcoin closed below $30,000.

It was the first time since July 2021 that crypto prices fell below $30,000. Bitcoin dropped below $23,000 for the first time since December 2020. By the end of 2022, Bitcoin had fallen below $20,000 since the crypto winter began in November 2021.

Bitcoin Price Today, BTC to USD live, Marketcap & Chart

A cryptocurrency called Bitcoin (BTC) is created by users through mining. Bitcoin has a current supply of 19,330,956 coins. The last known price of Bitcoin is 27,322.8171211 USD and is up 0.85 over the last 24 hours. There are currently 10127 active markets with $17,605,675,495.71 traded over the last 24 hours. More information is available at https://bitcoin.org.

| Previous Close | 27,284.83 |

| Open | 27,284.83 |

| Day’s Range | 27,259.66 |

| Week Range | 15,599 – 47,655 |

| Start Range | 28-4-2013 |

| Algorithm | N/A |

| MArketCap | 546.201 B |

| Circulating Supply | 19.33 M |

| Supply | N/A |

| Volume | 450,043,392 |

| Volume (24 Hrs.) | 21.45 B |

| Volume (24 Hrs.) All Cryptocurrencies | 21.45 B |

Bitcoin Price USD Today – 1 BTC = 28264.60 USD as on (29-3-2023)

What was the original purpose of bitcoin?

When Satoshi Nakamoto created Bitcoin in 2009, he had a vision for a new kind of money that was not controlled by any government or financial institution. Bitcoin is decentralized, meaning that no one entity can control it. This was a revolutionary concept at the time and is still one of the most appealing aspects of Bitcoin for many people. The original purpose of Bitcoin was to provide a more secure and efficient way of conducting transactions than traditional methods like banks or credit cards.

What factors affect the Bitcoin price?

The price of cryptocurrencies is influenced by supply and demand. Here are a few factors that can affect Bitcoin’s price. Because bitcoin is one of the most volatile assets, it’s worth investigating some of the factors that may influence its price.

Deficient Supply – The total supply of Bitcoin is capped at 21 million coins, with more than 90% being mined to date. Every four years, the rate of production for this digital currency is halved (the ‘halving’) which can cause a disruption similar to that of a commodities market such as oil or gold. The three Bitcoin halvings to date have all been followed by price fluctuations and volatility. The fourth halving is anticipated to occur in the beginning of 2024.

Attainability & Fluidness – As more people adopt Bitcoin, its value increases. Lately, announcements of platforms that accept it as payment have been driving up its price. To make it accessible to a wider investor base, some exchanges have created or are in the process of creating investment products such as futures and mutual funds. Bitcoin is generally regarded as the most liquid cryptocurrency since it can typically be exchanged for cash quickly on multiple markets. This liquidity can bring stability to the price, but changes in liquidity also mean price swings are likely. Greater liquidity makes Bitcoin more attractive to investors and traders as an asset with higher value.

Investing risks and considerations – Potential threats to Bitcoin’s price exist due to changes in supply and demand. Its digital presence can make it vulnerable, as seen from the countless cyberattacks on individual holders and exchanges, resulting in possible market fluctuations. Regulation of cryptocurrencies varies across nations – some have completely outlawed it, others are discussing prohibitive rules, while those who do accept it often impose taxes, restrictions on ownership, and liquidity.

Cryptocurrency Competitions – As a decentralized digital currency, Bitcoin does not have any fixed exchange rate with the US dollar or other physical money. Its value may differ from one trading platform to another. It is significant for investors in this field to take precautions, being aware that the cost of Bitcoin is highly unstable and its future worth could rely considerably on broader public acceptance. Thus, it is recommended that investors should inform themselves and assess whether or not participating in cryptocurrency complies with personal goals, periods, and willingness to bear risk.

New Bitcoin Securities – There are many cryptocurrencies, and they continue to grow in popularity as regulators, institutions, and merchants address concerns and make them acceptable forms of payment and currency. Finally, if consumers and investors believe that other coins will prove to be more valuable than Bitcoin, demand will fall, taking prices with it. If sentiment and trading move in the opposite direction, demand and prices will rise.

How to Buy Bitcoin

How to buy Bitcoin On Etoro – Here is a Step By Step Guide to How to buy bitcoin on ETORO for beginners

1. Open an account with etoro

2. Verification – Open an account and complete the verification process

3. Deposit – After opening the account make a deposit.

4. Search for Bitcoin and Buy – After completing the verification. setup etoro wallet and search for Bitcoin and buy with the help of a Debit or Credi Card.

Here is The list of the TOP 10 CRYPTO PLATFORMS TO buy Bitcoins

Bitcoin Technical Analysis

Bitcoin’s current price is $27,685.44, with a market cap of $535,031,949,808 and a 24-hour trading volume of $32,186,374,480. At the same time, the circulating supply is 19,325,437 BTC, and the total supply is 21,000,000 tokens.

Although Bitcoin has been registering a significant gain since the beginning of this year, it dropped to $20,108 on June 30, 2022, for the first time since December 2020. Since then, the price of Bitcoin has not crossed $25k for a long time. However, when BTC reached $19,669 in March 2023, investors were attracted to the token, and the price turned bullish after a long period. Now it trades above $27k and has crossed $25k.

Analysts believe that Bitcoin’s continual price volatility may reverse its position in the cryptocurrency market compared to other major cryptos like Ethereum. The ETH 2.0 merge has already been launched, and it is expected to improve network scalability and speed.

Bitcoin Price prediction 2023

It is believed that Bitcoin will rise significantly in the second half of 2023, possibly reaching $42,560.91. The Bitcoin price forecast for 2023 anticipates significant gains in the second half of the year. It is expected that BTC’s price will rise gradually, but there won’t be any substantial drops, as with other cryptocurrencies. The target price of $39,712.76 is quite ambitious, but given anticipated collaborations and advances, it is achievable in the near future. BTC’s minimum value is expected to be $34,039.51.

Bitcoin Price prediction 2024

In 2024, Bitcoin BTC price prediction has much room for expansion. As a result of the potential announcements of numerous new partnerships and initiatives, we anticipate that the price of BTC will soon surpass $70,919.45. However, we should wait to see if the BTC’s relative strength index comes out of the oversold zone before placing any bullish bets. BTC trading at a minimum price of $56,735.56 and an average price of $62,409.12 is expected due to market volatility.

Bitcoin Price prediction 2025

Bitcoin price prediction 2025: The minimum price for Bitcoin could be $226,866.86 and the maximum price value could be $241,046.04, averaging out to $232,538.54 by 2030.

Top 10 Unknown Facts About Bitcoin

Having heard a lot about Bitcoin, you may be wondering what it is and if it’s right for you. Here are 10 things you should know about it. and Bitcoin price prediction 2025

What Crypto?

Bitcoin, the largest and oldest cryptocurrency, was created in 2009 and is an alternative to the US dollar.

Bitcoin Founder

It is believed that Satoshi Nakamoto, the author of a white paper written in 2008, was the brainchild behind Bitcoin. Several people have claimed to be Nakamoto, but no one knows for sure who he or she is.

Bitcoin Price Forecast

Despite the global financial crisis, Bitcoin’s dramatic daily price swings in 2022 were significantly higher than the stock market’s daily swings in 2008, the most volatile year for stocks on record.

Bitcoin Mining

It is created when programmers solve complex computations and add them to the blockchain – the public ledger that records all Bitcoin transactions. This process, known as mining, requires a great deal of computing power.

Finite supply Causes Scarcity

One reason some people believe Bitcoin will eventually increase in value is its finite supply. As of February 2023, there are about 1.9 million Bitcoins left to mine1.

Your Digital Wallet

Once you transfer Bitcoin to someone else, there’s no way to recover it or dispute the transaction. Bitcoins are purely digital and stored electronically in programs called wallets.

Bitcoin Under IRS

Rather than treating Bitcoin as currency, the IRS treats it as property. When you receive Bitcoin as compensation, you must calculate your gain or loss. You should also calculate your loss each time you spend Bitcoin. Short-term gains are taxed as ordinary income, while long-term gains (1 year or more) are taxed as capital gains. Losses are taxed the same way as stocks.

Bitcoin’s Password Protection

It is estimated that 20% of Bitcoin, valued at approximately $140 billion, is lost forever because people forget their passwords.

Bitcoin matter of personal opinions

In contrast to stocks and bonds, Bitcoin doesn’t have an intrinsic value based on corporate earnings or cash flows. As with traditional currency, Bitcoin is valuable as long as people accept it as a currency. Therefore, when risk assets3 such as stocks are stressed, Bitcoin’s price will fluctuate wildly. Platforms like PayPal and Square can process payments made in Bitcoin, but they must be converted into fiat currency before they settle.

Binary Gold

In light of large-scale crypto scandals and the lack of regulation, it remains to be seen whether institutions and wealthy investors will continue to use Bitcoin as an alternative asset class.

Future Growth of Bitcoin

As a result of multiple incidents in the crypto fraternity, such as Terra LUNA’s collapse, the FTX crisis, high inflation, interest rate hikes worldwide, and central banks tightening their balance sheets, Bitcoin and the entire cryptocurrency market suffered tremendous volatility.

It is expected that Bitcoin’s price will continue to rise and stay around $27k for the year 2023. Despite this, crypto experts predict a long-term improvement for the crypto market and encourage users to buy Bitcoin at the current price levels.

Bitcoin price prediction 2025: Short investment history is marked by extreme price volatility. Your financial situation, investment portfolio, risk tolerance, and investment objectives will determine whether it is a wise investment. To ensure cryptocurrencies are appropriate for your situation, you should always consult with a financial expert before investing.

FAQ – Bitcoin Price Prediction 2025

Should I Invest in Bitcoin?

This past year, Bitcoin was one of the most talked-about coins in the crypto space, making BTC a good investment.

How much will be bitcoin in 5 Years?

Over the next five years, long-term investment in BTC could see the price rise to $184,584.07 based on increasing cryptocurrency popularity.

How much will be bitcoin in 10 Years?

In the next 10 years, the price of BTC could rise to $360,893.66 if you invest in Bitcoin today.

Who Owns the maximum Bitcoins?

MicroStrategy (MSTR) owned 132,500 bitcoins worth $2.194bn on 2 February 2023, making it the world’s biggest publicly traded bitcoin owner.

How much is 10000 Bitcoin worth?

The current value of 10,000 BTC in USD is $353,540,000. This information is based on real-time data.

Will Bitcoin rise in the coming year?

Our prediction foresees Bitcoin making a significant leap to an average price of $65,000 in 2024, driven by the Halving event. Following this surge, we anticipate a stabilization in 2025, with an average settling around $50,000.

What is Bitcoin Halving History?

The Bitcoin halving events and corresponding rewards are as follows: on November 28, 2012, the reward was 25 BTC; on July 9, 2016, it reduced to 12.5 BTC; on May 11, 2020, it further halved to 6.25 BTC, and it is expected to halve again in April 2024, reaching 3.125 BTC.

Could Bitcoin hit $100k in 2024?

I firmly believe that Bitcoin will eventually reach $100,000 per coin. If it reaches $100,000 per coin, it would certainly mark a significant milestone in the cryptocurrency world.

Ashish Dwivedi is the founder and chief editor of MoneyMystica, a top resource for finance, insurance, and share market insights. Driven by a passion for empowering individuals to make informed financial decisions, Ashish uses his extensive knowledge and practical experience to offer clear and actionable advice.