top 5 small-cap mutual funds: We have highlighted the best U.S. and international mutual funds, an allocation fund, and one short-term bond fund. there are more than a few active mutual funds whose managers have outperformed the pack, minimized volatility, and delivered enviable returns, all while keeping expenses in check.

Top 5 small cap mutual funds 2022

We began with an extensive list of mutual funds screened for high performance, reasonable risk, and low expenses. From this roster, we arranged funds by category. We selected U.S. and international equity, short-term bond, and asset allocation categories. Our screening focused on higher-than-average five-year performance, with mid to lower expense ratios.

Finally, we individually reviewed each fund’s investment style and strategy to uncover those with the potential to continue their outperformance during the current and future market cycles.

What are the different types of mutual funds?

- Mutual funds can be classified among the following types:

- Stock mutual funds. Also called equity funds, this type of mutual fund owns shares of stock in public companies. There is a very wide variety of different equity mutual funds, like growth funds, value funds, and income funds. Stock fund investors generally want more appreciation than income payments—or yield—although there are specialized dividend funds that aim to generate yield.

- Bond mutual funds. They are also referred to as fixed-income funds, bond mutual funds own Treasurys, municipal bonds, or corporate bonds. Bond fund investors tend to want income preservation and yield from their bond fund investments.

- Balanced mutual funds. Also called blended funds, these mutual funds invest in a portfolio of both stocks and bonds.

- Money market mutual funds. These mutual funds tend to offer very low yields and very low risk compared with bond and equity funds, and they can invest in high-quality, short-term debt issued by corporations and government entities. Money market fund investors are seeking capital preservation above all else.

- Target date funds. These mutual funds are designed for retirement investors and generally have a “target date” year when holders are expected to retire. They hold a mix of stocks, bonds, and other securities. Over time, the portfolio shifts its allocation from riskier investments to safer investments.

Why invest in the top 5 small cap mutual funds?

- Mutual funds offer an attractive combination of features that make them a good option for retail investors. These include:

- Diversification. The shortest definition of diversification is simply “never put all your eggs in one basket.” Mutual funds embody this approach as they own a portfolio of securities that includes a very broad range of companies and industries. This helps to lower risk and potentially boost returns.

- Affordability. Mutual funds typically have low minimum investment requirements and charge reasonable annual fees.

- Professional management. Not everyone has the time and knowledge to manage a diversified investment portfolio. When you buy shares of a mutual fund, the fees pay professional managers to choose the securities owned by the fund and manage the assets through good markets and bad.

- Liquidity. When you own shares of a mutual fund, you can easily redeem them at any time. The fund will always buy back your shares for an amount equal to the current net asset value (NAV) plus any redemption fees.

How to Choose the top 5 small cap mutual funds

There are thousands of mutual funds available on the market today. That means you need a good understanding of your financial goals to choose the right mutual fund for your needs. Once you’ve settled on a level of risk that’s right for you.

You’ll need to start digging into mutual fund lists like this one and start researching individual funds. Learning about how each fund works helps you know if it’s right for your goals and risk tolerance.

You may already understand that risk and return are directly proportional. That makes it essential to calibrate the rate of return you expect against the amount of volatility you can accept in your mutual fund investments.

What are the risks of mutual funds?

All investments involve taking on risk, and mutual funds are no exception. You may lose some or even all of the money you invest in a mutual fund. The value of the fund’s portfolio may decline, and bond interest payments or stock dividends can fall as market conditions change.

Past performance is less important with mutual funds as it does not predict future returns. Nevertheless, a mutual fund’s performance can give you an idea of how volatile or stable it’s been in the past.

Does a fund have a high or low turnover rate in its investments?

When fund managers buy and sell frequently, it creates taxable events. That’s nothing to worry about if you own shares of a mutual fund in a tax-advantaged retirement account, but if you own shares in your taxable brokerage account, that could greatly diminish your long-term gains.

What are mutual funds fees?

Mutual funds charge investors several different fees and expenses, which can vary from fund to fund.

Nearly all mutual funds charge an annual expense ratio, which covers the costs of paying the fund managers and other ongoing expenses.

The actively managed funds listed above charge higher expense ratios than index funds. That’s because they employ professional managers who are more involved in the fund’s day-to-day management.

Some mutual funds charge a sales fee known as a load, either when you purchase shares (a front-end load) or sell shares (a back-end load).

A back-end load fee is typically only charged if you sell shares sooner than five to ten years from purchase. Mutual funds may also charge 12b-1 fees, which are part of the share price. These fees cover sales, promotions, and costs related to the distribution of fund shares.

top 5 small cap mutual funds 2022

1. American Funds Washington Mutual F1 (WSHFX)

- A small sneak-peak: rivian stocks – Lucid Stocks – Apple stocks – Neo crypto –Nio Automotives– Netflix Stocks

MFS Blended Research International Equity is an international large-cap blend fund that offers a true mix of global growth and value stocks. Managers integrate both fundamental and quantitative research—and with 145 holdings and a 68% turnover ratio, BRXAX puts the “active” in actively managed.

So far, management’s assessments have panned out: BRXAX has delivered benchmark index-beating performance for years now. The fund has outperformed the category and MSCI ACWI ex USA index returns during the prior five-, three- and one-year returns.

BRXAX is globally diversified, with the largest country allocations to Japan, the U.K., France, China, Switzerland, and Canada. The top holdings include Taiwan Semiconductor Manufacturing Co. (TSM), Roche Holding (RHHBY), LVMH Moët Hennessy Louis Vuitton, Novo Nordisk (NVO), and DBS Group.

A caution with BRXAX is that the expense ratio falls in the middle range, suggesting that an incorrect strategy move could be costly to performance.

2. Thrivent Mid Cap Stock Fund (TMSIX)

The Thrivent Mid Cap Stock Fund is a concentrated active fund that holds less than 100 companies and seeks long-term appreciation. TMSIX is best for investors who are comfortable enduring a higher degree of volatility in exchange for the opportunity to earn greater returns over a longer time horizon.

Mid-cap stock funds are typically riskier than their large-cap brethren, and this Thrivent fund is more volatile than average. Returns have handily outperformed the S&P MidCap 400 Index, Russell Midcap Index, and the Morningstar Mid-Cap Blend Average benchmarks during recent one-, three-, five- and 10-year periods.

Around 48% of the fund is invested in the industrial, financial, and consumer discretionary sectors, with the next 10.9% in tech stocks. The top companies by weight include lesser-known names like United Rentals (URI), Devon Energy Corp. (DVN), and NVR, Inc. (NVR).

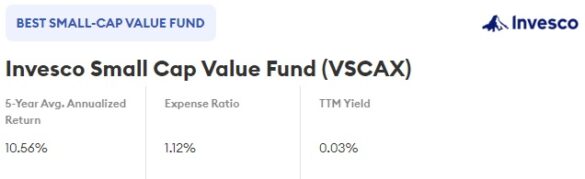

3. Invesco Small Cap Value Fund (VSCAX)

The Invesco Small Cap Value Fund is another pick whose long-term returns have rewarded investors despite near-term volatility and a relatively high expense ratio. VSCAX’s managers seek out deeply discounted stocks and out-of-favor picks, boosting the fund’s volatility and potential returns. Note that the fund handily outperformed the Russell 2000 Value IX’s five-year benchmark return.

This small-cap pick leans heavily on industrial stocks, with about a 34.5% allocation. Financials, energy and consumer discretionary stocks round out the next 37% of holdings. Northern Oil & Gas is the largest holding, with Parsons Corp., AECOM, KBR, and Flex, rounding out the top 13% of holdings.

Historically, small-cap value funds have outperformed many other strategies, but this approach has been ignored over the last decade in favor of large-cap growth companies. We could be due for a value stock rebound in the current environment of rising inflation and interest rates.

top 5 small-cap mutual funds

4. TIAA-CREF Social Choice International Equity Fund (TSORX)

The TIAA-CREF Social Choice International Equity Fund offers a great choice for investors who want ESG and international exposure in their portfolios. With 358 holdings and a low 12% turnover, managers have the highest conviction in their stock picks.

TSORX fund strives for a positive long-term total return, with higher dividends than other choices on our best mutual funds list. TSORX’s evaluation metrics prefer international firms with attention to ESG metrics. Sustainable funds demonstrate roughly equivalent performance to the typical mutual fund, so fear of sub-par returns is no reason to shy away from ESG investing.

Compared with the MSCI EAFE Index benchmark, TSORX has beaten the index returns during recent five-, three-, and one-year terms. But the fund fell slightly behind the benchmark during the first quarter of 2022. The top countries represented in TSORX are Japan, the U.K., France, Switzerland, Germany and Australia.

top 5 small cap mutual funds 2022

5.JP Morgan Income Fund (JGIAX)

The JP Morgan Income Fund demonstrates the advantages of active management expertise versus a passive index fund approach. With a relatively short average duration of 2.08 years among its holdings, the fund has outperformed its Bloomberg US Aggregate Bond Index (AGG) over the recent five-, three- and one-year periods.

JGIAX owns 2,328 individual bonds and has had a 54% turnover ratio during the last year. Strong performance during a challenging interest rate environment has rewarded investors with a steady income stream.

The fund owns a diverse stable of bonds with a range of credit ratings. Approximately 16.56% of the portfolio is rated AAA, whereas 18.53% are unrated bonds. High-yield corporate bonds contribute 32.9% to the portfolio makeup, explaining the high yield for such short-term holdings.

top 5 small cap mutual funds 2022

FAQs-top 5 small cap mutual funds

What is a mutual fund?

A mutual fund pools money from many investors and buys a diversified portfolio of stocks, bonds, and other securities. The fund sells shares to investors, and each share represents an investor’s equity ownership stake in the mutual fund and the income it generates.

What are top 5 small cap mutual funds

PRDGX

SSAQX

FLCEX

STSEX

what are no load mutual funds

A no-load fund is a mutual fund in which shares are sold without a commission or sales charge. 1 This absence of fees occurs because the shares are distributed directly by the investment company, instead of going through a secondary party.

which of the following bond mutual funds would provide tax-free income?

Dividends from ELSS funds are tax-free during the investment period. g. Profits from the sale of ELSS fund units are considered long-term capital gains and hence, are tax-free. The best way of investing in ELSS funds is through monthly SIPs (systematic investment plans).

What are tax free mutual funds?

Tax-saving mutual funds are just like any other mutual funds with an added tax-saving benefit. The special feature of this type of mutual fund